Americans spend $400 billion dollars per year to comply with the tax code. Americans also dedicate 9 billion hours of labor to comply with the current tax code. Beyond costly compliance, the current tax code distorts investment and work decisions in the economy. Something needs to be done to simplify the tax code and make it pro-growth.

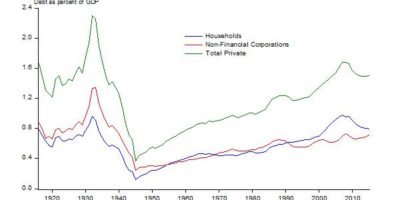

READ MOREWhen people refer to the national debt, they almost always mean the debt owed by our government. But there are actually two important types of debt in the American economy: government debt, and private debt owed by households and businesses.

READ MORE

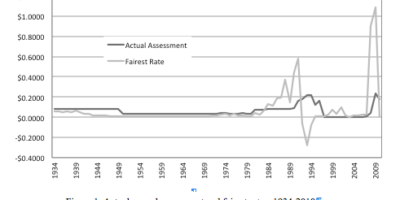

Many economists have argued that government mortgage programs and low interest rates policies caused the 2008 financial crisis. We maintain that government deposits insurance, provided in the United States by the Federal Deposit Insurance Corporation (or FDIC), may have also been a contributing factor. By failing to price risk fairly, the FDIC encourages banks to increase their risk-taking activities.

READ MORE

The level and growth of a nation’s private debt, more than public debt, predicts the worst recessions.

READ MORE

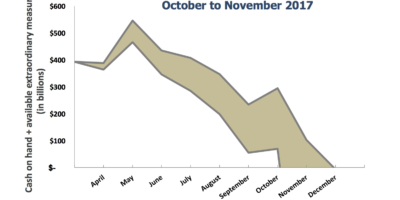

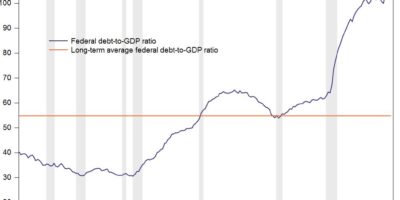

The Bipartisan Budget Act of 2015 suspended the debt ceiling through mid-March of this year. On March 16, the debt ceiling was raised to the current level. When the debt ceiling is reached, the Treasury will not be able to issue more debt to borrow new funds from the public. Instead, the Treasury must take extraordinary measures to raise cash. Extraordinary measures are policies that temporarily lower the national debt by reducing the Treasury securities held by government agencies—known as intragovernmental debt.

READ MORE

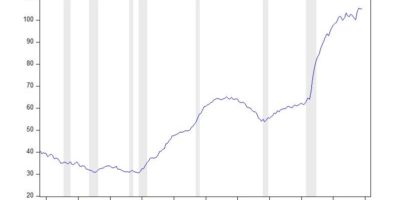

Ongoing federal budget deficits have required the U.S. Treasury to issue substantial amounts of debt to finance government spending. The Treasury has been able to easily issue debt since the federal government enjoys the highest credit rating, which lowers the interest rate that creditors demand. Historically low interest rates in general have further helped limit interest expense.

READ MORE

Throughout its history, AIER has pointed out the dangers of excessive amounts of both private and public debt.

READ MOREFacing the Facts How the federal government collects and spends money has changed substantially over the years. Policy decisions made many years ago influence federal outlays today in important ways. Because of changes in the structure of the budget, the annual appropriations process is constrained, and therefore, is a less powerful tool for addressing fiscal challenges than it used to be.

READ MORE

As an economic crisis manager, Leszek Balcerowicz has few peers. When communism fell in Europe, he pioneered “shock therapy” to slay hyperinflation and build a free market.

READ MORE

by Devin Roundtree Even among the most vocal advocates of returning to a gold standard, a banking system that requires banks to reserve 100% of all deposits redeemable on demand is considered impractical and a hindrance to economic growth. However, not …

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305