The Case for Increasing Stock Exposure in Retirement

People have different risk tolerances, different goals, and different financial characteristics. Much popular investment advice has recommended a conservative approach to investing in retirement – increasing investments in bonds, decreasing riskier stock investments, and withdrawing funds at a steady, slow pace, often 4 percent. This brief looks at an alternative concept—taking on riskier investments as you age by increasing exposure to stocks over the course of retirement.

Increasing risk exposure by allocating more to stocks over time is referred to as a rising equity glide path. It starts with a relatively low allocation to equities, say, 20 percent, and gradually increases the exposure to 70 percent over 30 years. This counters conventional wisdom, which advises a lower stock (and risk) exposure as retirees age and their income stream diminishes.

Our analysis assesses the value of equity glide paths based on utility, an economic term that refers to the total satisfaction derived from a pattern of income or consumption. We find that rising equity glide paths can improve utility on average, although the improvement is small.

We offer two big reasons that rising equity glide paths make sense. In our model, annual spending is constant and savings tend to decrease over time. This means that a retiree’s spending as a share of remaining savings tends to increase over time. We will explain why this increasing relative spending amount is the first reason that rising equity glide paths make sense. Also, as savings decline over time, pensions and Social Security become relatively more important sources of income. We will show why higher equity allocations make sense as pensions become more important sources of income.

Who should care about equity glide paths?

This research targets households that need to get some of their annual income from savings. The household should be looking for a systematic spending strategy that dictates how much to spend every year. This may exclude households with smaller portfolios that will not treat savings as a source of regular retirement income. It may also exclude households with very high savings who can comfortably live without spending from principal.

This research also targets people who are looking for a constant-dollar spending level. Although there is research suggesting that constant-dollar spending, or spending at the same amount each year, may not be as efficient as dynamic strategies, our experience suggests that many households are still looking for such a guideline.

Finally, it is imperative for those who use equity glide paths (and for those who don’t) to maintain discipline. When asset allocation fluctuates over time, it can be tempting to make adjustments based on current conditions. The model does not account for temporary adjustments to the glide path. In other words, a rising equity glide path works when it is a smooth, steady ascent.

How equity glide paths evolved

Researchers and practitioners have long been answering questions about how best to allocate a portfolio for retirement. One platitude says that retirees should decrease exposure to risk, and therefore to stocks, as they age. A rule of thumb has been to allocate “100 minus age” percent to equities. This means that a 65-year-old would allocate 35 percent to stocks and a 75-year-old would allocate only 25 percent, with the remainder in safer assets such as bonds, Treasurys, or cash. This pattern sets up a declining equity glide path during retirement.

This rule has shifted over time, and many researchers and practitioners began suggesting that retirees maintain a static allocation to equities during retirement. Bill Bengen, the financial adviser who developed the 4 percent withdrawal rule in 1994, used a static 50 percent allocation to stocks during retirement. His research showed that an even higher static allocation to equities, 75 percent, resulted in potentially higher safe withdrawal rates. Target-date funds, which help workers invest for retirement at a particular date, also follow this static allocation strategy and generally allocate around 40 percent to stocks throughout retirement.

Declining and static equity glide paths have recently been called into question. Michael Kitces and Wade Pfau, two popular retirement researchers, have written several articles that show how retirees can modestly reduce risk and improve performance using a rising equity glide path. Our analysis confirms the analysis of Kitces and Pfau using an alternative measurement technique.

To receive our reports in PDF format, become a Digital Member now.

Measuring retirement outcomes

Our analysis looks at the utility derived from simulated income using a measure called the certainty equivalence. To understand certainty equivalence, imagine an income stream that offers a 50/50 chance of either $0 or $60,000 every year. Most people would much prefer stable, guaranteed income. They would forego this uncertain income pattern and accept a guaranteed $25,000 annually because of risk aversion. Therefore, the certainty equivalence of an income stream with a 50/50 chance of $0 or $60,000 every year may be only $25,000, depending on the level of risk aversion.

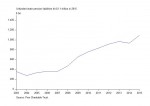

We calculated the certainty equivalence for thousands of simulated retirement income streams. The measure could then be used to directly compare different hypothetical outcomes. The best results from our model happened when people didn’t run out of money but also didn’t massively under-spend.

We looked at the average certainty equivalence from our simulations for each equity glide path, weighted by mortality probabilities. This is a different way to compare glide paths than the success rate measure used by Kitces and Pfau. Their success rate simply assesses the likelihood that a particular strategy would run out of money after 30 years. Our complete equation can be found in the May 2015 Journal of Financial Planning article titled, “Confirming the Value of Rising Equity Glide Paths: Evidence from a Utility Model,” or AIER working paper WP002.

Glide path performance

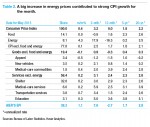

We started by looking at which glide path provided the best results for a 4 percent constant-dollar withdrawal on a $1 million portfolio, assuming no pension income. This withdrawal pattern, specified by the 4 percent rule, allows for spending $40,000 every year until savings run out. The certainty equivalence with this spending pattern would be the full $40,000 if savings never ran out in the simulations. However, it is unlikely that savings would never run out in any situation, because people may live longer than expected or market returns may be poor. We found that the best results happened when we started with a 20 percent equity allocation and built to 70 percent over 30 years (Table 1). The average certainty equivalence of this strategy is $35,385.

