Inflation Remained Elevated in February

“Market participants continue to expect three cuts this year — and that those cuts will begin in the first half of the year. But they have adjusted the odds.” ~William J. Luther

Monetary policy influences inflation, employment, and economic activity. A stable but dynamic monetary system is vital for supporting economic growth, individual liberty, and a prosperous society. Therefore, we examine the causes and consequences of monetary policy (including inflation), identify ideal and practical steps towards a better monetary policy regime, and look at monetary alternatives and financial regulation.

TL Hogan

OP-1793,'Principles for Climate-Related Financial Risk Management for Large …, 2023

Cryptocurrencies, Blockchain, and Public Choice

RM Yonk, D Waugh

Cryptocurrency Concepts, Technology, and Applications, 2023

General Institutional Considerations of Blockchain and Emerging Applications

PC Earle, DM Waugh

The Emerald Handbook on Cryptoassets: Investment Opportunities and …, 2023

The Value of Bitcoin in the Year 2141 (and beyond!)

JR Hendrickson, WJ Luther

The Economics of Blockchain and Cryptocurrency, 51-68, 2022

War, money & economy: Inflation and production in the Fed and pre-Fed periods

TL Hogan, DJ Smith

The Review of Austrian Economics, 1-23, 2022

“Market participants continue to expect three cuts this year — and that those cuts will begin in the first half of the year. But they have adjusted the odds.” ~William J. Luther

“The unique value of Chancellor’s book, beyond tracing this intellectual history of interest and illustrating it by financial debacles up and down the centuries, is to connect the social and market outcomes with the broken money markets.” ~Joakim Book

“If Congress could balance its budget, which hasn’t happened since 2001, it would remove a bullet the Fed could shoot at the economy.” ~Vance Ginn

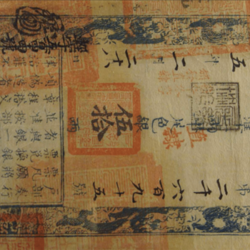

“Today the world still benefits from monetary and financial innovations begun in China, then picked up and carried like a baton in Renaissance Europe.” ~Paul McDonnold

” Fed watchers expect the Federal Open Market Committee will keep rates steady when they meet on March 19-20. In light of the CPI data, that’s a defensible move.” ~Alexander W. Salter

“While tailwinds from normalizing supply chains are cooling goods prices, concerns linger about the sustainability of this trend. In particular, the February CPI readings strongly suggest that the January updraft was not anomalous.” ~Peter C. Earle

250 Division Street | PO Box 1000

Great Barrington, MA 01230-1000

Press and other media outlets contact

888-528-1216

press@aier.org

This work is licensed under a

Creative Commons Attribution 4.0 International License,

except where copyright is otherwise reserved.

© 2021 American Institute for Economic Research

Privacy Policy

AIER is a 501(c)(3) Nonprofit

registered in the US under EIN: 04-2121305