Recession May Have Begun for the U.S. Economy

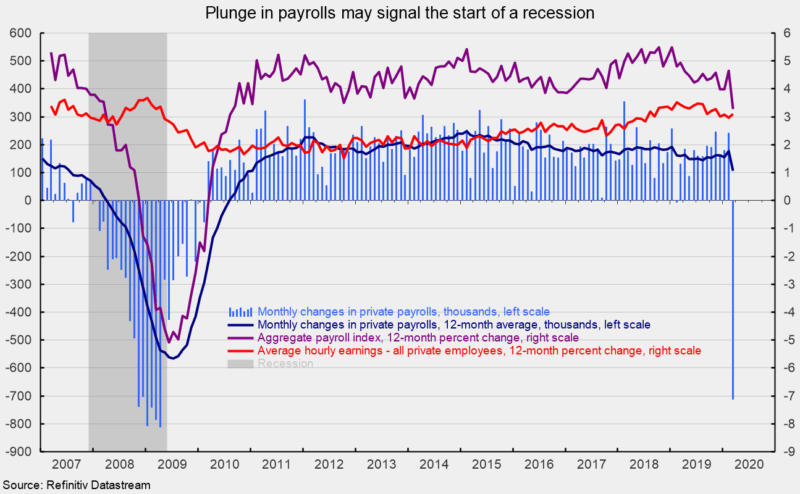

U.S. nonfarm payrolls lost 701,000 jobs in March, by far the largest loss since the Great Recession (see chart). Initial claims for unemployment insurance totaled 10 million in the last two weeks of March (and are not completely captured in the March employment report) suggesting additional steep losses in coming months. Payroll employment is a key coincident indicator for the economy. As such, the first of what is likely to be several months of sharp declines in payroll employment suggests that the U.S. economy may have peaked in February and entered a recession in March.

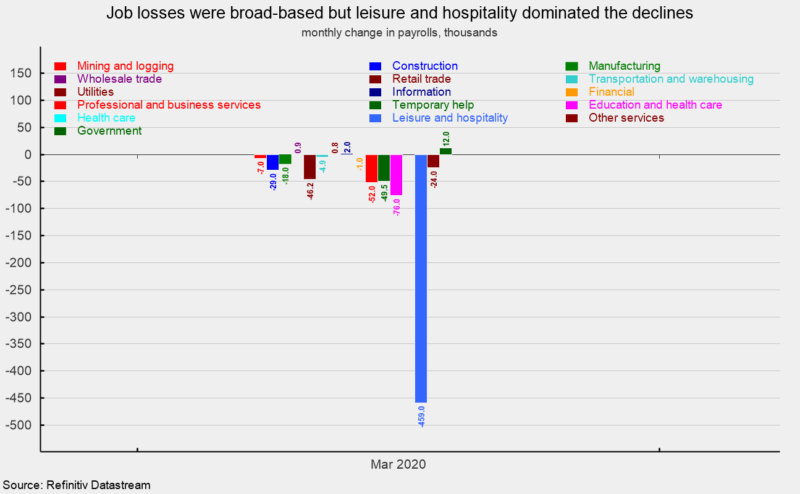

Private payrolls lost 713,000 in March. The losses were broad-based (see second chart) with goods-producing industries losing 54,000, private services losing 659,000 and government adding 12,000. Within the 54,000 loss, construction was down 29,000 jobs, nondurable-goods manufacturing fell by 11,000, while durable-goods manufacturing and mining and logging industries both lost 7,000 jobs.

For private service-producing industries, which typically account for the lion’s share of job creation, payrolls declined by 659,000, led by a 459,000 decrease in leisure and hospitality (see second chart). Health care and social-assistance industries fell by 61,200, professional and business services declined by 52,000 with temporary help accounting for 49,500 of that total. Retail lost 46,200 workers while “other” services decreased by 24,000.

The unemployment rate jumped to 4.4 percent and the participation rate declined to 62.7 percent. Both reverse positive results over the last several years. Average hourly earnings rose 0.4 percent in March, resulting in a 12-month gain of 3.1 percent. The average length of the workweek decreased by 0.2 hours to 34.2 hours in March.

Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls fell 0.7 percent in March and is up 3.3 percent from a year ago, the slowest pace of rise since 2010 (see first chart).

The sharply weaker jobs report for March combined with the record-shattering initial claims for the final two weeks of March make the probability of a recession a near certainty. Now the focus turns to monitoring the depth and duration of the recession. Much of that will depend on the progression of the COVID-19 outbreak, the ability of the medical and scientific community to find a cure and prevention, and the policies of the government to deal with the outbreak and mitigate the damage to the economy.