Retail Sales Rebound After Three Weak Months, Hitting A Record High

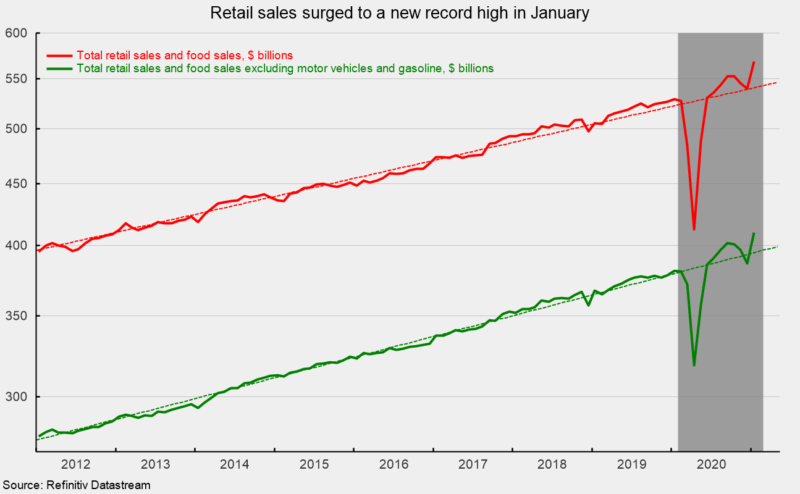

Retail sales and food-services spending jumped 5.3 percent in January following three consecutive declines from October through December. The rebound in January puts retail sales back above the nine-year trend to a new record high (see first chart).

Core retail sales, which exclude motor vehicle dealers and gasoline retailers, posted a sharp 6.1 percent surge for the month following decreases of 2.6 percent in December, 1.1 percent in November, and 0.2 percent in October. Core retail sales are also back above trend and at a new record high as well (see first chart). Total retail sales and core retail sales posted the strongest monthly gains since June 2020.

From a year ago, total retail sales are up 7.4 percent while core retail sales show a 7.6 percent rise. The 12-month gain in total retail sales is the best performance since 2011 while the 12-month gain in core retail sales is the fastest since January 2006.

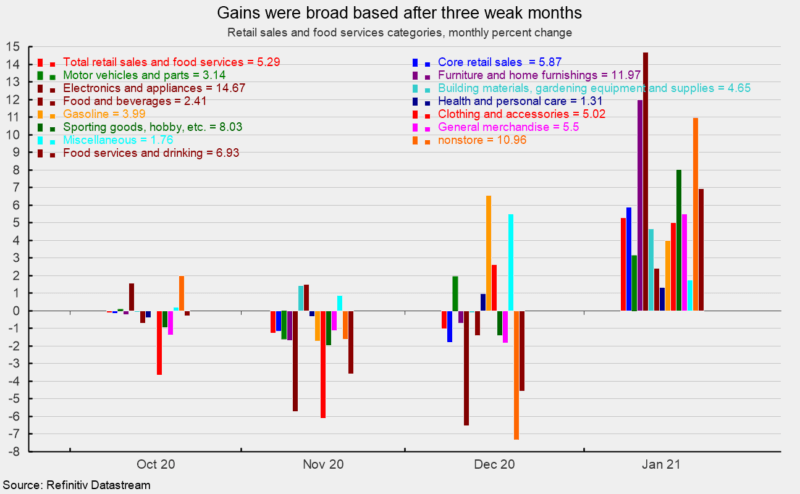

The gains in January were broad-based across the categories shown in the report. All thirteen major categories reported a gain in January sales (see second chart). Gainers were led by electronics and appliance stores (14.7 percent) followed by furniture and home furnishings (12.0 percent), and nonstore retailers (11.0 percent rise; see second chart).

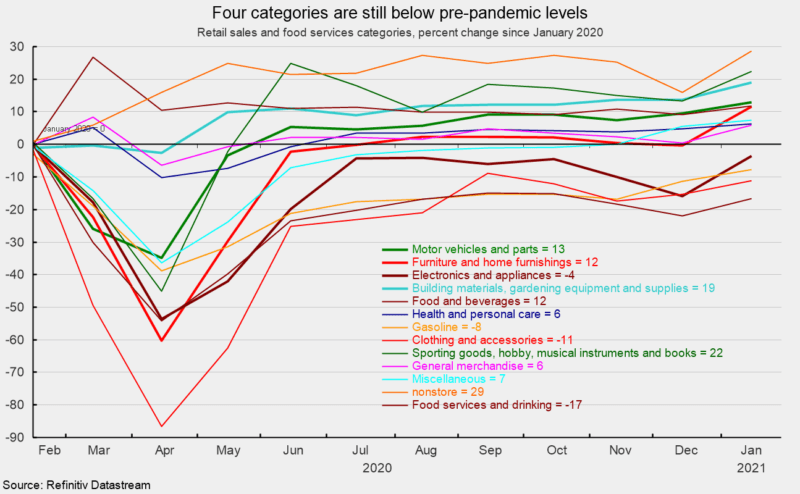

The strong January result still leaves four of the 13 categories with sales below their pre-lockdown levels. Restaurants were 17 percent below January 2020 followed by clothing and accessory stores (11 percent below), gasoline stations (8 percent below) and electronics and appliances (4 percent below; see third chart).

Retail sales posted a strong gain in January following three consecutive declines. Combined with the ongoing distribution of vaccines, declining cases of Covid-19, and easing of government restrictions on consumers and businesses, the gain in retail sales is a very positive sign. The positive momentum needs to be sustained and spread to other areas such as the labor market before an all-clear signal can be issued, but the report is clearly a favorable sign.