These lofty heights reflect easy money and a bubble just waiting to pop.

READ MOREResearch Reports, 05/22/1956, Special Bulletin

READ MORELuring Businessmen, Savers, and Investors To Their Economic Deaths Including as a Supplement: Retirement and Estate Planning During an Age of Inflating

READ MOREBy Donald G. Ferguson, Bion H. Francis, E. C. Harwood, Benjamin D. Manton, and Their Assistants on the Institute Staff Part I Where Does Money Come From, and What Is Inflation? Has the Danger of Inflation Passed? Part II Inflation’s Timing and Warning …

READ MOREFinancial wellness has become a popular topic with policymakers, human resources departments, and the financial media. The concept is simple: Just as with physical health, financial wellness assesses your ability to support yourself into old age.

READ MORE

It is generally a reasonable approach to invest in passively managed index funds because research has shown that actively managed funds have not shown a consistent ability to beat their indexes. But you’ve got to pay attention to the fees.

READ MORE

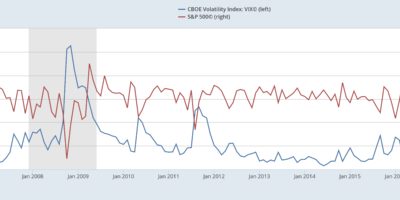

Stocks are well known for their high volatility. Stocks respond to financial, economic, and political events in real time. The recent Brexit vote, for example, caused a sharp drop in stock prices. But the U.S. stock market was able to rebound in several days. Going forward, it is certain that stock markets will be sensitive to events like the upcoming Federal Open Market Committee meeting (July 26-27), the ongoing presidential election, oil shocks, and so on. But it is far from certain whether we can predict future stock returns. However, an index, called VIX, may surprise investors.

READ MORE

It seems employers are being encouraged to help their young employees spend their money as fast, or even faster, than they earn it. Some employers are taking the bait. Some even think it is a benefit to make employees loans, help pay them off, or be better at payday loans than payday lenders.

READ MORE

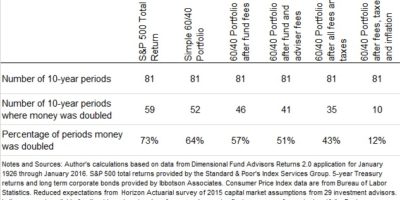

Sometimes when I do a back-of-the-napkin estimate about how much I’ll have saved in the future, I’ll use a handy formula known as the “rule of 72.” This rule says that if you divide 72 by your rate of return, the resulting number is roughly how many years it will take your money to double.

READ MORE

By relying on familiarity as a proxy for a more thorough understanding of these generic medicines, consumers often overspend on name brand medicines. Trusting our intuition instead of relying on objective data can also lead us astray when it comes to investing.

READ MORE

Target date funds are investment vehicles that have gained popularity with regular people but get mediocre marks from investment advisers. Offered by most fund families (Vanguard, T. Rowe Price, Fidelity, etc.), they are frequently included as an offering in 401(k) plans. According to Morningstar, investors had about $700 billion in target date funds at the end of 2014, although their growth is slowing. There’s a lot to like about target date funds.

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305