Consumer Optimism Extends Rebound in June, But Outlook Remains Uncertain

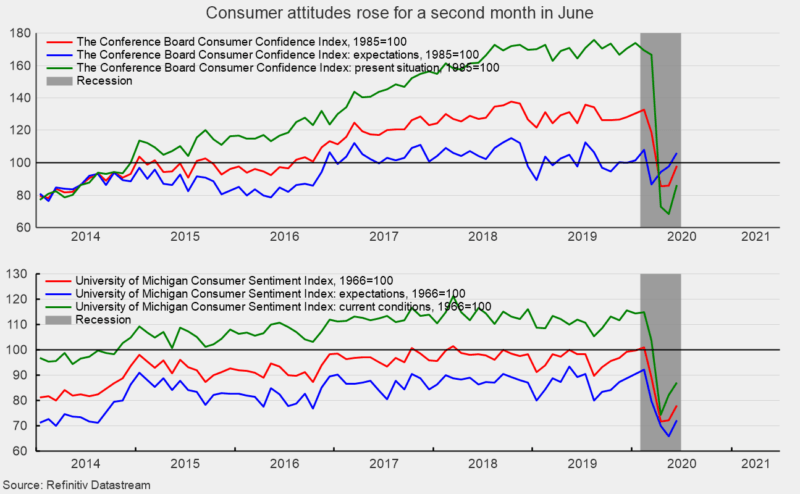

The Consumer Confidence Index from The Conference Board recovered somewhat in June, rising 12.2 points to 98.1 but is still 21.1 percent below the year-ago level. The index is constructed so that it equals 100 in 1985 (see top chart). Both components rose in June.

The present-situation component increased to 86.2 from 68.4, a 17.8-point gain though the June result is 47.5 percent below June 2019. According to The Conference Board report, “Consumer Confidence partially rebounded in June but remains well below pre-pandemic levels. The reopening of the economy and relative improvement in unemployment claims helped improve consumers’ assessment of current conditions, but the Present Situation Index suggests that economic conditions remain weak.”

The expectations component added 8.4 points to 106.0 from 97.6 in the prior month (see top chart). The Conference Board report also noted, “Looking ahead, consumers are less pessimistic about the short-term outlook, but do not foresee a significant pickup in economic activity. Faced with an uncertain and uneven path to recovery, and a potential COVID-19 resurgence, it’s too soon to say that consumers have turned the corner and are ready to begin spending at pre-pandemic levels.”

The Conference Board results are mostly in line with the final results from the University of Michigan. The final June results from the University of Michigan Surveys of Consumers show overall consumer sentiment rose again following a sharp gain in May. The May rise followed the largest single-month decline on record in April. While the two consecutive gains are consistent with other signs that the unprecedented plunge in economic activity (a result of government shutdowns intended to slow the spread of COVID-19) may be starting to reverse, the survey notes that there were wide disparities regionally, likely caused by new outbreaks of COVID-19 in some states.

Consumer sentiment increased to 78.1 in June, up from 72.3 in May, an 8.0 percent rise (see bottom chart). From a year ago, the index is still down 20.5 percent. Both sub-indexes posted gains in June. The current-economic-conditions index rose to 87.1 from 82.3 in May (see bottom chart). That is a 5.8 percent gain but still leaves the index with a 22.2 percent decrease from June 2019. The second sub-index — that of consumer expectations, one of the AIER leading indicators — rose 6.4 points or 9.7 percent for the month but is 19.0 percent below the prior year (see bottom chart).

According to the University of Michigan report, “Consumer sentiment slipped in the last half of June, although it still recorded its second monthly gain over the April low. While most consumers believe that economic conditions could hardly worsen from the recent shutdown of the national economy, prospective growth in the economy is more closely tied to progress against the coronavirus.”

The link between the virus and the economy is becoming apparent in regional sentiment. The University of Michigan report further states, “The early reopening of the economy has undoubtedly restored jobs and incomes, but it has come at the probable cost of an uptick in the spread of the virus. The Sentiment Index rose by just 0.5 Index-points among Southern residents in June, and by only 3.3 Index-points among Western residents. In contrast, the Sentiment Index among residents of the Northeast rose by an all-time record of 19.1 Index-points in June, with residents apparently expecting the later and more gradual reopening to produce at worst a negligible increase in infections.”

The University of Michigan report adds, “The resurgence of the virus will be accompanied by weaker consumer demand among residents of the Southern and Western regions and may even temper the reactions of consumers in the Northeast. As a result, the need for additional fiscal policies to relieve financial hardships has risen. Unfortunately, confidence in government economic policies has fallen in the June survey to its lowest level since Trump entered office.”

The path of recovery may ultimately depend on progress understanding the virus that causes COVID-19 and the ability to develop and deploy a vaccine. Economic activity remains extremely distorted following the outbreak of COVID-19 and the implementation of lockdown policies to reduce the spread of the virus. As some restrictions are eased, signs of a rebound in activity and consumer sentiment are emerging. However, resurging cases in some states is causing regional disparities in expectations for the economic outlook. Overall, the outlook remains highly uncertain.