Consumers Grow Less Optimistic About the Short-Term Outlook in November

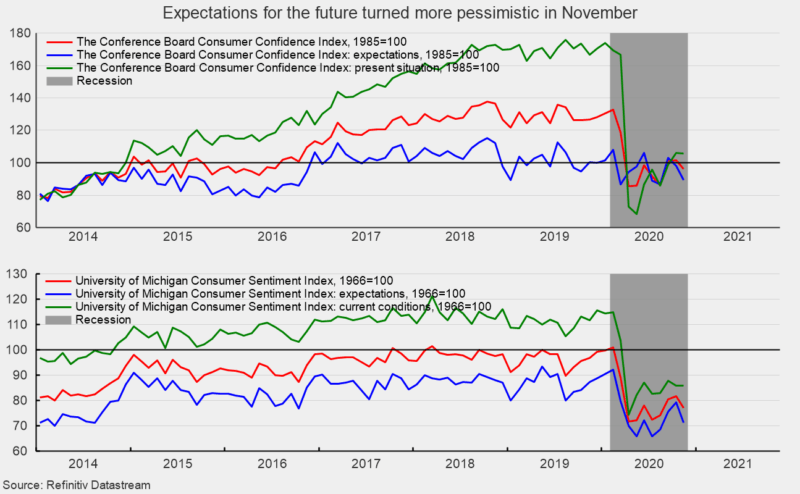

The Consumer Confidence Index from The Conference Board fell in November, decreasing by 5.3 points to 96.1. The index is constructed so that it equals 100 in 1985. Overall consumer confidence is in the middle of its long-term historical range, but well below the pre-pandemic level (see top of first chart).

Both components of the index fell for the month though the drop was much more severe for the expectations component. The present-situation component fell 0.3 points to 105.9 while the expectations component sank 8.7 points, taking it to 89.5 from 98.2 in the prior month (see top of first chart). The changes for the month closely match the preliminary results from the University of Michigan Survey of Consumers (see bottom of first chart). The report suggests that the resurgence of Covid-19 is increasing uncertainty and exacerbating concerns about the outlook among consumers.

For the present situation component, The Conference Board report says, “Consumers’ assessment of present-day conditions held steady, though consumers noted a moderation in business conditions, suggesting growth has slowed in Q4.” The report also noted, “The percentage of consumers claiming business conditions are ‘good’ declined from 18.6 percent to 17.6 percent, but those claiming business conditions are ‘bad’ also decreased, from 34.4 percent to 33.5 percent. Consumers’ assessment of the labor market was unchanged. The percentage of consumers saying jobs are ‘plentiful’ held steady at 26.7 percent, while those claiming jobs are ‘hard to get’ was virtually unchanged at 19.5 percent.”

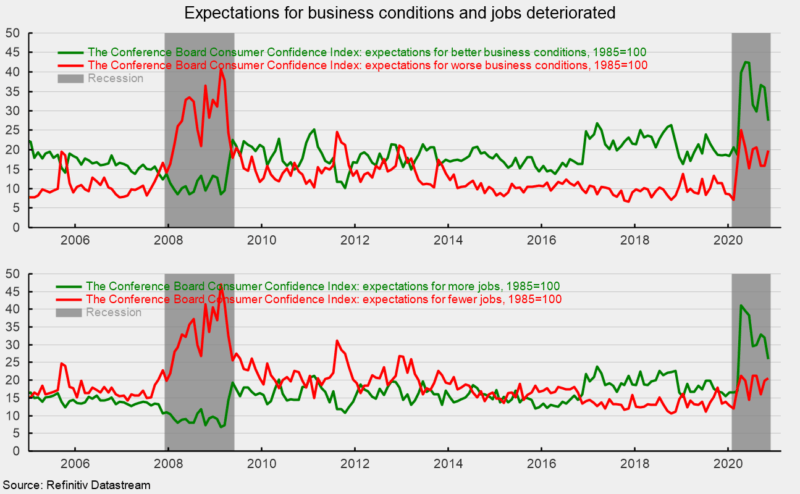

Regarding the expectations component, the report states, “Consumers, however, have grown less optimistic about the short-term outlook. The percentage of consumers expecting business conditions will improve over the next six months decreased from 36.0 percent to 27.4 percent, while those expecting business conditions will worsen increased from 15.9 percent to 19.8 percent.” Furthermore, the report adds, “Consumers’ optimism regarding the job market also weakened. The proportion expecting more jobs in the months ahead declined from 32.0 percent to 25.9 percent, while those anticipating fewer jobs increased moderately from 19.8 percent to 20.5 percent.”

Overall, consumer attitudes remain cautious. The two surveys suggest that the election and the surging number of new Covid-19 cases are weighing on consumers’ minds. Pessimism about jobs and the economy, whether a result of economic policies or the coronavirus, may restrain consumer spending and harm the economic recovery. The outlook remains highly uncertain.