Bitcoin Is Not a Product

I became curious about the date of my first personal exposure to Bitcoin, and found an email dated February 2010. It was a competent explanation. I responded: “very interesting.” That tells me that I didn’t really understand what I was reading. As I recall, I had something like a bad attitude. The correspondent was a code geek, not an economist, much less a monetary economist. He surely did not understand that you can’t just type on a computer and cause money to come to life, especially not a money that had no tied relationship to an existing money or commodity like gold that had been money in the past.

Six months later, I received another article submission from another computer scientist. It was a more elaborate explanation. I still didn’t get it. I wrote him back as follows: “interesting! lots of questions. But we can’t publish it because it would seem to be an endorsement.” I think I must have meant that I believed Bitcoin to be a commercial product, company, or maybe private stock issue. In fairness (to myself), I had already experienced many attempts over the previous ten years to make a money for the Internet. They all failed. They were all proprietary. They were businesses, products, companies. I had no reason to think that Bitcoin was different.

Say It Three Times: Distributed

The key word I had missed was this: distributed. All previous attempts to create a money especially for the Internet had not lived on a distributed ledger, so they were necessarily centralized by design. They were controlled by a single company that we had to trust and, to use them, they had to trust you. Bitcoin was instead trustless because anyone could run a full node of the protocol. This is what made all the difference, and became the source of Bitcoin’s technical stability. Missing this insight – and probably another dozen or so – I had misconstrued the revolutionary structure of the blockchain.

It is absolutely essential to understand the distributed model even to have a first-level conception of what cryptocurrency really is. It is not a proprietary product. It is not a company. It is not even a brand. It is a technology. It is a technology that, by design and structure, doesn’t have an owner – or, more accurately, it is owned by anyone and everyone. It is a distributed ledger. The purpose of it is to carefully delineate ownership claims and provide a chronological and immunity audit trail of changes in ownership rights. Bitcoin is a token that provides evidence of authority and access to make changes in the ledger, and thereby absorbs and reflects the value of the services provided by the ledger itself.

That realization took me several years. Among many commentators and interviewers – it might be more accurate to say among most – this realization has yet to dawn. I’m interviewed regularly on television and podcasts, and it is almost always the case that people have it in their minds that Bitcoin is like a stock or some other proprietary asset. In that case, the frenzy for crypto strikes people like other bubbles in history, such as the dot-com boom in which people dumped good money on bad stocks and watched them soar and then crash back down.

Not a Company

The failure to understanding the difference is the source of unlimited confusion. So we are clear, Bitcoin is not like Microsoft. It is like computing. It is not like Kohler. It is like running water. It is not like Exxon. It is like fossil fuel. It is not like Honda. It is like internal combustion. It is a generally available technology, which is why the ecosystem of payment tokens is a lot bigger than Bitcoin, which today only constitutes 38% market dominance in the whole space.

