The Multiyear Decline in US Economic Freedom

Economic freedom in the world has plunged in recent years, due mainly to the interventions and fiscal-monetary profligacy associated with COVID shutdowns, mandates, and subsidies. The global measure is given in Figure One. This is a significant reversal of freedom’s increase between 2010 and 2019. But the downtrend is much worse and more prolonged in the US.

Figure Two makes clear that economic freedom in the US also has declined significantly, but it’s done so since the financial crisis and “Great Recession” of 2007-09, not only amid COVID lockdowns. The overall score for the US was 82 in 2007 (out of a maximum of 100) but is only 71 today. In this time the US has moved from the category of “Free” (80-100) to “Mostly Free” (70-80) to the precipice of becoming merely “Moderately Free” (60-70). In 2007 only three countries were economically freer than the US, but by 2015 eleven nations were. Today, 24 are freer (including Canada, Chile, Czech Republic, Denmark, Estonia, Finland, Germany, Ireland, Latvia, Norway, South Korea, and Sweden).

In 2007 the three countries economically freer than the US were Hong Kong, Singapore, and Australia. Hong Kong was ranked #1 every year from 1995 to 2019 (and #2 in 2020), but was then summarily omitted from the rankings by the Heritage Foundation under the mistaken claim that its economic policies were suddenly “controlled from Beijing.” Heritage did this in response to Hong Kong’s government precluding violent insurrectionists (who posed as “champions of democracy”) from taking over the local legislature. For the Heritage perspective, see Edwin J. Feulner’s, “Hong Kong Is No Longer What It Was,” wherein he admits that the editors of the Index recognize that Hong Kong “offers its citizens more economic freedom than is available to the average citizen of China.” For Hong Kong’s view, see “Hong Kong Minister Blasts City’s Disappearance from ‘World’s Freest Economies’ Rankings.”

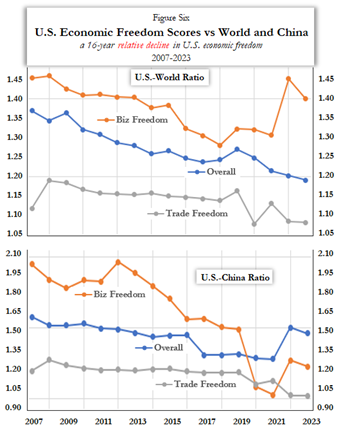

Figures Three, Four, and Five depict the trend of scores since 1995 for the US, the World average, and China, along three measures: overall economic freedom (Figure Three), business freedom (Figure Four), and trade freedom (Figure Five).

Overall (Figure Three), US economic freedom has declined since 2007 while the world average has held steady (at around 60). On business freedom (Figure Four), China has become much freer and the US less so since 2006. According to Heritage, the “Business Freedom” metric measures “an individual’s ability to establish and run an enterprise without undue interference from the state” and without “burdensome and redundant regulations.”

On trade (Figure Five), China became substantially freer during the decade of 1995-2005 and has maintained that level since then, while US economic freedom, after being steady through 2005, has eroded since then (especially since 2019, due to Trump’s trade wars).

Figure Six depicts relative scores (ratios) for the US versus the world average and China, again using the overall measure, the business freedom metric, and the trade freedom metric. The US-World Ratio for the overall index has declined 13 percent, from 1.37X in 2007 to 1.19X in 2023. The US-China Ratio for trade freedom fell 16 percent in the year before Trump became president (1.21X in 2015) to today (1.02X, as Biden hasn’t rescinded or reduced the Trump tariffs). The US-China Ratio for business freedom plummeted 37 percent, from 1.95X in 2007 to 1.23X in 2023 – due to China’s absolute measure increasing by 46 percent while the US absolute measure declined by 8 percent.

Why does this matter? Most people, including many professional economists and data analysts (who should know better) seem to cling to the impression that US economic freedom is high and stable, while China has become less free economically. The facts say otherwise, and the facts should shape our perceptions and theories. Human liberty also should matter; much of our lives are spent engaged in market activity, pursuing our livelihoods, not in political activity. Finally, as a rule (which is empirically supported) less economic freedom results in less prosperity.

Neither major US political party today seems much bothered by the loss of economic freedom. They don’t talk about it. It’s not that a model of the proper policy mix isn’t available, for it was adopted in 1980s and 1990s as “Reaganomics” in the forms of supply-side economics and neo-liberalism. Each has been out of fashion for most of this century – and it sure shows, especially in the freedom indexes. So-called “Bidenomics” now pledges the precise opposite set of policies, both supply-crushing and illiberal, and likely to move the economy from slow growth to no growth to “de-growth.” Without a reversal in the trend of declining economic freedom in the US, we’ll likely be suffering more from less liberty, less supply growth, and less prosperity.