For comparison, the average certainty equivalence of a static 50 percent allocation to equities is $34,852, about 1.5 percent worse that the optimal glide path. This small difference suggests that there are many reasonable equity glide paths with these return assumptions and a 4 percent withdrawal. However, rising equity glide paths, those in the top right of the table, tend to be better than declining or static equity glide paths.

This result is consistent with the baseline results provided by Kitces and Pfau, who found the top-performing glide path rises from 30 to 70 percent. Kitces and Pfau also found that the success rate improves only by one percentage point, from 94.1 to 95.1 percent, compared with a static 50 percent allocation.

Withdrawal rates

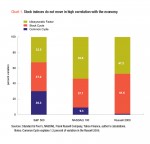

The asset allocation decision should not be made independently from the withdrawal rate decision. What happens when we allow the withdrawal rate to change from our original 4 percent? In our baseline scenario, we found that if we increased the withdrawal rate to 4.2 percent, the certainty equivalence increased to $35,488 (Chart 1).

Spending $42,000 per year would cause savings to run out in about 29 percent of 30-year scenarios. However, when combined with actual life expectancies, we found that this pattern, applied to opposite-sex married households in which both members retire at age 65, would cause only about 15 percent to completely exhaust savings. This represents a balance between the potential for running out of money and the potential for under-spending during retirement.

For a household that needs a higher withdrawal rate, it may be optimal to allocate investments more aggressively to stocks. A high allocation to equities gives the best chance, on average, for savings to last when a high withdrawal rate is needed. Chart 2 shows that if you have to withdraw more, it is optimal to be riskier with investments. In order to separate the effects of withdrawal rates, we look here only at the static equity allocation, with the understanding that a rising equity glide path may help incrementally.

This is the first justification for the benefit of rising equity glide paths. For example, let’s say you spend $42,000 per year, adjusting upward for inflation. Your assets will decrease over time as you spend from principal. The same $42,000 every year will become a larger share of your remaining assets. This higher percentage withdrawal suggests a higher equity allocation over time, aligning with a rising equity glide path.

Including pension income

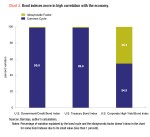

We now look at results when pension income is included. Although few people working today will receive a corporate pension, most will receive Social Security, and many households nearing retirement have some remnant of a pension. The Survey of Consumer Finances, a triennial Federal Reserve Board survey of household finances, shows that about half of households aged 55 to 64 expect to receive between $30,000 and $50,000 per year in guaranteed retirement income, inclusive of Social Security.

Guaranteed income should have the effect of increasing the optimal withdrawal rate and equity allocation. The logic is straightforward: A household may be willing to take more investment risk with savings when failure still leaves the household with some guaranteed income, as opposed to none. Exhausting savings and having no income must be avoided at all costs, whereas exhausting savings and having $40,000 income is slightly more tolerable. This is one of the central points of a 2011 paper in Financial Analysts Journal by finance professors and authors Moshe Milevsky and Huaxiong Huang, “Spending Retirement on Planet Vulcan: The Impact of Longevity Risk Aversion on Optimal Withdrawal Rates.”

When we include $40,000 of guaranteed income, the optimal withdrawal rate with a static 50/50 portfolio is 5 percent. It is higher than the 4.2 percent we found earlier because the utility-maximizing household is willing to tolerate increased risk since the downside is not as calamitous. The optimal glide path also increases exposure to equities, starting with an allocation of 40 percent and increasing to 80 percent (Table 2). Again, the household is more willing to tolerate asset risk because of the safety net provided by the guaranteed income. We confirmed in our model that the optimal withdrawal rate and equity allocation increase as guaranteed income increases compared with savings (Chart 3).

This is the second reason that rising equity glide paths make sense. In the model where households spend from savings over time, guaranteed income becomes relatively more important. When guaranteed income is the primary component of retirement income, it is optimal to accept more risk with greater exposure to equities.

Why a rising equity glide path may be optimal

How should retirees think about asset allocation during retirement? Although the answer will vary by household, this brief provides two mathematical explanations for why rising equity glide paths may be right for some households. Although the overall improvement in utility is small, sophisticated investors, advisers, and planners will be looking for ways to get any advantage they can with retirement savings.

First, calibrating an appropriate withdrawal rate is critically important for maximizing utility. The withdrawal rate and equity allocation decisions must be coordinated. A higher withdrawal rate may require a more aggressive equity allocation. Likewise, a higher equity allocation may allow for a higher withdrawal rate. If retirees are spending from principal, as they are in our model, a constant-dollar withdrawal will become a higher percentage of the remaining portfolio. As the withdrawal percentage increases, we have shown it is optimal for the allocation to equities to increase as well, consistent with the rising equity glide path.

Second, the results from this paper and others show that optimal equity allocations and withdrawals increase as the ratio of guaranteed income to savings increases. Again, this is consistent with the advantages of the rising equity glide path. If retirees are spending from principal, pension and Social Security income become relatively more important sources of income. The logic follows that it is optimal to increase exposure to equities as savings shrink.

These results highlight two reasons that help explain why rising equity glide paths may be optimal for many households.