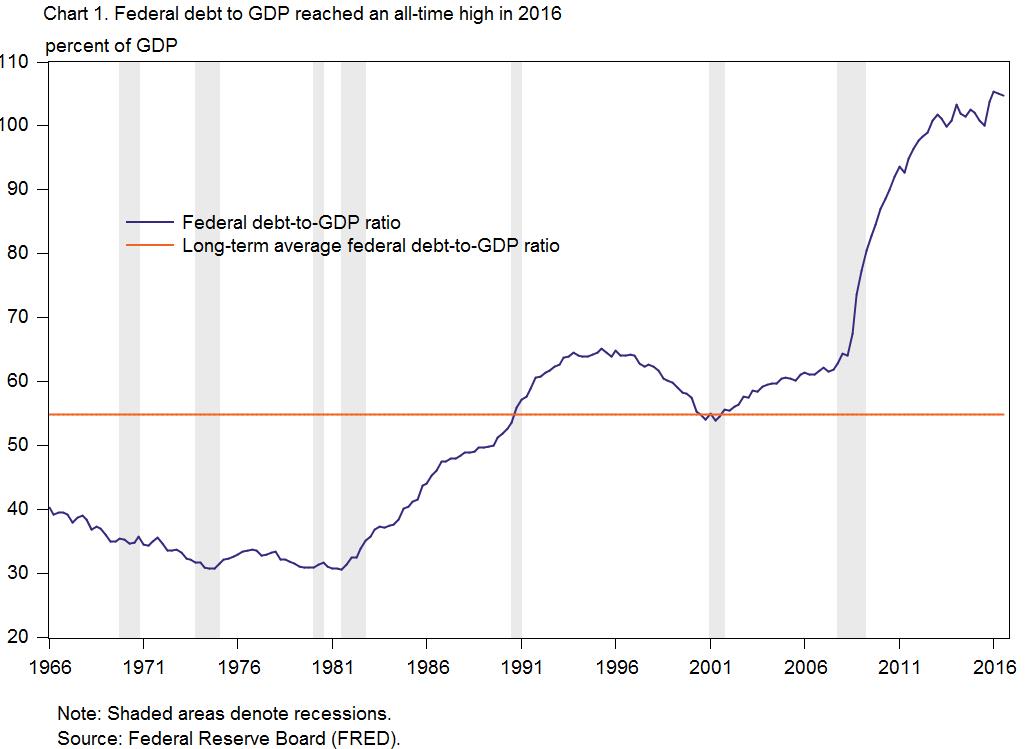

The Federal Debt is Near an All-time High

Throughout its history, AIER has pointed out the dangers of excessive amounts of both private and public debt. Following the Great Recession, the federal government debt reached new highs. The federal government can continue to borrow as long as creditors are willing to lend. Eventually, the government must raise taxes and/or lower spending. It might also reduce the real value of the national debt through inflation. The new administration has no plan to put the federal debt on a sustainable path, without which creditors may be less likely to purchase Treasurys, or government securities.

Looking at the federal debt relative to gross domestic product helps put the data in context. Prior to the Great Recession, the ratio of federal debt to GDP stood at 62.8 percent. Following the recession, the combination of a run-up in debt and anemic GDP growth pushed the federal debt-to-GDP ratio to all-time highs. At the end of 2016, federal debt approached a record high of 104.8 percent of GDP, which is more than double its long-term average of 54.8 percent from 1966 through the start of 2017.

The U.S. government sells Treasurys to finance the debt. Domestic residents and foreigners lend to the government by purchasing them. Foreign demand for Treasurys accelerated during the recession but has slowed in recent years. At the end of 2016, foreigners became net sellers of Treasurys for the first time since 2001. Japan and China, the largest foreign holders of Treasurys, have leading the selling in recent months. Falling foreign demand means that U.S. household demand for Treasurys will be important moving forward.

Click here to sign up for the Daily Economy weekly digest!