New Home Sales Jump to the Highest Level Since 2007

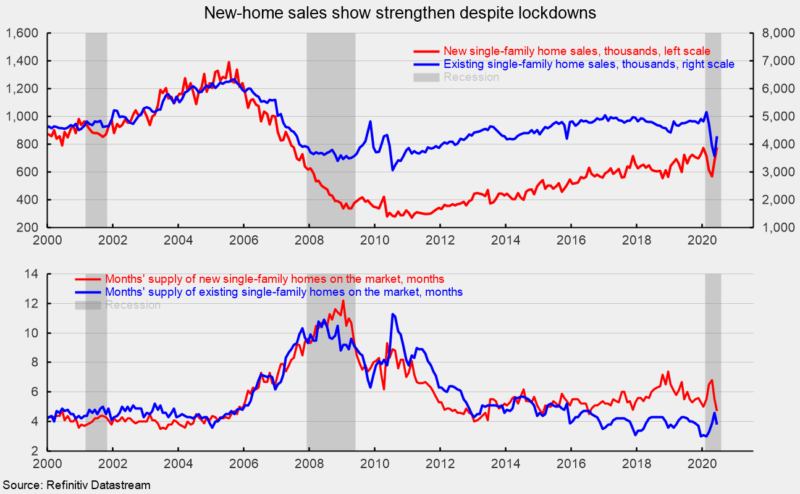

Sales of new single-family homes have bounced back, posting gains in May and June following three consecutive drops in February, March, and April. Total sales jumped 13.8 percent in June to a 776,000 seasonally adjusted annual rate, the fastest pace since July 2007, and are up 6.9 percent from a year ago (see top chart).

Sales rose across all four regions tallied: sales surged 89.7 percent in the Northeast, putting sales 111.5 percent above year-ago levels; sales were up 18.0 percent in the West, leaving that region’s sales rate 4.1 percent above the year-ago pace; sales were up 10.5 percent in the Midwest (and were 33.3 percent above year-ago levels); while in the South – the largest region by sales volume – sales increased 7.2 in June but were 1.8 percent below the year-ago level.

Total inventory of new single-family homes for sale declined 1.3 percent to 307,000 in June, the third decrease in a row, leaving the months’ supply (inventory times 12 divided by the annual selling rate) at 4.7, down 14.5 percent from May’s 5.5 months, and 14.5 percent below the year-ago level (see bottom chart).

Sales in the market for existing single-family homes rose 19.9 percent in June, coming in at a 4.28 million seasonally adjusted annual rate (see top chart). From a year ago, sales are off 9.9 percent. The June pace is about in line with the dip in early 2014 but below the range of 4.4 million to 5 million since early 2015 (see top chart).

By region, sales for existing single-family homes followed the same pattern as total existing homes: sales were up 30.8 percent in the West but are still down 12.4 percent from the year-ago level; sales rose 24.2 percent in the South, leaving that region’s sales rate 2.5 percent below the year-ago pace; sales gained 11.7 percent for the month in the Midwest but are 12.5 percent below the June 2019 rate; and sales were up 4.9 percent in the Northeast, leaving sales 25.9 percent below year-ago levels.

The existing single-family home segment saw inventory fall 0.7 percent to 1.37 million, pushing months’ supply to 3.8 from 4.6. Months’ supply for the existing single-family segment is very low by historical comparison (see bottom chart).