Rethinking ‘Safe’ Asset Allocation in Retirement

How should retirees think about allocating assets during retirement? One platitude says that retirees should decrease exposure to risk, and therefore to stocks, as they age. But this “safe” approach is increasingly being called into question.

A rule of thumb has been to allocate “100 minus age” percent to equities. This means that a 65-year-old would allocate 35 percent to stocks, and a 75-year-old would allocate only 25 percent, with the remainder in safer assets such as bonds, treasuries, or cash. This allocation sets up a “declining equity glide path” during retirement. As you age, you take less risk.

This rule has shifted over time, and many researchers and practitioners began suggesting that retirees maintain a static allocation to equities during retirement. Bill Bengen, the financial adviser who developed the 4 percent rule in 1994, used a static 50 percent allocation to stocks during retirement. Target-date funds, which help workers invest for retirement at a target date in the future, also follow this static allocation strategy and generally allocate around 40 percent to stocks throughout retirement.

But declining and static equity glide paths have recently been called into question. Michael Kitces and Wade Pfau, two popular retirement researchers, have written several articles that show how retirees can modestly reduce risk and improve performance using a “rising equity glide path.” Our most recent brief, “The Case for Increasing Stock Exposure in Retirement,” arrives at the same conclusion as these authors, but in a different way.

Our analysis assesses the value of each approach based on utility, an economic term that attempts to measure total satisfaction. We find that rising equity glide paths can improve utility on average, although the improvement is small.

Nevertheless, there are two big reasons we believe rising equity glide paths make sense. In our model, annual spending is constant and savings tend to decrease over time. This means that a retiree’s spending as a share of remaining savings tends to increase over time. We explain why this increasing relative spending amount is the first reason that rising equity glide paths make sense. By being more aggressive in later years, you may be less likely to run out of money.

Also, as savings decline over time, pensions and Social Security become relatively more important sources of income. We show why higher equity allocations make sense as pensions become more important sources of income. As you increasingly rely on your pension and Social Security, your savings become a smaller share of your overall assets. Taking on higher risk with this shrinking minority of your portfolio gives you the opportunity for a higher return.

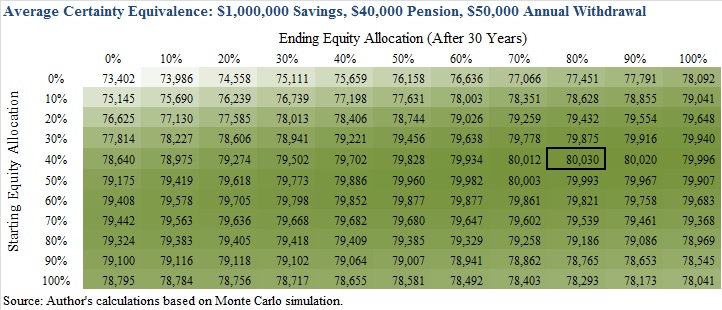

At the end of the day, the relative improvement from rising equity glide paths as compared with a static 50/50 allocation is small, but notable. The table below looks at utility measures from our research for various starting and ending equity allocations (the glide path assumes a linear increase or decrease in allocation over 30 years). The optimal path for this example starts retirement with a 40 percent allocation to stocks and increases to 80 percent over 30 years.

Although this pattern of increasing risk exposure over the course of retirement may seem startling, it could be suitable for some retirees. It’s always good to talk to your financial advisor armed with some additional knowledge.