Business Conditions Monthly December 2023

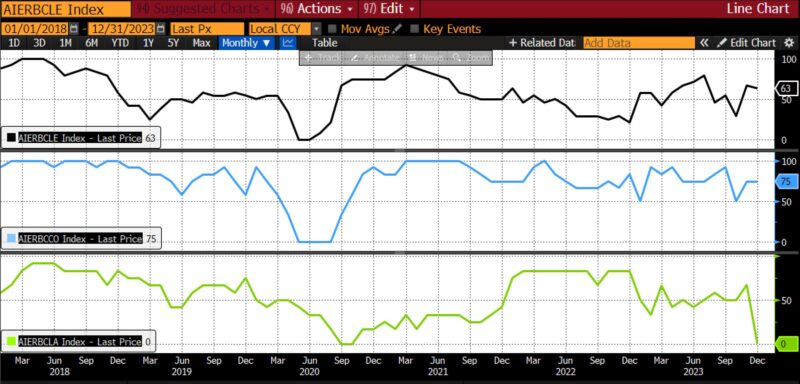

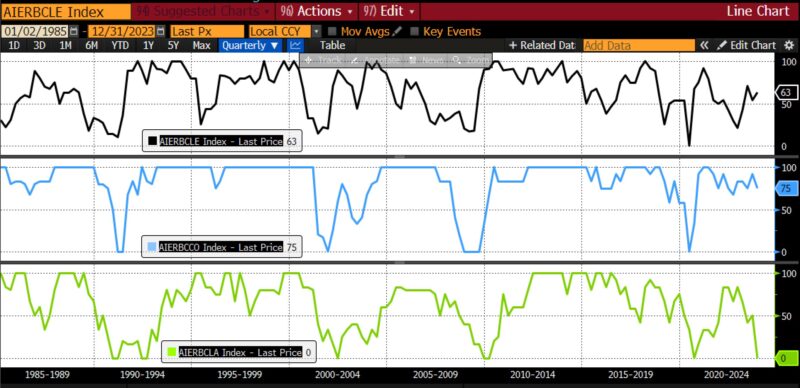

In December 2023, the AIER Business Conditions Monthly indices again emphasized the unpredictable nature of economic data in the post-COVID-19 period. The Leading Indicator fell slightly from November 2023’s 67 to 63, while the Roughly Coincident Indicator remained at 75 from the previous month. The Lagging Indicator, however, plummeted to zero for the first time since late 2020.

Leading Indicators (63)

From November 2023 to December 2023, seven of the twelve leading indicators rose, four declined, and one was neutral.

