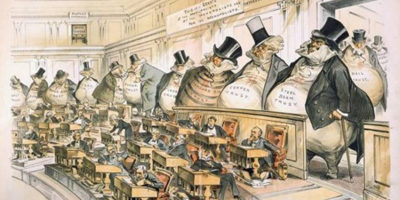

“Politicians are quick to ignore the costs of government spending in proposing legislation and obscure those costs by issuing debt rather than raising revenues. It is politically popular to issue debt and send checks to everyone. The benefits of the policy are clear: people get checks. The costs, which ripple out through financial markets as interest rates are bid up, are difficult to tie to the policy.” ~ Nicolás Cachanosky

READ MORE

The IRS has released new tax data that demonstrate how much we’ve been fooled by claims that the rich aren’t paying their fair share. Those claims are based on statistical errors and incomplete data. Now that we have the complete data, we gain more per …

READ MORE

Carbon emissions are not, contrary to what many economists and non-economists seem to believe, approaching the idea of a pure externality; their costs are only partially external to the main transaction.

READ MORE

Democrats can reject neo-Brandeisian antitrust along with the other pillars of left-populism, or seek a victory that in many ways will prolong rather than end the Trump era.

READ MORE

The 2020 presidential field is saturated with candidates decrying wealth inequality and making the argument to soak the rich. One front-runner, for instance, is constantly denouncing “the millionaires and the billionaires.” Ominously, a New York Times …

READ MORE

When debating tax policy it is important to use empirical evidence to inform the discussion of what rates the top earners currently pay and what rates we would like them to pay, or if a rate change is even warranted at all.

READ MORE

Freedom goes down when tariff revenues go up. It’s high time we revisited the Declaration of Independence and renewed our commitment to freedom.

READ MORE

We still have no clue just who will pay for what and how much the bill will be.

READ MORE

The primary driver of Saez and Zucman’s claims about the tax rates on the wealthy do not reflect a regressive shift over time. They arise almost entirely out of unconventional and contested adjustments to their previous numbers.

READ MORE

Casting billionaires as direct actors leading to poverty and inequality puts the actual well-being of people behind the short-term success of someone’s political agenda. Now that’s what I call injustice.

READ MORE

With the U.S. government taking in more taxes each year, it is clear that Americans aren’t able to use their hard-earned money for good. Perhaps that’s one of the main reasons why Americans aren’t volunteering as often as we once did.

READ MORE

A new report in the New York Times claims the ultra-wealthy pay a lower tax rate than the poor. A closer look at tax statistics reveals that story is also likely wrong.

READ MORE250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305