Finance Memes and the Collective Influence of Young Retail Investors

The past year saw the realization of a new force in the financial sector. It wasn’t a new hedge fund or a billionaire with an innovative strategy; in fact, it wasn’t one single entity but millions of new self-led investors on platforms like Robinhood. Two thousand and twenty saw a massive swell in new users as millions of young people were confined to remote work with plenty of extra cash and nothing else better to do. Finfeed writes

“The pandemic has seen a surge in enthusiastic first time share market investors, with Robinhood outperforming competitors by adding over 3 million new customer accounts in 2020 thus far, and in June having a 4.3 million daily average revenue trades.

September saw the fintech giant’s 4th major venture capital investment this year, raising $460M and bringing their valuation to $11.7B.”

In terms of experience and education, many have none and they are predominantly millennials or younger. Rather than using Wall Street lingo and complicated spreadsheets, they often get their information from social media forums including platforms like Reddit, Barstool Sports, and Instagram meme pages. They buy stocks because of popularity and sentimental value, oftentimes directed by quasi-cultish edicts rather than traditional investing advice. A working paper from the National Bureau of Economic Research elaborates on this phenomenon when it states,

“This evidence suggests that RH investors may have actively added cash to fund purchases of more stocks. Thus, during the March 2020 stock market decline, RH investors collectively acted as a (small) market-stabilizing force. (Because RH investors also buy after stock market increases, they may not be a stabilizing force in other situations. Indeed, they also added funds aggressively after large upswings.)

“RH-type investors may very well have played a role in the active trading of, and the steady-state demand for, cannabis and many other (otherwise) obscure stocks.”

When stocks began to plummet in March of 2020, many traditional investors such as hedge funds began to pull from the market. However, Robinhood investors opted to “buy the dip” which is a popular slogan that illustrates a strategy of almost praxeological importance to many young investors. The sheer number of investors acting in uncoordinated but collective action managed to have a discernible effect on the market and an even greater effect on individual stocks. It also turned out to be the right move.

A Mix of Strategy and Comedy

Mantras like “Buy the Dip” refer to a common practice of aggressively purchasing stocks when the price falls regardless of the context and often without consideration of other factors. Slogans like “Stonks (slang for Stocks) only go up” illustrate the highly optimistic expectations these young traders have as they continue to fuel a raging bull market while the global economy grinds to a halt. Many of these traders fully understand how ridiculous such market performance is as they share comedic videos of Federal Reserve Chair Jerome Powell printing money, disparaging comments about market bears, and sync the rise of indexes like the Dow to electronic music.

Such youthful attitudes also apply to their collective financial practices which were mostly geared towards investing in popular companies. These investors also displayed peculiar interest in cannabis stocks and companies popular with millennials. NBER writes,

“Despite unusual interest in some “experience” stocks, their aggregated consensus portfolio (likely mimicking the household-equal-weighted portfolio) primarily tilted towards stocks with high past share volume and dollar-trading volume. These were mostly big stocks. Both their timing and their consensus portfolio performed well from mid-2018 to mid-2020.”

This mug with a photoshopped picture of Fed Chair Jerome Powell is being sold by a popular financial meme page known as Wall Street Bets which is named after the popular Reddit forum. On the forum and outlets like it, there is much content bragging about making or losing large sums of money as well as quasi-satirical content about making risky stock purchases. NBER writes about the influence of the popular refrain “Buy the Dip” when it notes that during the bear market of March 2020,

“Aggregate RH holdings also increased during this episode. RH investors did not panic or experience margin calls. Their first “purchasing” spike (i.e., an increase in the sum total number of holding investors in all stocks) occurred as early as the next day, presumably reflecting their existing purchasing power in their accounts. A second spike occurred about four days after a large market movement. This is roughly the time required to complete a cash bank transfer.”

Such a practice seems overly simplistic and even dangerous. However, in this case, it paid off handsomely with Robinhood users collectively outperforming professional investors. Part of this was due to sheer collective action; another component was excellent timing combined with a sort of crowd knowledge.

The Power of Cult Investing and David Portnoy

One of the most significant collective abilities of young amateur investors is to generate market movements through sheer activity. Market Insider writes

“As Robinhood traders pile into certain stocks, they help boost performance over the next one week and one month relative to stocks with decreasing popularity, according to a study conducted by JPMorgan.”

Oftentimes these bull runs are sparked by information shared through social media as well as the aforementioned bullish tendencies of young investors sitting at home with nothing else better to do.

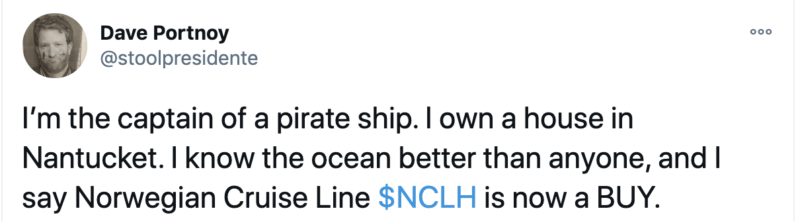

One extreme example of this dynamic is the influence of Barstool Sports founder David Portnoy, who began a day trading initiative in 2020. With little to no experience, Portnoy began streaming and tweeting about his wild investments as a small army of young investors followed his lead.