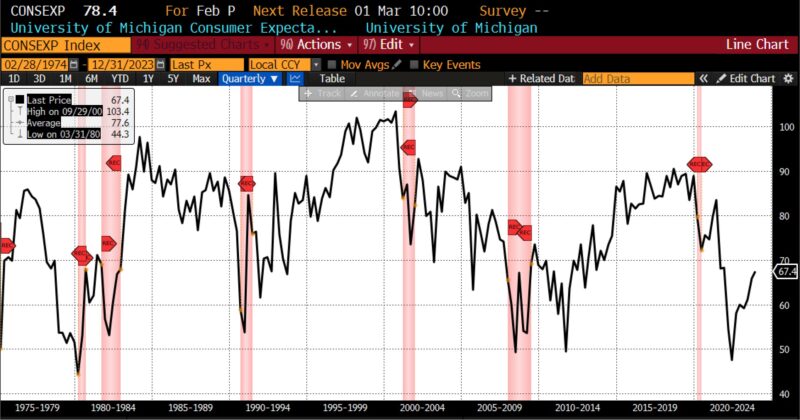

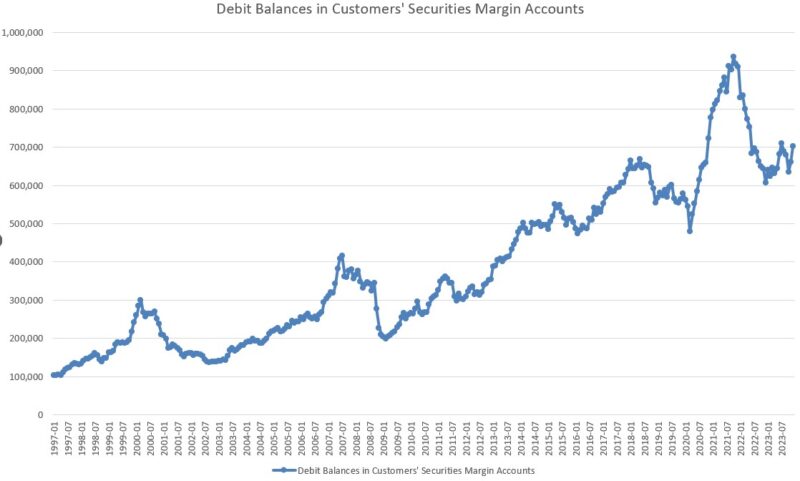

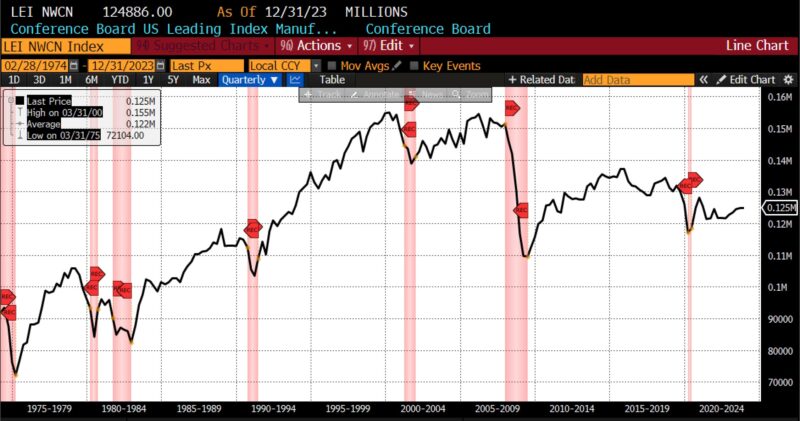

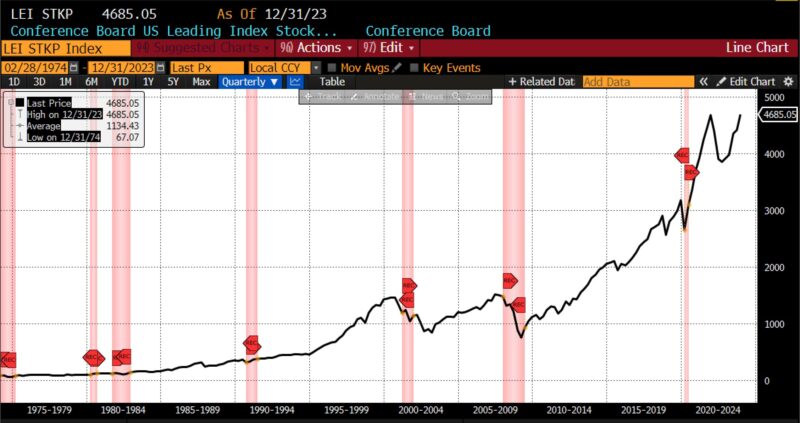

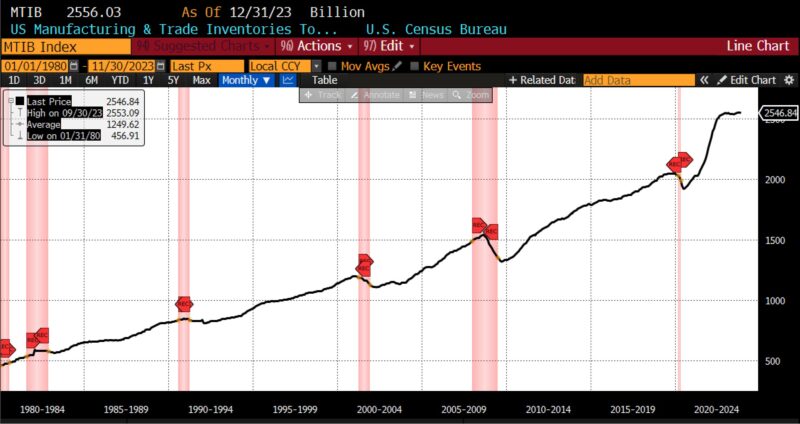

Rising were University of Michigan Consumer Expectations Index (18.7 percent), FINRA’s Debt Balances in Customers’ Securities Margin Accounts (6.0 percent), US Initial Jobless Claims (5.6 percent), Conference Board US Leading Index Stock Prices 500 Common Stocks (5.0 percent), Adjusted Retail and Food Services Sales Total (0.6 percent), Conference Board US Leading Index Manufacturing New Orders Consumer Goods and Materials (0.1 percent), Conference Board US Manufacturers New Orders Nondefense Capital Good Ex Aircraft (0.1 percent). The Inventory/Sales Ratio: Total Business was unchanged from November to December. The US Average Weekly Hours All Employees Manufacturing (-0.3 percent), US New Privately Owned Housing Units Started by Structure Total (-4.3 percent), United States Heavy Trucks Sales (-4.6 percent), and 1-to-10 year US Treasury spread (-11.7 percent) declined.

