The Fed Has A Commitment Problem

In August, the Federal Reserve announced it was embracing average inflation targeting. In targeting average inflation, the Fed will allow inflation to rise above 2% temporarily, to make up for periods of lower-than-2% inflation. Indeed, that is required to hit2% inflation on average.

The Fed’s previous regime, in contrast, did not target the average rate of inflation. It acted more like a 2% inflation ceiling. The regime change, therefore, tries to make the Fed’s commitment to 2% inflation more credible by requiring to make up for past mistakes.

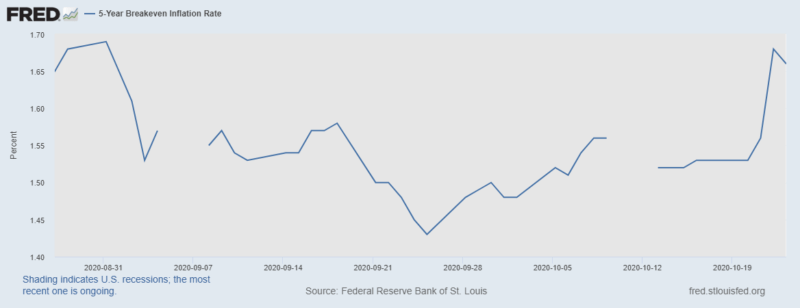

In theory, the Fed’s new inflation-targeting regime will do a better job of anchoring market expectations and thereby promote informed long-term contracting. In practice, it doesn’t seem to have worked.The TIPS spread, which is the difference in yields between five-year Treasuries and five-year inflation-indexed Treasuries, is a standard measure of market inflation expectations. Investors should be indifferent between these assets when the additional nominal yield on ordinary Treasuries just equals expected inflation. Hence the difference in yields is a good indicator of what the market thinks is going to happen to prices in the next five years.

As the TIPS spread shows, inflation expectations rose slightly after Powell’s announcement, but then fell. Only recently did they spike upwards again. But they are still below 2%—and nowhere near the level required for the Fed to hit 2% inflation on average. Inflation has come in under the Fed’s 2% target recently. Hitting the average inflation target would require a period of higher-than-2% inflation. But the market doesn’t buy it. Instead, market participants believe inflation will be around 1.70% on average over the next five years.

What’s going on? Why hasn’t the Fed been able to convince markets that higher inflation is coming? In brief: the Fed has a credibility problem, which hasn’t been helped by its policy response to Covid-19.

The Fed’s main job is monetary policy: changing the supply of the economy’s most liquid asset to keep markets stable. And, to be fair, much of what the Fed has done in response to the Covid-19 pandemic and corresponding restrictions on activity has been monetary. Most of the increase in its balance sheet is due to outright asset purchases, especially of Treasuries and mortgage-backed securities. The problems, however, are with the Fed’s other activities, which have no basis in sound monetary theory.

Markets don’t believe the Fed is serious, in part, because the Fed has spent too much time and effort devising a host of novel credit policies that bear little relationship to the Fed’s traditional mandate. Contrary to what Fed officials claim, there are no good reasons for the Fed to conduct these policies.

The Fed’s direct lending programs to small- and medium-sized businesses, to large corporations, and to state and local governments are especially egregious. This is fiscal policy, not monetary policy. It’s not about giving markets the liquidity they need to keep them stable. It’s about picking winners and losers. And the Fed has no business doing that. When it does, markets rightly become skeptical that the Fed cares about its monetary mandate.

The Fed’s credit allocation efforts have been tiny to date. Of the Fed’s approximately $7 trillion in assets, these credit programs represent only $20 billion or so. But size isn’t everything. Public perception and precedent matter, too.

Fed officials have spent disproportionate time and energy explaining these new programs to the public and lauding their benefits, which signals to markets that the Fed cares more about playing with its new powers than keeping markets liquid. The precedent these facilities have created is even worse. Now that the Fed is actively engaged in de facto fiscal policy, the politicians who oversee the Fed have a strong incentive to use the Fed’s balance sheet to advance partisan agendas.

It’s time for the Fed to get serious about monetary policy. To do that, it must forswear credit policy immediately. In fact, the Fed should cease any and all fiscal policies by other means, leaving such things to Congress. It should renew its commitment to open-market purchases on a broad base of assets. This would maximize monetary stimulus and minimize costly resource misallocation. The whole point of a central bank is competently administering monetary policy. Right now, the Fed is failing at this basic task.