Employment and the Participation Rate Rose in January

The labor market rebounded in January. U.S. nonfarm payrolls added 225,000 jobs after an increase of just 147,000 new jobs in December. The December gain was revised up 2,000 from an initial estimate of 145,000 jobs. Combining the last two months with a 5,000 upward revision to November, the three-month average gain in payrolls came in at 211,000 in January.

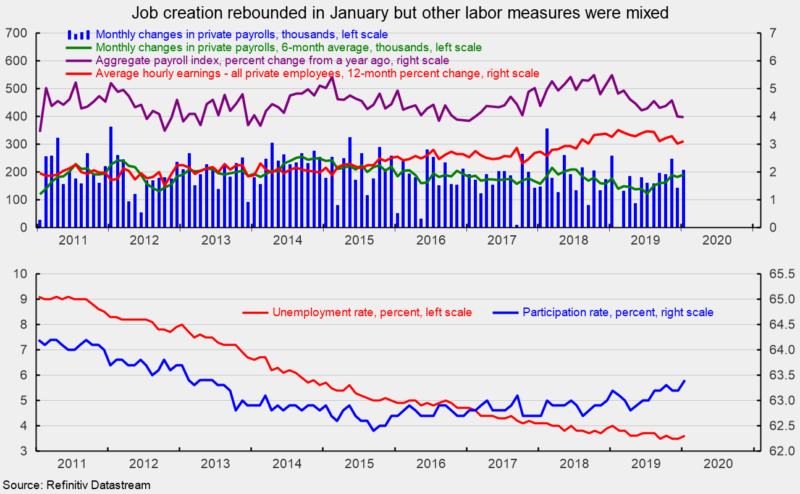

For the private sector, nonfarm payrolls added 206,000 in January following a gain of 142,000 in December. On a three-month average basis, private payrolls added 198,000. Over the last six months, the average gain is 206,000 for total nonfarm jobs and 190,000 for the private sector. The six-month average for private payrolls has been trending higher since hitting a relative low of 123,000 in July 2019 (see top chart).

Goods-producing industries added 32,000 in January, ahead of the monthly average gain of 11,000 over the past year. Construction led with the addition of 44,000 jobs while durable-goods manufacturing and nondurable-goods industries lost 11,000 and 1,000, respectively. Within private service-producing industries, which typically account for the lion’s share of job creation, payrolls added 174,000 workers, led by gains of 47,000 in health care, 36,000 in leisure and hospitality, 28,000 in transportation, and 21,000 in professional and business services. Retail employment led on the downside, losing 8,000 for the month.

The unemployment rate ticked up to 3.6 percent from 3.5 percent in December but remains close to a five-decade low (see bottom chart). The labor force participation rate moved up to 63.4 percent in January, the highest since February 2013, as 50,000 people joined the labor force in January (see bottom chart). Over the past year, more than 1.4 million people have entered the labor force.

Average hourly earnings rose 0.2 percent in January, leaving the 12-month change at 3.1 percent, down from 3.5 percent for most of the first half of 2019 (see bottom chart). Average hourly earnings growth has been slow compared to previous cycles, especially given the low unemployment rate, but has now been above the three percent level for 18 consecutive months.

Average weekly hours were unchanged at 34.3. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 0.4 percent in January and 4.0 percent from a year ago. This index is a good proxy for take-home pay and has posted relatively steady year-over-year gains in the 3.5 to 5.5 percent range since 2011 (see top chart). Continued gain in the aggregate-payrolls index is a positive sign for consumer income and spending, supporting continued economic expansion. The strong rebound in job creation in January allays some fears about the durability of the current expansion. However, the outlook remains highly uncertain. Erratic trade policy, tariffs, deteriorating relations with major trading partners, slow global growth, and the recent outbreak of the coronavirus represent threats to the global economic expansion. Furthermore, the first estimate of fourth quarter real gross domestic product released on January 30th shows U.S. economic growth is highly dependent on the consumer. A strong labor market remains key for sustaining consumer incomes, sentiment and spending. Overall, the economy continues to grow but significant risks remain.