Roughly Coincident (75) and Lagging Indicators (0)

Within the Roughly Coincident Indicator, four constituents rose, one declined, and one was neutral. From November to December the three Conference Board metrics, Consumer Confidence Present Situation (7.8 percent), Personal Income Less Transfer Payments (0.2 percent), and Coincident Manufacturing and Trade Sales (0.2 percent), as well as US Employees on Nonfarm Payrolls Total (0.2 percent), expanded. US Industrial Production was unchanged and the US Labor Force Participation Rate fell by 0.5 percent.

All six of the lagging indicators declined for the first time since November 2020 between November and December 2023. The ISM Manufacturing Report on Business Inventories (-0.1 percent), Census Bureau US Private Constructions Spending Nonresidential (-0.2 percent), US Commercial Paper Placed Top 30 Day Yield (-0.9 percent), Conference Board US Lagging Commercial and Industrial Loans (-0.9 percent), US CPI Urban Consumers Less Food and Energy Year over Year (-2.5 percent), and the Conference Board US Lagging Average Duration of Unemployment (-14.4 percent) contracted in the last month of the year.

The unprecedented volatility observed in the three Business Conditions Monthly indicators over recent months exemplifies the distortions prevalent in economic data broadly in the post-pandemic era. The sharp swings witnessed from one month to the next highlight the challenges in accurately capturing and assessing the underlying trends and dynamics of the current US economy. While such fluctuations raise reasonable concerns about the reliability of economic data, it is essential to recognize that they are occurring within a unique context shaped by policy responses to the pandemic and their subsequent effects upon consumer behavior, manufacturing, trade, business investment, and beyond.

The economic scenario depicted in the December 2024 Business Conditions Monthly is, once again, one of contradictory indications. A somewhat strong leading indicator suggests future economic growth, indicating potential improvement or expansion in the near future, driven by factors like rising consumption, consumer confidence, and manufacturing orders. The strong coincident indicator portrays current economic conditions as robust and stable, suggesting that, despite recent slowdowns in certain areas, the US economy is generally performing well. All of this is at odds with the plummeting lagging indicator, which suggests recent contraction owing to rising unemployment durations, falling inventories, declining private nonresidential construction, and other signs of weakness.

It may be premature to formally reevaluate the relationship within the Business Conditions Monthly indicators and macroeconomic aggregates. Over time, however, it may become necessary to reassess our analytical frameworks and methodologies in order to ensure the accuracy and relevance of the economic data used in capturing the progress of the US economy.

Discussion

Consumer spending, a stalwart contributor to economic expansion, exhibited a mixed trajectory in the fourth quarter, with growth in goods consumption moderating while spending on services accelerated. Mounting signs of labor-market softening, however, characterized by larger applicant pools and easing wage pressures, cast doubt on the sustainability of consumer spending trends. Business investment, particularly in equipment, remained lackluster, which suggests subdued corporate confidence in future growth prospects. The interplay of trade dynamics and inventory fluctuations add further complexity to the economic narrative, with the trajectory of trade services and the unpredictability of inventory adjustments posing additional forecasting challenges.

The economic landscape in early 2024 is similarly characterized by a mixture of positive and concerning indicators. On one hand, consumer confidence rose in January, reflecting optimism fueled by expectations for lower inflation and interest rate cuts. The Conference Board’s consumer confidence index improved, driven by improving perspectives on current economic conditions and labor markets. There was, however, a notable drop in buying plans for homes, cars, and major appliances, indicating a hesitancy among consumers to spend following the holiday season. Additionally, recent hot inflation prints have tempered the improvement in sentiment, with rising inflation expectations potentially overshadowing positive economic news.

Retail sales in January experienced a larger-than-expected decline, signaling a pullback in consumer spending after a strong round of holiday shopping in December. While technical factors and adverse weather conditions may have contributed to the weakness, the overall trend suggests a less-vigorous start to the year for consumers. Despite this, strong fundamentals, such as the solid January jobs report, have provided some support to investor sentiment. But downward revisions to sales figures for December and November indicate that consumer spending might not have been as robust as previously reported, leading to a more cautious outlook for economic growth in the first quarter.

