Retail Sales Growth Picked Up in January After a Sharp Fall in December

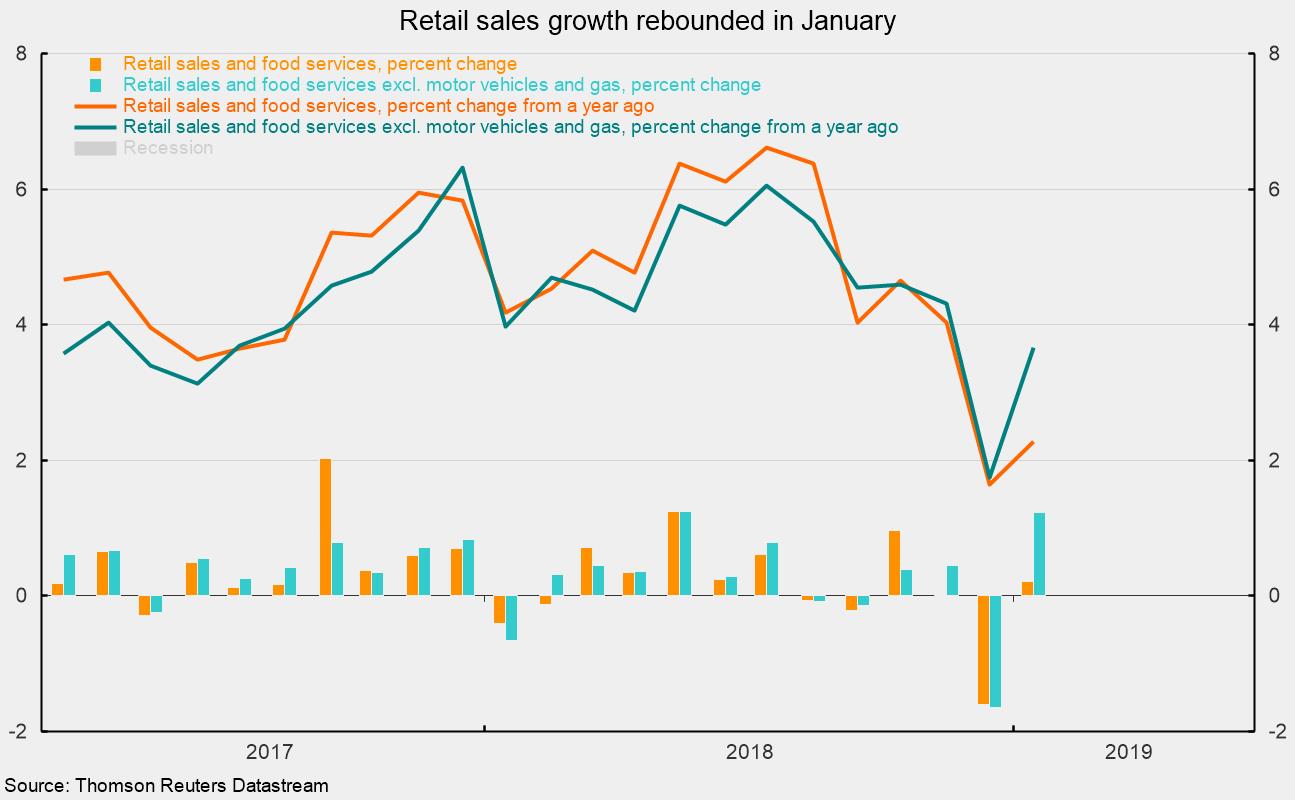

Retail sales and food services rose 0.2 percent in January following a sharp 1.6 percent decline in December. Over the past year, they are up 2.3 percent, ahead of the 1.6 percent 12-month change through December (see chart). Retail sales and food services have been broadly trending higher since late 2015, when the 12-month change hit a low of 1.8 percent. The 12-month growth hit a recent peak of 6.6 percent in July 2018. The solid gains were consistent with strong consumer fundamentals including a tight labor market, accelerating hourly earnings growth, and high consumer confidence. However, sales fell sharply in December, likely hurt by the government shutdown and harsh weather in some areas of the country.

The recovery in January is even more dramatic for core retail sales — that is, food services and retail sales excluding motor vehicles and gasoline. Core retail sales rose 1.2 percent in January after a 1.6 percent drop in December. The January gains brought the 12-month change to 3.7 percent, up from a 12-month increase of 1.7 percent in December (see chart).

Gains in retail sales in January were mixed among the components. The major components to show declines for the month were motor vehicle and parts dealers, down 2.4 percent for the month but up 0.2 percent for the past year, furniture and home furnishings, down 1.2 percent in January and off 2.7 percent over the past year, electronics and appliance stores, off 0.3 percent (down 3.3 percent from a year ago), and clothing stores, down 1.3 percent for the month but up 1.6 percent for the year.

The gain in core retail sales in January was driven by sporting-goods, hobby, musical-instruments, and book stores, which rose 4.8 percent but are down 6.1 percent from a year ago, building-materials and building-supplies stores, up 3.3 percent (8.7 percent for the year), and non-store retailers, primarily online stores, with a gain of 2.6 percent (7.3 percent from a year ago). Non-store retail sales have been growing at a faster pace than general retail sales for more than a decade and now account for about 17 percent of core retail sales.

Food and beverage stores, health and personal-care stores, general-merchandise stores, miscellaneous store retailers, and food-service and drinking places (restaurants) all had gains in January.

Gasoline-station sales posted a 2.0 percent drop in the latest month, putting the 12-month decline at 4.2 percent, but this category tends to be driven by price changes (as opposed to sales volume) more than other categories. Average retail prices for gas decreased 5.1 percent for the month and are off 9.4 percent over the past year.

Today’s data suggest that the sharp decline in December was likely an outlier, impacted by the government shutdown and weather. However, ongoing uncertainty around U.S. economic policies as well as broadening risks in the global economy have the potential to negatively impact the current economic expansion. While the most likely path is continued economic expansion, heighted caution is warranted.