A new report in the New York Times claims the ultra-wealthy pay a lower tax rate than the poor. A closer look at tax statistics reveals that story is also likely wrong.

READ MORE

Private clubs are voluntary associations. Opting out of citizenship altogether is not a realistic option.

READ MORE

Some economists are touting Elizabeth Warren’s wealth tax as a solution to our budget woes. Closer examination reveals that their revenue projections are wildly exaggerated.

READ MORE

“Every individual, it is evident, can, in his local situation, judge much better than any statesman or lawgiver can do for him.” ~ Adam Smith

READ MORE

Every promise of a free government service should be greeted with instant, habitual, and empirically verified incredulity.

READ MORE

An “efficient” carbon tax — one that truly solves the so-called “market failure” problem — requires that government officials first divine the optimal rate of emissions and then set the tax at a level that will result in this rate of emissions.

READ MORE

The opportunity to voluntarily tax yourself at rates you so choose is available to you via the US Treasury.

READ MORE

The prospect that the US president would conclude that tariffs cause growth has always been the downside of good economic numbers. Good performance of the macroeconomy only encourages his worst instincts to impose more harmful trade policies.

READ MORE

Unfortunately, these foolish mistakes will be made on the back of smokers who may get to switch away from tobacco.

READ MORE

Taken together, the top quintile of earners, representing 53 percent of total income, paid 70 percent of all federal taxes, or 17 percentage points above their fair share.

READ MORE

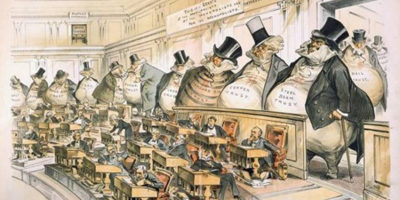

We ought to attack the true root cause of inequality — that is, rent-seeking. This is far more productive than redistributing the rents that the rent-seekers captured.

READ MORE

There is never any good reason for government to subsidize a private company. Such handouts are appalling in their cronyism, in addition to being a sign of economic ignorance.

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305