Small Decline in Consumer Sentiment Masks Big Partisan Divide

The final January results from the University of Michigan Surveys of Consumers show overall consumer sentiment fell in January and remains well below pre-lockdown levels, though well above prior cyclical lows. Despite the small decline, the details show deep partisan differences, especially for consumers’ expectations.

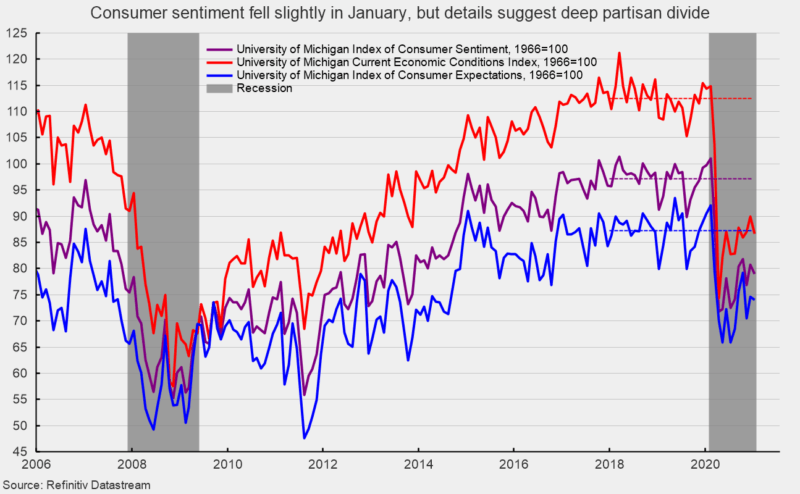

Overall consumer sentiment decreased to 79.0 in January, down from 80.7 in December, a 2.1 percent decline (see chart). From a year ago, the index is down 20.8 percent. The sub-indexes both fell in January. The current-economic-conditions index dropped to 86.7 from 90.0 in December (see chart). That is a 3.7 percent decline and leaves the index with a 24.2 percent decrease from January 2020. The second sub-index — that of consumer expectations, one of the AIER leading indicators — sank 0.6 points or 0.8 percent for the month to 74.0 (see chart) and is 18.2 percent below the prior year.

All three indexes remain well below the pre-pandemic levels, with the Current Economic Conditions index 22.9 percent below its 2018-2019 average and the Index of Consumer Expectations 15.2 percent below the recent average. Combined, the overall index sits 18.7 percent below the pre-pandemic average (see chart). All three are also well above the lows from the last recession: 55.3 for the overall index, 57.5 for the present situation index, and 49.2 for the expectations index (see chart).

According to the report, “The overall stability of consumer confidence has benefitted from wearing masks and social distancing, the quick substitution of home for office work, and the prompt distribution of generous federal benefits. These factors helped to absorb the pandemic’s negative impact on the economy as well as on personal finances.”

Regarding the partisan divide, the report goes on to add, “In contrast to the reduced levels but relatively stable trends in consumers’ economic expectations, partisan views have remained quite volatile. In the past three months, the Index of Consumer Expectations, the primary gauge for the future performance of the economy, has jumped among Democrats to 91.8 in January from 68.6 in October, and among Republicans it has plunged to 51.4 in January from 96.4 in October. This reverses the shift which occurred when Trump was elected and maintained throughout his term in office. The data also indicate that the weighted average across Democrats and Republicans (74.2) has closely followed trends for Independents as well as the all-household average. The sharp partisan differences have been effectively neutralized with respect to economic expectations, although still exerting a dominant force shaping public discussions.”

Overall, the report suggests consumer sentiment, like many other economic gauges, is making progress recovering from sharp plunges during the worst of the lockdowns but remains well below pre-pandemic levels. Furthermore, the survey provides evidence of deep partisan divides (though they offset in the aggregates), though simply watching the news provides more than enough evidence of the deep and growing divides in the country.

Vaccine distribution, easing lockdowns, and supportive fiscal and monetary policies have helped ease some of the devastation of lockdowns but recent mutations (and the potential for more mutations) by the virus and the deep partisan rancor by policymakers are significant risks for the economic outlook.