Inflation Remained Elevated in February

When inflation picked back up in January 2024, many commentators described it as more noise than signal. The latest data from the Bureau of Economic Analysis (BEA) casts doubt on that view.

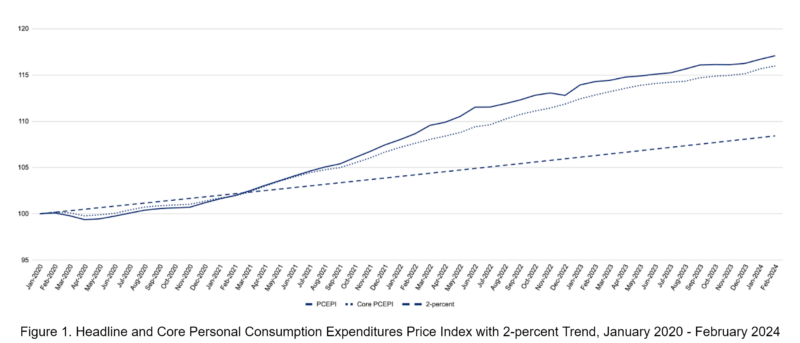

The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounding annual rate of 4.0 percent in February. The PCEPI has grown at an annualized rate of 3.3 percent over the last three months and 2.5 percent over the last six months. Prices today are 8.7 percentage points higher than they would have been had they grown at an annualized rate of 2.0 percent since January 2020.

Core inflation, which excludes volatile food and energy prices, also remained elevated. Core PCEPI grew at a continuously compounding annual rate of 3.1 percent in February. It has grown at an annualized rate of 3.5 percent over the last three months and 2.9 percent over the last six months.

At the press conference following the Federal Open Market Committee (FOMC) meeting in March, Federal Reserve Chair Jerome Powell told reporters the FOMC was preceding cautiously:

We didn’t excessively celebrate the good inflation readings we got in the last seven months of last year. We didn’t take too much signal out of that. What you heard us saying was that we needed to see more. That we could, that we wanted to be careful about that decision. And we’re not going to overreact as well to these two months of data, nor are we going to ignore them.

That would seem to imply the FOMC does not plan to cut its federal funds rate target soon.

Governor Christopher Waller echoed Powell’s view in a talk at the Economic Club of New York earlier this week:

It is appropriate to point out that a month or two of data does not necessarily indicate a trend, and there are good reasons to think that progress on inflation will be uneven but likely to continue down toward 2 percent. At the same time, monetary policy is data driven, and I do want to take it into account when formulating my economic outlook. While I don’t want to over-react to two months of data, I do think it is appropriate to react to it.

Waller said “there is no rush to cut the policy rate.” Given the latest data, he thinks “it is prudent to hold this rate at its current restrictive stance perhaps for longer than previously thought to help keep inflation on a sustainable trajectory toward 2 percent.”

The median FOMC member continued to project three 25-basis-points cuts at the March meeting. But many FOMC members revised their projection up. In December 2023, there were five below-median projections for the federal funds rate this year. Now, there’s only one.

Market participants continue to expect three cuts this year — and that those cuts will begin in the first half of the year. But they have adjusted the odds. The federal funds futures market puts the odds that the Fed will hold its target rate at 5.25 to 5.5 percent through June at just 36.4 percent, up from 24.4 percent one week ago.

Fed officials look prescient at the moment. They held their federal funds rate target high when low inflation readings led others (myself included) to call for cuts. The months ahead will determine whether that assessment stands.