Low Mortgage Rates May Support Housing Rebound

Housing construction activity sank in April as starts fell by 30.2 percent while new permits dropped 20.8 percent. Total housing starts dropped to 891,000 at an annual rate from a 1.276 million pace in March, the slowest pace since February 2015. The dominant single-family segment, which accounts for about three-fourths of new home construction, decreased 25.4 percent for the month to a rate of 650,000 units, also the slowest since 2015. Starts of multifamily structures with five or more units slumped 40.3 percent to 234,000, the worst since June 2013. From a year ago, total starts are off 29.7 percent with single-family starts down 24.8 percent and multi-family starts posting a 38.6 percent decline.

Total and single-family starts fell across all four regions in the report. Total starts fell 43.6 percent in the Northeast, 43.4 percent in the West, 26.0 percent in the South, and 14.9 percent in the West. For the single-family segment, starts were down 66.0 percent in the Northeast, 41.6 percent in the West, 15.0 percent in the South and 13.3 percent in the Midwest.

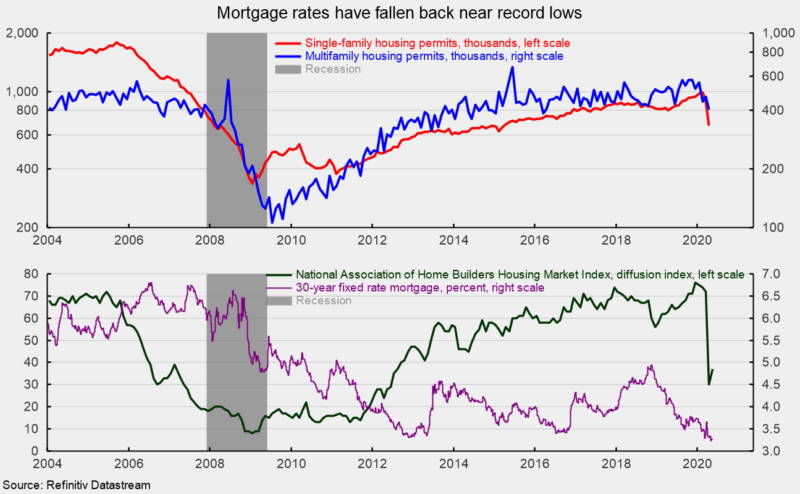

For housing permits, total permits fell 20.8 percent to 1.074 million from 1.356 million in March. Total permits are 19.2 percent below the April 2019 level. Single-family permits were down 24.3 percent to 669,000 in April (see top chart) while permits for two- to four-family units were down 30.4 percent to 32,000 and permits for five or more units were down 12.4 percent to 373,000. Combined, multifamily permits were 405,000, the slowest pace since March 2016 (see top chart). Permits for single-family structures are down 16.4 percent from a year ago while permits for two- to four-family structures are down 33.3 percent and permits for structures with five or more units are down 22.6 percent over the past year.

Mortgage rates have been falling since late 2018. The market reaction to the COVID-19 outbreak as well as Fed rate cuts have driven rates even lower in recent weeks. The rate on the 30-year fixed rate conventional mortgage is back below 3.5 percent, near all-time lows (see bottom chart).

The decline in mortgage rates has helped give a small boost to the National Association of Home Builders Housing Market Index, rising 7 points to 37 in May (see bottom chart). The 7-point gain follows a plunge of 42 points, from 72 in March to 30 in April. Lower mortgage rates and an easing of shelter-in-place restrictions should provide support for housing activity. There has been some speculation and anecdotal stories of rising demand for the lower density housing of suburbs and rural areas given the harder impact of the COVID-19 outbreak on high-density urban areas. Whether this turns out to be a sustained trend or temporary reaction is likely dependent on whether an effective vaccine is developed, new, permanent regulations are imposed on urban dwellers and businesses, and whether remote work becomes a more popular option.