To some, this was simply an amusing tweet exhibiting a sort of frat boy bravado as any stock relating to travel was devastated by global lockdowns. However, thousands of investors either thrill-seeking or calculating, or both bought in. According to data provided by Robintrack.net at the start of May 6th (the day of the tweet), 267,320 Robinhood users owned shares of NCLH. The next day that number increased to 273,276 users. Besides Portnoy’s endorsement, travel stocks such as NCLH and American Airlines became extremely popular with the Robinhood crowd during the pandemic. According to the data, there were only 762 Robinhood users holding shares of NCLH at the beginning of 2020. That number rose to over 100,000 on March 24. The stock is still one of the most popular stocks on the Robinhood app.

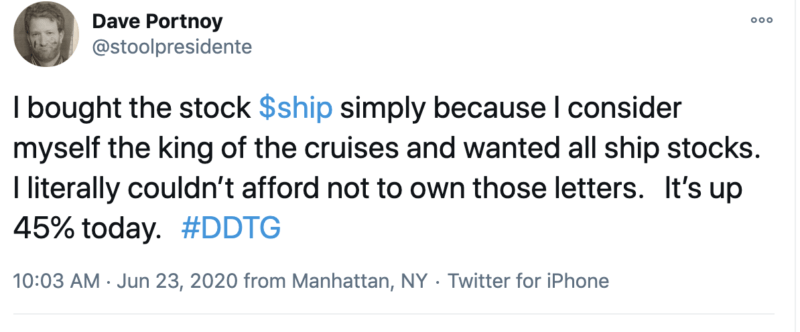

A more impressive demonstration was when Portnoy made the following tweet on June 23, 2020

Portnoy made a further comment stating he didn’t know what the company was. SHIP is the ticker symbol for Seanergy, which is a shipping company based in Greece and at the time of this writing is worth 54 cents a share. According to Yahoo Finance SHIP stock opened at $3.36 a share the day Portnoy made the tweet and within 24 hours hit $5.92 a share. That was a 76 percent increase.

Perhaps one of the most miraculous achievements Portnoy has pulled off was his investment in a nanocap stock. The Business of Business writes

“He made a killing off of an obscure US-listed Israeli medical company called InspireMD (NSPR). In a very confident and not-at-all stilted explanation, Portnoy says he got the stock tip on a date, and put $400,000 down on a barely-touched nanocap just to impress the lucky woman.”

Portnoy tweeted about the stock the morning of June 10, 2020. According to Robintrack.net there were 10,108 Robinhood users invested in the stock. The same day that number went as high as 16,330.

Tesla and the Sheer Belief of Investors

Perhaps one of the most consequential investment trends of young retail investors has been their collective affinity for certain stocks and the sheer buying force behind them. To some degree, they have willed the success of certain stocks into existence as in the case of Norwegian Cruise Line and propelled countless more to new heights. It is possible to observe such buying patterns across a multitude of stocks but few compare to the growth of Tesla. Although roughly 75 percent of Tesla stock belongs to large institutional investors, that remaining percentage of stock is held by incredibly enthusiastic retail investors.

Reuters writes that

Tesla shares are among the most popular on U.S. retail investor platforms, such as Robinhood Markets Inc and TD Ameritrade AMTD.O. The number of users holding Tesla stock on the Robinhood trading app increased more than 400% from the first two weeks of July 2018 to the same point this year, according to data from Robintrack.net, which compiles data on the investing platform.

Screenshot from Wallstreetmemes.com demonstrating cult-like adoration for Tesla CEO Elon Musk as well as an ironic sense of humor surrounding the stock price.

Although Tesla is still barely profitable as a company and is still struggling to put a comparable number of products on the market compared to its peers, investors believe Elon Musk is the future. Tesla stock has increased over 700 percent in the past year. For many investors, that’s all that matters, which when combined with strong buying momentum creates a complementary cycle of investment. CNBC’s Jim Cramer explains Tesla’s popularity with young investors along with other stocks here. He explains that millennials in particular are attracted to tech stocks more so than older investors and those purchasing tendencies have become a real market force.

Key Takeaways

The past year has seen millions of new young retail investors flock to the stock market as lockdowns confined countless people to their homes. In particular, it pushed millions of excited, inexperienced, and aggressive young adults with some disposable income into the market. These investors were free to throw their money at whatever sparked their passions, whether it be from hours of research or seeing a funny meme on an internet forum. However, in the stock market if enough people collectively do something it becomes reality. Many believed that young retail investors on platforms like Robinhood would be a danger to themselves, including the state of Massachusetts which took issue with its youthful appeal. In reality they actually ended up changing the dynamic of the market to benefit them which is why more investors are entering the market, not less.

Much like all other behaviors associated with young retail investors, on their own, they seem reckless but collectively they help shift results in their favor. Sometimes they are simply the right choice despite expert opinion. These trends not only demonstrate an interesting short-term market force but also the permanent introduction of new demand side forces as a result of the growing financial enfranchisement of younger investors.