How the West Won the Money Race

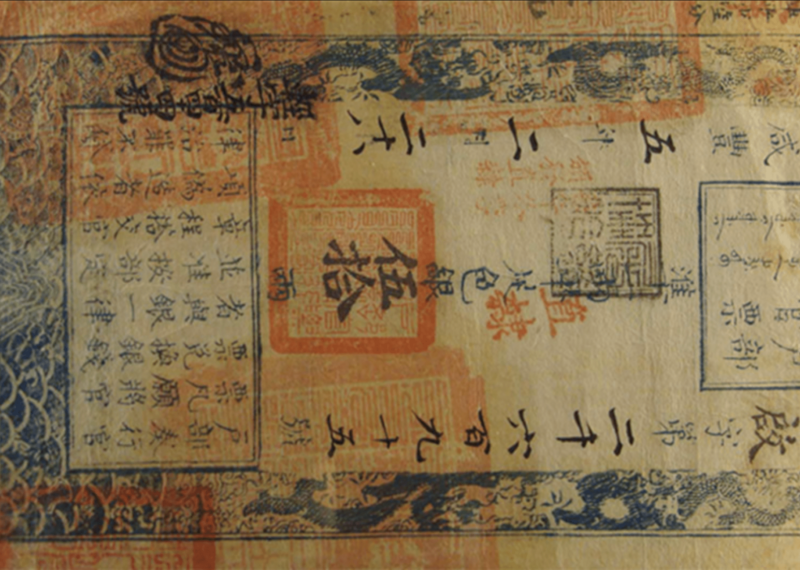

When Marco Polo arrived in Yuan Dynasty China, among the wonders he found was that money grew on trees. His travelog tells how the Emperor Kublai Khan’s mint in present-day Beijing processed the cambium layer of mulberry trees—a soft, sticky substance found between the wood and the bark—into “something resembling sheets of paper.” These were cut into rectangles and marked with an imperial seal made from cinnabar. Just like that, paper money was born. Worthless in and of itself, to be accepted and used by a population such money must be backed by something trustworthy. In the United States, prior to 1971 that something was gold. Today, it is the presumably sound policies of the US government and the Federal Reserve. The backing of the Khan’s money was less subtle: a promise that anyone who didn’t accept it would have their head and body separated. Polo, an Italian accustomed to money made from gold and silver, found the widely traded Chinese currency utterly remarkable, what he called “the secret of alchemy in perfection.”

As with other earth-shaking inventions such as gunpowder and printing, China’s paper money had beaten Europe’s to the punch by centuries. But the head start didn’t last. To understand why requires understanding the two systems that produced them. Something resembling paper money had first appeared in China during the ninth century Tang Dynasty. Named “flying cash,” it allowed wealthy merchants to park their heavy strings of coins (China’s coins had holes in the center to make carrying easier) at a depository office in return for certificates. These could be conveniently carried and redeemed for hard money at different locations. Not having to port heavy metal around made trade, the source of all wealth, much easier at a time when China was the eastern terminus of the bustling silk road that stretched westward to the doorstep of Europe.

Initially resistant to flying cash — which had been invented by private merchants — the Chinese government gave in to its popularity, finally not only accepting it but taking it over (they weren’t called dynasties for nothing). But since flying cash was not widely used as a medium of exchange, it was left to the eleventh-century Song Dynasty to create the world’s first true national paper money, followed by the world’s first national inflation of paper money. The notes in question, named hui-tzu (“check medium”) were for a time responsibly managed by the government. But with expensive wars to fight against Tartars and Mongols, the temptation for debasement became too great. Between 1190 and 1240, the supply of hui-tzu increased six-fold. The price level increased twenty-fold.

Not long after this China fell to the Mongols and their Khans, who introduced their own version of paper money which so astounded Marco Polo on his visit. But the Khans proved even more inept at currency management than the Song, overprinting and devaluing it. After multiple impoverishing inflations, the seventeenth-century Ming Dynasty finally threw up its hands and banned paper currency, reverting to metallic money despite its being an almost literal weight around the neck of trade.

By this time, of course, Polo had long since returned to Italy, published his travelog to great acclaim — his fellow Europeans scarcely believing the contents — and died in 1324. Even before that, Europe had taken baby steps along the road to paper money. The Knights Templar, a tough order of monks who protected European pilgrims visiting Jesus’s homeland, had allowed travelers to deposit hard money at their London headquarters in exchange for a document which could be redeemed upon arrival in the Holy Land. Akin to China’s flying money, these documents were not a true currency, but along with other financial services did earn the Templars the distinction of being history’s first private bankers.

The first true European paper money didn’t appear until 1661 in Sweden, and its subsequent development was markedly different from that in China. While governments got involved, they didn’t take over. All sorts of private entities across Europe — from banks to trade guilds to individuals — began issuing their own separate currencies. It was disjointed, chaotic, and as fecund as a compost heap. Like other goods and services in a market economy, currencies competed for public adoption and use. Issuers who developed the best reputations for preserving their paper’s value, and reliably backing it with valuable metals, enjoyed the widest acceptance.

Meanwhile, the European banking industry was developing in a similarly decentralized way. The most successful early European bank was that of Italy’s Medici family, which adopted the double-entry bookkeeping innovations of the Franciscan monk and “father of accounting” Luca Pacioli. These techniques allowed a business or other organization to be financially X-rayed — the ebb and flow and accumulation of funds inside made visible for the benefit of investors and lenders. For those who can’t appreciate the beauty of such an innovation, consider the beauty that the Medici’s success created, as the family would sponsor some of the greatest artists of the Renaissance, from Donatello to DaVinci.

All of this is not to say that the system of European money and banking was perfect. It included booms, busts, and even periodic scams. But it kept centralized government at arm’s length, something that did not happen in China. This allowed the system to gestate, grow, fertilize free trade, and drive the industrial revolution, an economic explosion from which the Western world’s economies have yet to look back.

Past advantages, however, do not guarantee future success. Just ask China, or the Medici family. During the fifteenth century, with their financial empire arguably spread too far and thin, bad management and delinquent loans brought about the Medici Bank’s decline and eventual closure in 1494.

Today the world still benefits from monetary and financial innovations begun in China, then picked up and carried like a baton in Renaissance Europe. They enable us to buy cars and homes, and to avoid toting suitcases filled with metal on vacation. They even provided me with my first adult job, as a credit analyst in a community bank where I applied Pacioli’s double-entry system to businesses seeking loans. We should remember that these advantages did not appear in a vacuum, but grew out of a political system that had only recently begun emphasizing individual rights over centralized control. If that environment had been in place in China, the story would have played out very differently.