Trio of Reports Sends Mixed, but Mostly Positive, Signals

The preliminary September results from the University of Michigan Surveys of Consumer Sentiment show overall consumer sentiment jumped 4.6 points to 100.8 versus the final August result of 96.2. That is just the third time since 2004 that the index has breached the 100 threshold. Results from the August retail-sales and industrial-production reports were a bit softer, both posting gains but with mixed results among the details. Still, retail sales and industrial production are on solid growth trends, supporting a positive outlook.

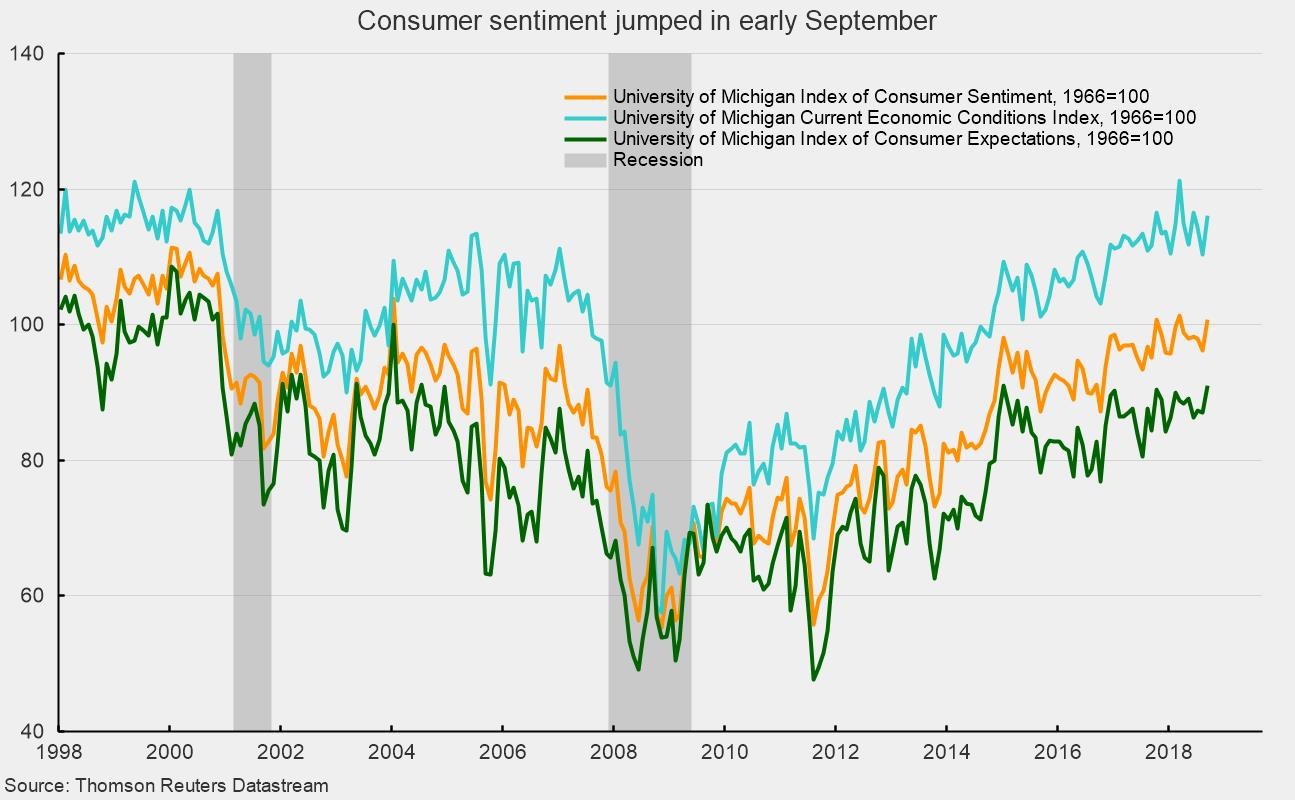

For the University of Michigan consumer-sentiment survey, both sub-indexes had strong performances in early September. First, the current-economic-conditions index rose to 116.1 from 110.3 in August. That is a 5.3 percent gain for the first part of the month and a 3.9 percent increase from September 2017. The second sub-index — consumer expectations, one of the AIER leading indicators — rose 4.6 percent for the month and showed a 7.9 percent gain from the prior year, to a level of 91.1. The expectations index is now at a new cycle high and the highest level since 2004 (see chart). The increase was largely due to more favorable views on jobs and income.

Retail sales for August rose 0.1 percent. Over the past 12 months, retail sales are up 6.6 percent, the second-fastest pace since 2012, only behind the 6.7 percent gain last month. The details of the report were a bit mixed but still suggest that economic growth is maintaining strong momentum, supported by consumer spending and a robust labor market.

The August gain in retail sales was boosted by a 1.7 percent increase in gasoline sales. Gasoline sales are often driven by volatile gas prices. Excluding gas sales, retail sales fell 0.1 percent in August but are still up 5.5 percent from a year ago, the third-fastest pace since 2015. Among the 13 categories tallied separately, 8 had gains, 2 were unchanged, and 3 had declines for the month. Over the past year, however, only one category — sporting-goods, book, hobby, and music stores — shows a decline in sales, dropping 3.9 percent.

Among the categories with gains in August were miscellaneous store retailers (2.3 percent), non-store retailers (0.7 percent), health and personal-care stores (0.5 percent), electronics stores (0.4 percent), restaurants (0.2 percent), sporting-goods, hobby, and book stores (0.2 percent), and general-merchandise stores (0.1 percent).

Building-materials and garden-equipment stores’ sales and food-and-beverage stores’ sales were unchanged for August versus July.

The weakest categories for August were clothing stores (−1.7 percent), motor vehicles and parts dealers (−0.8 percent), and furniture and home-furnishings stores (−0.3 percent).

The combination of a strong labor market and solid wage gains has helped boost consumer confidence to a very high level. In aggregate, these data all suggest strong support for further gains in consumer spending and solid growth for the economy overall.

Industrial production rose 0.4 percent in August, the same gain as in July and the third increase in a row. Over the past year, industrial production is up 4.9 percent, continuing a modest upward trend in growth. The gain helped push capacity utilization up 0.2 percentage points to 78.1.

Gains in industrial production were led by mining and utilities output. Utilities output jumped 1.2 percent after a 0.1 percent increase in July. Utilities output is often related to weather conditions.

Mining output rose 0.7 percent and is up a robust 14.1 percent over the past year. Mining output has increased substantially over the last few years, reflecting a resurgence in energy-related production.

Manufacturing accounts for about 75 percent of total industrial production and posted a 0.2 percent increase in the month. Within manufacturing, durable-goods production surged 1.0 percent, led by gains in primary metals, machinery, and motor vehicles, while nondurable-goods production fell by 0.5 percent on widespread declines.

Measured by market segment, consumer-goods production — about 28 percent of total production — rose 0.3 percent in August, with consumer durables up 1.6 percent and consumer-nondurables production unchanged from the prior month. Business equipment — about 10 percent of production — rose 1.2 percent in August and is up 4.2 percent from a year ago. The monthly gain was boosted by a 2.1 percent surge in transit equipment and a 1.6 percent increase in industrial equipment. Materials production — about 46 percent of output — rose 0.5 percent for the month and is up 7.2 percent from a year ago.

While some of the details in the retail-sales and industrial-production reports show some scattered weaknesses in August, the majority of the details suggest solid economic momentum and continued economic expansion.