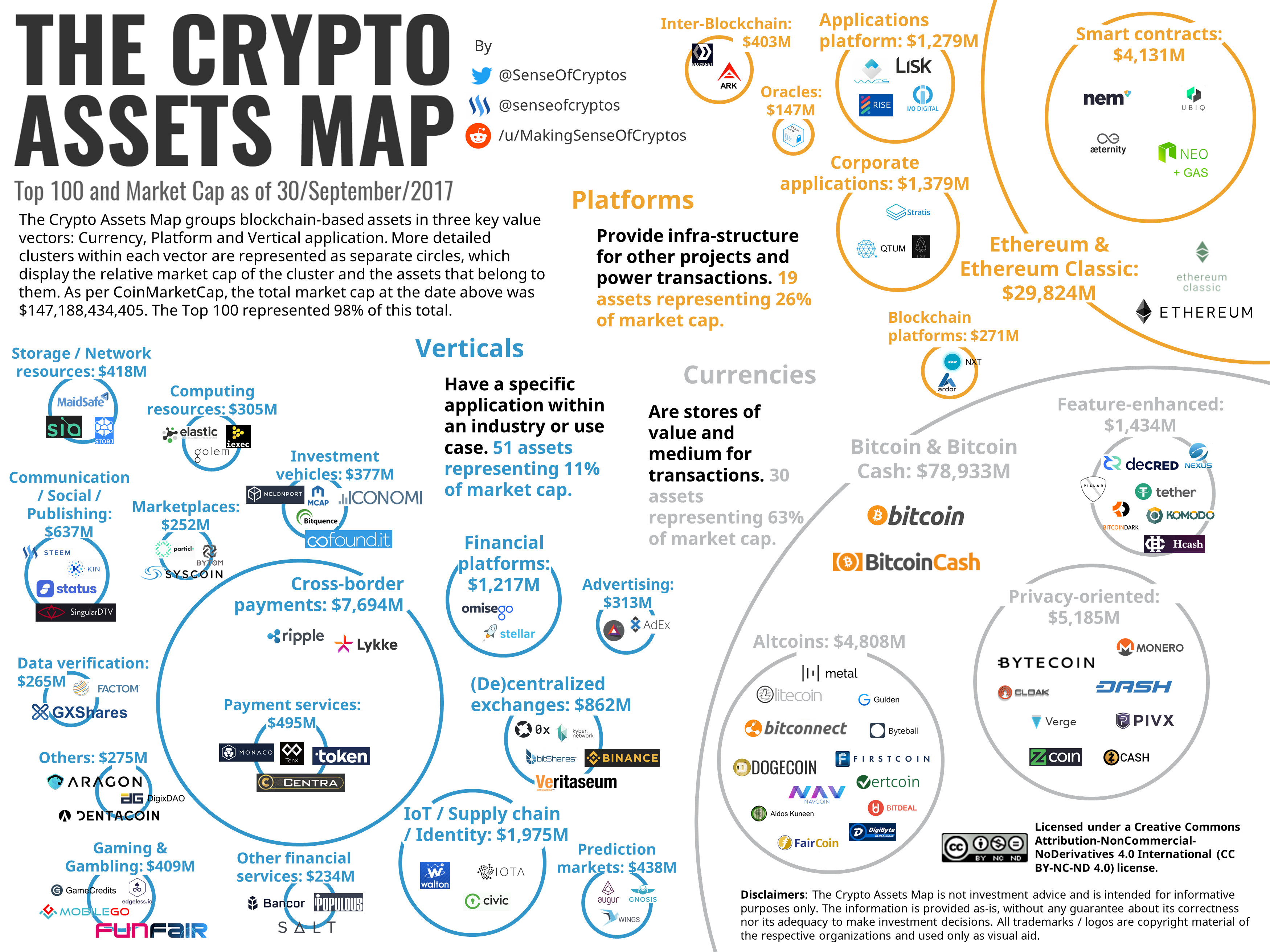

Blockchain technology that is actually capable of doing much more than just money for the Internet. We are already seeing attempts to create taxonomic systems for classifying the many forms of innovation that are growing out of it. One of the most well-thought-out and elaborate is offered by Brave New Coin.

Here is a graphical representation.

That represents a very earnest effort, but it also strikes me as not entirely effervescent. A simpler approach is offered by Anthony Pompliano. He argues for three general categories: payment tokens, utility tokens, and security tokens. The first we understand. It is like Bitcoin, Dash, Monero, Litecoin, and so on. A utility token provides some service on its own, like registering property titles, recording contracts, striking deals, and simply documenting ownership rights.

The most interesting and edgy among the three is the third category of security tokens. These enable enterprises to raise capital funding for various ventures, thus competing directly with traditional lenders, venture capitalists, and so on. They enable any owner or entrepreneur to go out to the public and sell rights to ownership to the future performance of the commercial enterprise. As we look to the future, the most spectacular development of this sector might take place within this category.

Security tokens offer a number of advantages over traditional means of raising capital. As Pompliano explains, it is about lower fees, faster execution of business plans, free market exposure, a larger investor base, and reduced danger of manipulation by official institutions. Imagine if any business could raise money from anyone on the planet, pitching a bright future to anyone willing to commit resources. What a gigantic advance over traditional securities!

Unfortunately, in this class of cryptoassets, we find the biggest conflict with traditional regulators. I’m guessing that the fights over this area of innovation could even be more intense than the battle over the future of money itself. It could prove more controversial than the advent of capitalism itself, which shocked the world in the 18th century by introducing a profound disturbance in the demographics of wealth and the distribution of power in society. Capitalism put the common person in charge of consumption and thereby production. Security tokens could take this model to a whole new level, putting every person in charge of the investment side of commercial society.

Prepare yourself. It’s going to be a wild and glorious ride. But we can’t begin to understand where we are going until we get the basics right.