“Tax revenues are harvested from private citizens by means of coercion and extractive measures… Paying taxes to remain free of incarceration or not face withering financial penalties is hardly indicative of cooperative exchange. ” ~Tom Savidge and Peter C. Earle

READ MORE

“The pain and uncertainty from an ever-changing federal progressive marginal individual income tax system with forced withholding and payment or refund later are destructive.” ~Vance Ginn

READ MORE

“Means tested welfare necessarily crowds out the poor from productive employment by substituting government grants for family earning and community support.” ~Donald J. Devine

READ MORE

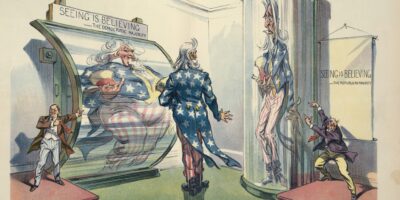

“The hungry behemoth that is the US federal government is already eating the rich… Jeff Bezos’ great fortune would finance the government for… less than a week. ” ~Joakim Book

READ MORE

“Federal spending spikes immediately after a recession or emergency, then lowers when the crisis subsides, but never down to pre-crisis levels.” ~Peter C. Earle and Thomas Savidge

READ MORE

“The only sense in which the American middle-class is disappearing economically is that an ever-increasing percentage of American households earn annual incomes that are in the upper brackets.” ~Donald J. Boudreaux

READ MORE

“We each owe more than $100,000 as a share of the national debt… Our earning years are subsidizing not our own economic coming-of-age, but retirement and medical benefits for people who navigated a less-challenging wealth-building landscape.” ~Laura Williams

READ MORE

“Taxing unrealized capital gains from property, stocks, and other assets is a bad idea. It undermines economic growth, stifles innovation, and infringes on personal liberty.” ~Vance Ginn

READ MORE

“Both property tax increases and rent control continue to be controversial, after decades, in that they both represent forms of grand theft against housing owners and rental housing providers.” ~Gary M. Galles

READ MORE

“Whether the distribution is problematic and calls for correction is one question, but measuring the extent of inequality and whether it is getting worse is an entirely different issue.” ~Robert Mulligan

READ MORE

“President Biden has maintained his predecessor’s duties on some $370 million worth of Chinese imports. Both national conservatives and liberal protectionists are dead wrong about tariffs and growth.” ~Tarnell Brown

READ MORE

“Any discussion of income inequality that fails to address whether the source added value for others or simply extracted unearned rents, is not merely incomplete, but misleading.” ~Robert Mulligan

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305