The post-Halloween candy market is a commercial society of traders buying low and selling high, and it’s a microcosm of what happens when market exchange works well.

READ MORE

The tree cover of the planet is increasing, thanks mostly to increased efficiencies in food production.

READ MORE

The Trump administration needs to give the economy a dose of the right kind of nothing, relax the trade war antics and stop bashing trade partners, lay off the Fed, and by doing so will give real GDP growth a positive nudge.

READ MORE

Look back 150 years (from the end of the Civil War), ignore whatever party or president was dominant, and try to discern a relationship between the size, scope and power of the U.S. federal government and America’s economic growth rate.

READ MORE

Edward Stringham on Fox News comments on the growth rates of the American economy and the factors that go into causing it.

READ MORE

The data alone tell the story no one wants to hear. Continued economic growth does not so much allow as require the inclusion – indeed the expansion – of the number of undocumented immigrants on American employment rolls.

READ MORE

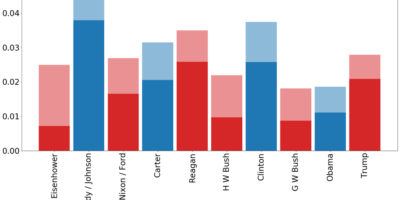

Long-term stability in economic growth owes to the robustness of economic organization in the United States. A single president might transform the economic landscape, but that transformation is necessarily constrained.

READ MORE

Conventional wisdom says that inequality in the United States is spiraling out of control. But what do the data actually say?

READ MORE

Vlad the Impaler and his literary incarnation — Count Dracula — have real historical roots in a dark period of economic nationalism.

READ MORE

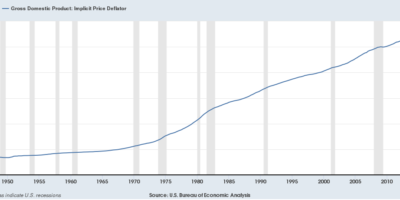

Long-run growth projections have plummeted since the Great Recession. How much blame does fiscal austerity bear for this bleak outlook?

READ MORE

Light, as we know it today, is a commodity. That would not have been possible without the institutional prerequisites — freedom to create, own, and exchange — that built the modernity we too often take for granted.

READ MORE

If all mixed societies are inherently unstable then why are they historically so common and why do many keep going for hundreds of years in peace and rising prosperity?

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305