Correlation Is Not Enough

In John McGinnis’ Law & Liberty review of Tyler Cowen’s new generative book (with what makes it generative an additional source of interest), Who is the Greatest Economist of All Time and Why Does it Matter?, both of which are worth reading, there was one section that particularly struck me as meriting further discussion, in part because I have just begun new economics principles courses, where it must be stressed.

Economics is properly obsessed with causal inference in evaluating policies. In evaluating policy, correlation is not enough, given the existence of so many confounding variables. One must show that a policy actually contributed to a result.

The “correlation does not imply causation” focus of McGinnis’ quote gets attention in the opening chapters of many economics texts and opening days of many introductory courses, including mine. He also nails that its importance arises from the desire to accurately understand and evaluate public policies. But that desire evokes a seldom-discussed distinction between how economics is generally taught–from cause to effect–and how it can help evaluating policies — including going from effect back to potential cause.

Students primarily learn economics from cause to effect, because the focus is on understanding the whys of market mechanisms. Starting from the premises of scarcity and self-interested market participants, steps in any chain of economic logic tend to be about how incentive change X would lead a self-interested individual to change their choices about variable Y as a result.

For instance, at the core of the law of demand is that if the price of a good fell, it would become cheaper relative to alternative (substitute) goods, shifting some purchases away from those other goods to the good in question. Such an incentive story is limited by a ceteris paribus (other things equal) addendum, to abstract from other causation stories that might also be at work, allowing us to understand each particular incentive mechanism clearly. Of course, in the real world, other things are not always equal, making the transition from understanding the intuition to applying it effectively a step up in difficulty.

Trying to interpret the real world with economics tools also introduces a different use of those tools. Not only can we reason from cause to effect, we can reason from effect back to (possible) cause to understand something that has happened or is happening. And that can provide a valuable check on interpretations adopted because they advance someone’s agenda, rather than accuracy.

An increase in demand for a particular good, ceteris paribus, will cause an increase in its market price. But while some might claim that an increase in the price of a particular good was therefore caused by an increase in demand, because it matches their desired narrative about what is going on, that is not necessarily true. Something that decreased supply would also increase the price. But it would point to very different implications.

Consider an area where housing prices have risen sharply (as in certain areas of Southern California, where I live). That could be because demand has risen and/or because supply has fallen, say due to stringent restrictions on housing production.

Which interpretation comes across better? Claiming that it is due to the former allows a more “innocent” explanation of the price rises — people just like the area better, which can be self-attributed to good local government policies benefiting all. But the latter interpretation is much less positive, since it reflects political efforts to benefit existing homeowners at the expense of owners who have not yet developed their land and those who have yet to become homeowners, as part of what William Fischel termed “the homevoter hypothesis.” That comes across as an abusive government policy.

How can we determine which of those competing interpretations is more accurate in such a case, since both are consistent with increased housing prices? That would involve using what I sometimes describe as a “look there, too” approach. It is true that both an increase in demand and a decrease in supply would increase the price of a good, such as housing in an area. But correlation is not enough. The increase in demand story also implies an increase in the amount of the good supplied, while the latter implies a decrease in the amount of the good supplied. If we look at that variable, too, we can conclude that if output is falling, the main cause of higher housing prices is supply restrictions.

Another example of using the “look there, too” approach involves the frequently-repeated claim that higher union wages also benefit non-union members. The key argument used is that increasing union wages requires non-union employers to also increase their wages, or their workers will leave for better options. But that would only happen if there were more jobs available at the higher wages than before (i.e., there was an increase in demand), when in fact there will be fewer jobs available at higher wages. And looking at the number of jobs available, too, reveals the falsity of the union claims.

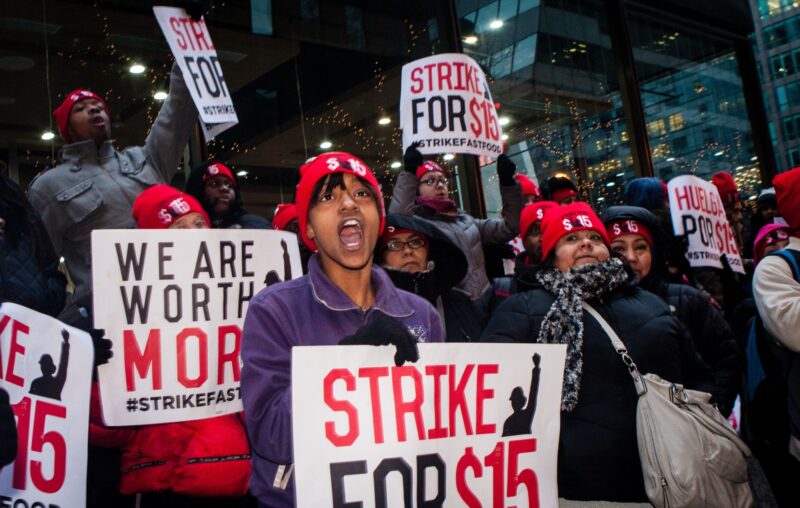

The way price ceilings (as with rent control) and price floors (as with minimum wages) are promoted also run afoul of looking at the quantities exchanged as well as the price.

For the low-skilled, minimum wage advocates frame the issue as “If you could earn more per hour, you would be better off.” But that presumes laborers will be able to sell the additional labor services they would offer (i.e., it represents an increase in demand). Unfortunately, they will sell fewer labor services, as employers will hire fewer work-hours at a higher mandated wage.

In a parallel manner, rent control advocates frame that issue as “If you could rent for less, you would be better off.” But that presumes that wanting more housing at lower rents will enable them to actually rent more (i.e., it represents an increase in supply). Unfortunately, they will find less housing available, because rental housing suppliers will offer less housing at a lower mandated rent.

So far, I have only focused on examining both price and quantity exchanged, rather than just price, to hone our understanding of public policy effects. But a given policy often has predictable effects on multiple variables, and looking at those other variables can also correct erroneous interpretations. For instance, minimum wage backers claim low-income workers would be better off as a result of mandatory wage hikes. But if workers were made better off, wouldn’t their labor force participation rates be higher, rather than lower? And wouldn’t their quit rates be lower, rather than higher?

“Look there, too” is an essential principle for macroeconomics issues, as well. Often it is because no macroeconomic variable is measured perfectly. When that is the case, careful analysis often requires that we compare alternative, differently imperfect measures bearing on the same issue. One example is using both unemployment rates based on an imperfect household survey) and employment rates (based upon an employer survey that is imperfect in different ways). We cannot rely on a particular measure being accurate (so when a single measure is used as the sole basis for conclusions, we should be particularly leery), but the more we see a similar analytical story being told by different measures, the more confident we can be in that story. Similarly, when someone argues that workers’ real (adjusted for inflation) wages are lower than in the past, as unions do every Labor Day, that would imply it should take more labor hours to buy particular goods than in the past. But that is not the story told by such measures.

Introducing economics students to economic analysis would seem to require that teachers start with cause-to-effect reasoning, given the field’s focus on causal inference. But we should also recognize that economics is incredibly useful in understanding what is or has been going on in a particular situation by reasoning from effects back to potential causes, particularly in the face of incentives facing so many to “put the best face on” their pet policies to move the political policy dial. That is why the “look there, too” approach is helpful. And in an election year, with the cornucopia of promises and solutions that accompanies them, it is even more helpful.