The January jobs report revealed surprisingly robust job gains, significantly lowering the likelihood of a Fed rate cut in March. Revised benchmark data showed that the labor market was weaker than previously thought from late 2022 through early 2023, but ran hotter than realized in the second half of 2023. Nonfarm payrolls increased by 353,000 in January, higher than expectations, with a net upward revision of 126,000 for December and January combined. While average hourly earnings increased and the U-3 unemployment rate held steady in the 3.7 percent range, average weekly hours worked declined, tempering the overall positive picture.

Favorable news on the job market continued in early February 2024, boosting consumer sentiment in turn and reflecting the positive impact of January’s blockbuster payroll gains. Concerns about escalating inflation, however, particularly in light of recent price increases for gas and other goods, could dampen the improvement in sentiment. Inflation expectations have edged higher, raising concerns about the erosion of purchasing power and living standards. As inflation remains a key issue, particularly in the lead-up to the November presidential elections, policymakers and market participants will closely monitor future economic data releases to gauge the trajectory of inflation and its implications for the broader economy.

The labor market picture is cloudier than generally recognized at present. Three factors cast some doubt on the remarkably strong labor market data of late.

First, abnormally low survey response rates in 2023 and January 2024 raise questions about the reliability of the data. Second, there are reasons for questioning the accuracy of the birth-death model and the potential undercounting of business closures therein. Revisions to the Bureau of Labor Statistics’ Business Birth-Death Model contributed significantly to non-seasonally adjusted payroll figures, with higher contributions from May to November. Updated population controls have additionally decreased the estimated size of the civilian noninstitutional population, affecting the reported labor force size. Third, the decline in average weekly hours worked, particularly in cyclical industries, offset higher wages. That leads to a constant level of weekly earnings from December to January, but adjusting for the decline in hours worked payrolls, would have declined by the equivalent of 485,000 full-time jobs in January 2024. So concerns about data reliability and potential economic implications remain, heightening uncertainty surrounding future Fed policy decisions.

Global economic headwinds, including the outbreak of recessions in the United Kingdom and Japan alongside notable economic slowdowns in both China and Germany, cast an additional shadow over the outlook. The predictive power of consumer sentiment has degraded over time, and rising inflation, credit card delinquencies, and a larger-than-expected drop in retail sales suggest underlying weaknesses.

In the aftermath of the first run of the fourth-quarter 2023 GDP report, which surpassed expectations, an air of cautious optimism has pervaded economic discourse in the media. Despite that outcome, concerns persist regarding potential downward revisions to GDP figures in light of tepid survey data, an aspect increasingly acknowledged by officials. The GDP growth of 3.3 percent for the fourth quarter, outperforming estimates and led primarily by robust consumer spending, underscores a semblance of resilience in the economy, albeit shadowed by apprehensions stemming from sluggish business investment and uncertain trade dynamics.

Readings from regional Fed surveys, meanwhile, suggest that GDP prints may eventually be revised downward. Despite the positive GDP figure, which is not heavily weighted by the Federal Reserve or the National Bureau of Economic Research, it remains possible that a recession is currently underway.

The NBER places relatively low weight on GDP in determining past business cycles, considering a range of indicators and focusing on monthly chronology. Contrary to popular belief, a recession doesn’t necessarily require two consecutive quarters of GDP contraction, with equal weight placed on Gross Domestic Income (GDI), which contracted in the year through 3Q23. The NBER emphasizes economy-wide measures of economic activity, giving relatively little weight to real GDP due to its quarterly measurement and susceptibility to revisions. Each economic downturn is unique, with some marked by significant GDP contractions and others not, such as the mild recession in 2001.

Historically, initial prints of real GDP were often revised down later, suggesting potential downward revisions to recent GDP prints, despite recent strength in hard data. Soft data indicate room for caution, emphasizing the need to consider both hard and soft data together. While GDP growth in 4Q suggests resilience, a holistic view suggests caution and the possibility of a mild recession similar to that seen in 2001.

The anticipated Fed rate cuts, if realized, are likely to occur much later in the year due to nagging inflationary pressures and glimpses of economic resilience that the Federal Reserve cannot disregard. Amidst the prevailing economic landscape, characterized by a confluence of divergent signals across various indicators, prudence dictates our vigilant and objective monitoring of forthcoming policy deliberations and statistical releases. Given the intricacies inherent in recent (and perhaps distorted) assessments of the US labor market, consumer sentiment, and analogous datasets ostensibly portraying favorable contours, all of which juxtaposed against the contemporaneous downturns afflicting several major global economies, a forecast of economic contraction continues to pervade our outlook for 2024.

LEADING INDICATORS

ROUGHLY COINCIDENT INDICATORS

LAGGING INDICATORS

CAPITAL MARKET PERFORMANCE