Personal Income and Savings Fall as Government Supports Fade

Personal income fell 2.7 percent in August, according to data from the Bureau of Economic Analysis. Personal income data over the past six months have been sharply distorted by lockdown policies which caused massive layoffs, and government stimulus programs that sent transfer payments skyrocketing. As those payments fade, measures of personal income and components are returning to trend.

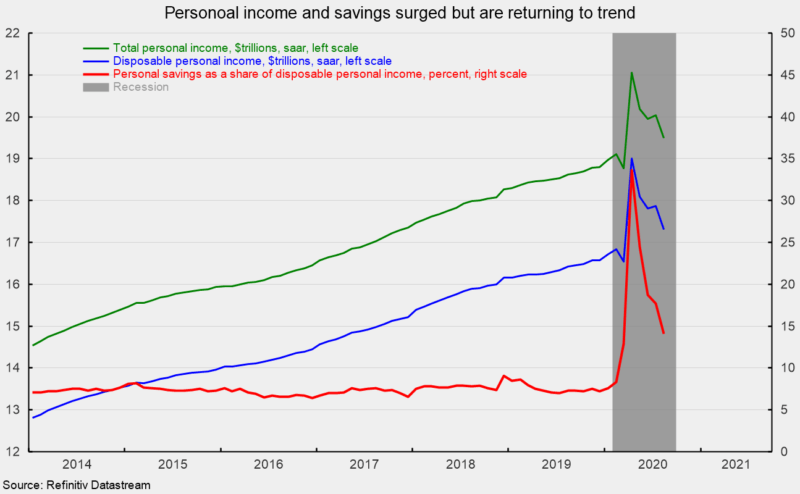

Disposable personal income fell 3.2 percent after a 0.3 percent increase in July. The personal savings rate fell in August, coming in at 14.1 percent of disposable income following rates down from 17.7 percent in July and a peak of 33.6 percent in April (see first chart).

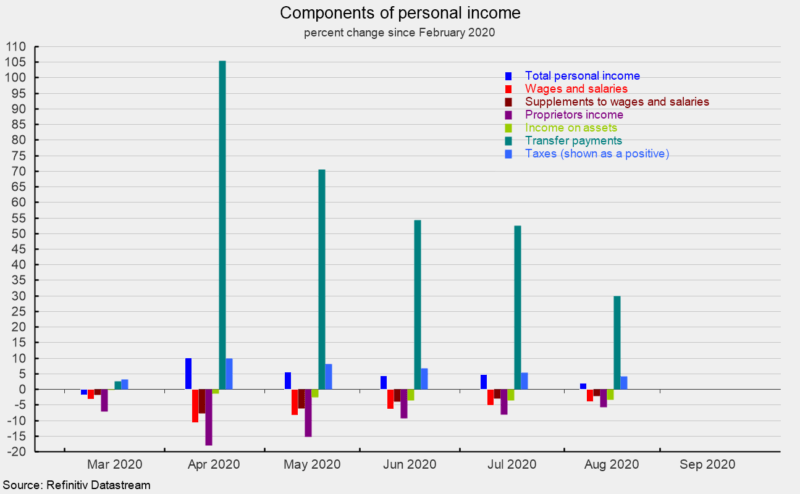

The drop in personal income consisted, in part, of a 1.3 percent increase in wages and salaries. Wages and salaries, which typically account for about half of personal income, rose as some employees went back to work after lockdown policies were eased. However, wages and salaries are still down 3.9 percent since February (see second chart). Supplements to wages and salaries (primarily employer contributions to pension and insurance funds and government social-insurance programs) which typically account for another 12 percent of personal income also posted a gain, rising 0.8 percent in August but are still down 2.1 percent from February.

Proprietors’ income jumped 2.7 percent for the month following a 1.2 percent rise in July while income on assets (interest and dividends) rose 0.2 percent in the latest month. Since February, these two components are still off 5.7 percent and 3.4 percent, respectively (see second chart).

Personal transfer payments fell 14.8 percent in August, the fourth consecutive decline after a massive 100.5 percent gain in April. Personal tax payments rose 1.3 percent in August, leaving disposable income with a drop of 3.2 percent. Since February, transfer payments are still up 29.9 percent while tax payments are down 4.2 percent (shown as a positive on the second chart since lower tax payments are a positive for disposable personal income).

On the spending side, total personal consumption expenditures (PCE) rose 1.0 percent in August following a 1.5 percent increase in July. Among the components, durable goods rose 0.9 percent while nondurable-goods spending fell 0.1 percent and spending on services increased 1.4 percent for the month.

The price indexes from the report on personal income and spending are the primary measures followed by the Federal Reserve. The total PCE price index increased 0.3 percent in August as durable-goods prices rose 0.9 percent, nondurable-goods prices increased 0.2 percent, and services prices increased 0.3 percent. The PCE price index excluding food and energy rose 0.3 percent for the month.

Over the past year, the PCE price index is up 1.4 percent, versus 1.1 percent in the prior month. The core PCE index, which excludes food and energy prices, is up 1.6 percent from a year ago. That measure has been running at or below 2 percent since 2012.

Economic activity remains extremely distorted following the outbreak of Covid-19 and the implementation of lockdown policies to reduce the spread of the virus. As restrictions are eased, signs of a rebound in activity began to emerge but many of those signs are now slowing, raising doubts about the durability and robustness of the recovery. Massive damage has been done to the economy and with government support fading, the recovery remains highly uncertain. Ultimately it will be the progression of the virus, the success of efforts to eradicate it, and policies implemented to deal with it that will determine the path of economic recovery.