Struggling Economy Sends Consumer Sentiment Tumbling Again in April

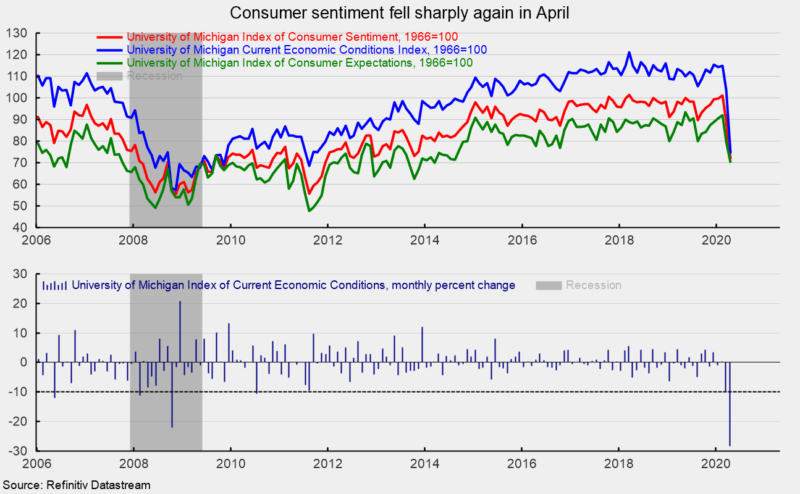

The final April results from the University of Michigan Surveys of Consumers show overall consumer sentiment fell sharply from the final March result, registering the second double-digit percentage decline in a row. Consumer sentiment decreased to 71.8 in April, down from 89.1 in March, a 19.4 percent decline (see top chart). From a year ago, the index is down 26.1 percent. March and April combined show a two-month drop of 29.2 Index-points.

The two sub-indexes also posted sharp declines in April. First, the current-economic-conditions index dropped to 74.3 from 103.7 in March (see top chart). That is a 29.4 point or 28.4 percent decline following a 9.7 percent fall in March (see bottom chart). From a year ago, the current conditions index is down 33.8 percent.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — sank a much-less-severe 9.6 points or 12.0 percent for the month and is 19.8 percent below the prior year. While the 12.0-point decline puts the index at the lowest level since March 2014, the less severe drop in the expectations index relative to the current conditions index perhaps indicates an underlying optimism about the future. According to the report, “While the decline in both indices indicates an ongoing recession, the gap reflects the anticipated cyclical nature of the coronavirus. In the weeks ahead, as several states reopen their economies, more information will reach consumers about how reopening could cause a resurgence in coronavirus infections. Consumers’ reactions to relaxing restrictions will be critical, either putting further pressure on states to reopen their economies, or exerting added pressure to extend the restrictions even if it has negative consequences for economic prospects. The risks associated with these decisions are not equally balanced, with an incorrect decision to reopen having serious repercussions. The necessity to reimpose restrictions could cause a deeper and more lasting pessimism across all consumers, even those in states that did not relax their restrictions.”

The shuttering of many businesses, the sharp rise in layoffs over the last five weeks, and sharp distortions to economic activity have resulted in a record-shattering plunge in consumer sentiment. Stimulus efforts may help in the short term (though early indications are that there are major failures in government systems to actually distribute stimulus funds) but ultimately, beating COVID-19 and getting life back to normal is the only way to sustainably boost the economy and consumer sentiment. Whether that is a quickly achievable outcome or not is highly questionable. Expect extraordinarily weak economic reports over the next several months.