Liquidity Crises and the Blockchain

In my last post, I compared the functions of cryptocurrencies to those of clearinghouses in terms of the ease with which they can help financial institutions clear balances between one another. This post will consider the implications of the blockchain for macroeconomic dynamics.

I have noted before that recessions are typically associated with an increase in demand for liquidity. When uncertainty increases, investors prefer to have dollars on hand or assets that can reliably serve as access to dollars. They expect the value of assets they own will fall. This can be especially problematic if the fall in asset values makes the investors insolvent, a state where the value of one’s debts exceeds the value of one’s assets. The trouble arises that if assets experience a significant devaluation, the ability of the financial system to provide loans — and in so doing, create new money — is inhibited. Put differently, when the increase in demand for money drives down prices of assets, this inhibits the ability of the banking system to meet demands for money. Richard Timberlake showed that clearinghouse associations played a role in mitigating this problem, providing liquidity during market downturns. Currency creation by the clearinghouse association was supported by reserves that member banks held at the clearinghouse association. The new money would be lent at interest to member banks with the expectation that these banks would be able to pay back the loan once the crisis subsided.

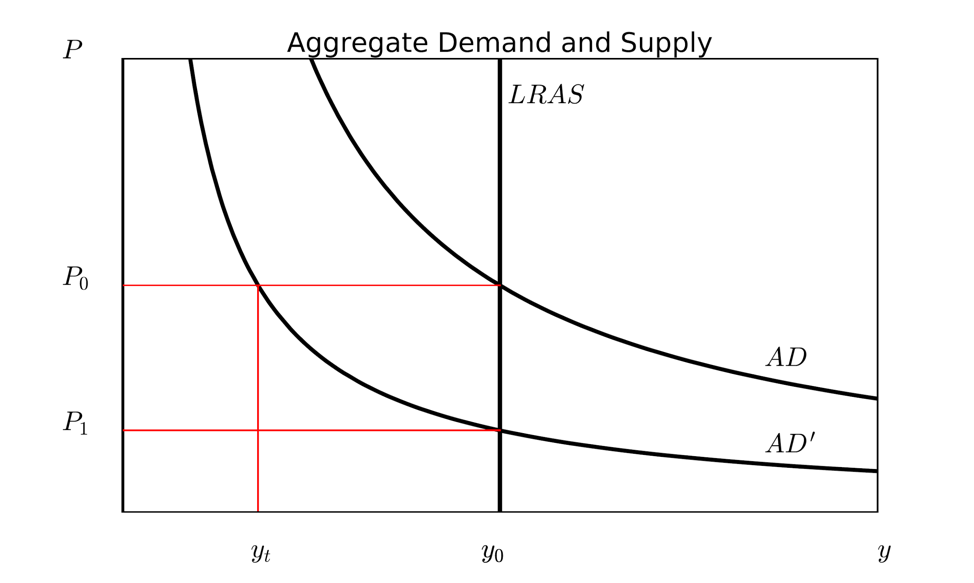

The creation of currency during a crisis helps to offset the shortfall in aggregate demand that occurs when markets have yet to adjust to the changing preferences of investors for money. When the market is unable to meet investor demand for money and prices have not fully adjusted to reflect this condition, the macroeconomy experiences a temporary disequilibrium, or recession, in which many goods remain unsold. This is reflected in the graph below of aggregate demand and supply as the discrepancy between y0 and yt, where y0 represents the dollar value of goods available for sale and yt represents the dollar value of goods that are actually purchased. Here we assume that no new money is created to offset this discrepancy. Until prices move downward to reflect the new nominal value of total expenditures, the economy will remain in recession.

Such a state of the economy may be necessary for its structure to adjust to reflect changing preferences of individuals in light of their reduced incomes. Processes that facilitate money creation in the economy, such as provision of credit by clearinghouse associations more than a century ago, allow a recession to reallocate resources away from inefficient firms while limiting harm to more efficient firms. Without such processes, a crisis can become systemic as a shrinking credit stock creates a feedback loop where devaluation of assets causes further shrinking of the credit stock, which devalues assets further, and so on.

Enter the blockchain. Some cryptocurrencies enable the creation of new currency that is linked to an asset whose ownership is defined on the blockchain. The process is slightly complex, but the idea is simple. If you own a home, for example, you can place the home on the blockchain and receive either cryptocurrency or an asset redeemable for cryptocurrency. The details of asset control vary between systems, but in general, one maintains some control over the asset even after it is placed on the blockchain and one may maintain part of the ownership as well. What matters for the present discussion is that the blockchain represents a source of money creation during a crisis that will limit the extent to which asset prices fall in terms of the local legal tender.

This means that demand for the commonly accepted medium of exchange will experience less violent oscillations during a crisis. Individuals can acquire cryptocurrency that can then be exchanged for the commonly accepted medium of exchange. Or if parties are willing to accept the cryptocurrency, it can be used as a medium of exchange itself. We have yet to experience a crisis in which this interaction between demand for money and creation of new units of cryptocurrency has occurred, but theory suggests it will promote stability in otherwise unstable times.