Can You Expect Your Money to Double in 10 Years?

Sometimes when I do a back-of-the-napkin estimate about how much I’ll have saved in the future, I’ll use a handy formula known as the “rule of 72.” This rule says that if you divide 72 by your rate of return, the resulting number is roughly how many years it will take your money to double.

For example, if I expect returns of 7 percent a year, I would expect my money to double in about 10 years (72 / 7 = 10.3 years).

I was recently talking to an adviser who made a confident statement that he expected to double his clients’ money every 10 years. Based on the rule of 72, this suggests that he thinks he can return an average of 7.2 percent per year over the next 10 years. Historically, the S&P 500 has returned almost 10 percent per year, so this statement doesn’t seem outlandish. But let’s dive a little deeper and play this out in the real world.

Stock returns only

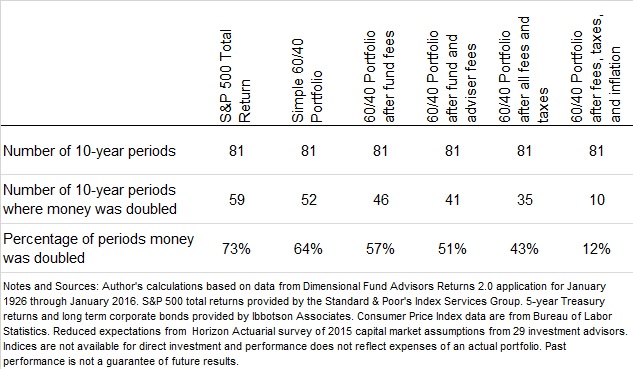

We have data since 1926 for the S&P 500. Using annual data, this means that we have 81 possible 10-year periods of overlapping historical data. If you were to invest 100 percent in the S&P 500, there would have been 59 of these 10-year periods during when you would have doubled your money. This is a pretty good success rate (about 73 percent), but nowhere near a guarantee.

Take, for instance, the period from January 2000 through December 2009. During this period, not only would you have failed to double your money, you actually would have lost money. On the other hand, the 10-year period ending in 1959 saw stock returns of over 600 percent. Suffice it to say, the range of possible outcomes is broad.

Of course responsible advisors realize that a 100 percent stock portfolio is rarely appropriate, even for the most risk tolerant investors. So what happens when we add a little diversification?

Diversified (60/40) portfolio

I looked back at returns for a portfolio comprised of 60 percent stocks (S&P 500) and 40 percent bonds (20 percent in long-term corporate bonds and 20 percent in five-year U.S. Treasuries). The good news is that this diversified portfolio would have mitigated the risk of that lousy 2000 through 2009 decade – you would have made about 36 percent instead of losing almost 8 percent.

But there is no free lunch. While diversification lowers your risk, now there are even fewer 10-year periods when you would have doubled your money with this 60/40 portfolio. Of the 81 possible periods, this portfolio would have doubled your money in only 52 of them (64 percent). Still not a bad rate of success, but this doesn’t yet account for any fees.

Diversified portfolio after fund fees

Mutual funds, index funds, and ETFs are subject to fees (often listed as “expense ratios”). The fees on ETFs using simple index funds can be low, ranging from 0.05 to about 0.30 percent. The fees on mutual funds tend to be higher, often ranging from 0.50 to above 1 percent. I have no idea what funds the adviser in question uses, but let’s assume he’s chosen a mix of mutual funds and ETFs with average fees of 0.50 percent.

After accounting for these fees, out of 81 possible historical 10-year periods, we’re down to 46 (57 percent) that would have doubled your money. Oh wait, doesn’t the adviser charge fees too?

Diversified portfolio after fund and adviser fees

I’m betting the adviser didn’t account for his own fees in his calculation of doubling up every 10 years. Let’s add in a lower-than-average adviser fee of 0.75 percent (many adviser fees start at 1 percent or above).

After accounting for fund fees and adviser fees, our historical 60/40 portfolio doubles every 10 years in only 41 of 81 cases (51 percent). Things are looking a little less certain. And we’ve yet to look at the taxes.

Diversified portfolio after fees and taxes

Capital gains taxes are 15 percent for most people. There may be other taxes paid during the course of the 10 years, but we’ll just assume this base 15 percent rate. The investor may not actually realize these taxes during the period, but if he wants to use the money for something in 10 years, he’ll need to sell his investments and realize the capital gains.

Accounting for these potential taxes, the number of periods where you could have doubled your money falls to 35 out of 81 (43 percent). This still fails to account for the purchasing power of the portfolio.

Diversified portfolio after fees, taxes, and inflation

If you doubled your money during the late 1970’s and early 1980’s, you barely kept up with inflation. In other words, prices of goods and services were skyrocketing as well, so doubling your money wouldn’t have got you anywhere in terms of what you could do with it.

For example, in the decade from 1974 through 1983, our diversified portfolio after fees and taxes would have more than doubled (2.07 times). But after accounting for price increases during this period, the value of the portfolio would have actually been about 5 percent less than at the beginning of the period. You’d be worse off financially.

If we account for inflation in our historical examples, we drop to just 10 of 81 periods (12 percent) during which you could have truly doubled your money. Suddenly, this adviser’s promise is looking doubtful, to say the least.

Conclusion

Anyone that promises to double your money in 10 years may be using a back-of-the-napkin estimate instead of a rigorous analysis that accounts for fees and inflation. Will your money double in 10 years? Maybe, but it’s far from a guarantee.

Instead of focusing on what you may or may not return over the next 10 years, it may be wise to focus on controlling what you can by minimizing costs, making efficient tax allocations, and diversifying your exposure. Save as much as you can and evaluate your situation only after the years have passed.

Click here to sign up for the Daily Economy weekly digest!

American Investment Services, Inc. (AIS) is an S.E.C. Registered Investment Adviser founded in 1978. AIS is wholly-owned by the non-profit scientific and educational organization American Institute for Economic Research.