No, We Don’t Need A New Reconstruction Finance Corporation

A crisis virtually ensures that bad ideas will be touted out at some point or another. Particularly bad ideas will become proposals. But the worst ideas of all are not only endorsed, but have actually been tried time and time again, and somehow their insufficiency (or outright failure) goes unnoticed.

It’s not surprising that with bailout numbers ranging from $2 to $6 trillion being thrown around, intellectuals on both the left and the right are angling for support of pet projects while decrying the efforts of their ideological opposites as cronyism or outright corruption. The stimulus bill which Speaker of the House Nancy Pelosi proposed a few days back included, among other items which seem curiously disconnected with stopping the spread of COVID-19: $35 million for the Kennedy Center. (Fortunately, the highly principled Republicans who stand for fiscal responsibility and lean budgets stood their ground…and only allowed $25 million.)

With the initial parameters of the stimulus package mostly fleshed out (although more will assuredly follow), the conversation has shifted to how the proceeds will be meted out. Treasury Secretary Mnuchin has stated that the lending program will operate through a Treasury-Fed partnership, the prospect of which puts both political partisans and more general skeptics of bailouts on alert: as John Cassidy wrote in a recent article in The New Yorker, the administration of these lending programs must be undertaken in a “reasonable and transparent manner that minimizes the scope for political cronyism.”

His proposal: a revival of the Reconstruction Finance Corporation.

Predictably, this is not the first time that this recommendation has been made. Just last year, when the idea of a Green New Deal was still being thrown around, mention was made of an RFC-type government institution through which its programs would be administered. In 1980, it was suggested that a new Reconstruction Finance Corporation would be an appropriate vehicle through which the decline of U.S. cities could be mitigated. (Two bills were introduced in Congress that year to re-establish it.) It also was proposed on the Senate floor in 1974 as a corrective to the alleged inability of laissez faire policies to address the stagflationary slump. In March of 1971, the re-introduction of the RFC was also invoked in conjunction with the rescue of the Penn Central. And it has come up time and time again.

Origins

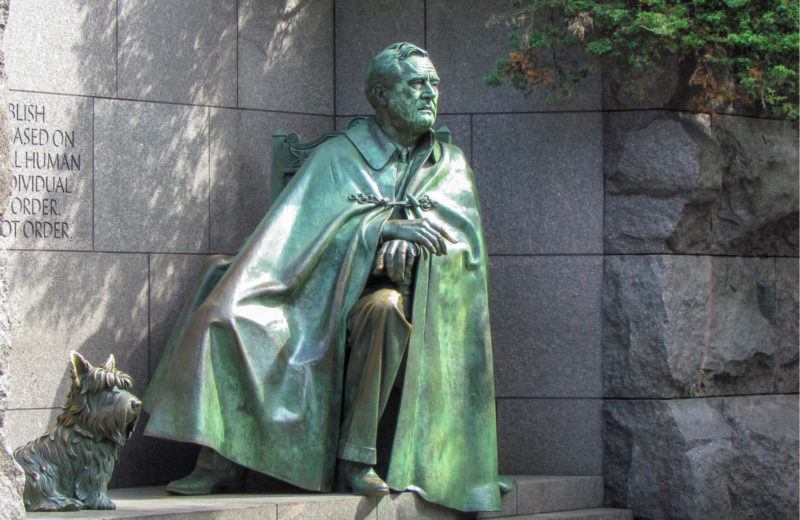

The Reconstruction Finance Corporation (modeled after the earlier War Finance Corporation) was created in early 1932 under the Hoover Administration as what amounted to the “discount lending” facility of the Federal Reserve System: it would lend to financial institutions chartered by states and in rural areas. (It replaced a less successful agency, the short-lived National Credit Corporation.) With the election of Roosevelt and its inclusion in the policy implementations of the New Deal, the size of the RFC expanded – as, predictably, did its reach. Among its broadened powers were the ability to purchase stock in banks and extend loans for everything from agricultural projects to disaster relief.

When the Roosevelt Administration set its sights upon devaluing the dollar, the RFC was the agency through which part of the operation was accomplished: it began quietly purchasing gold in global markets when the price was approximately $31.36 per ounce. In doing so it slowly lifted the gold price to $34 per ounce and then set a floor at $35 per ounce, which was announced as the new official dollar price of gold in January 1934.

It expanded vastly further in 1940, to prepare the way for American entry into World War II, but was abolished by an act of Congress in 1953, completing its dissolution in 1957.

And today, as has become a perennial exercise, The New Yorker’s Cassidy recommends the formation of an independent, transparent, and crony-free Coronavirus Finance Corporation – citing the “success” of the original Reconstruction Finance Corporation.

The Real Record of the Reconstruction Finance Corporation

Initially, the transparency which is often cited as one of the RFC’s attributes was not in place. And by several accounts, during those first five opaque months of operation – before taxpayers could see what it was up to – the activity of the Reconstruction Finance Corporation was an unabashed, quintessential purveyor of cronyism:

The successor to [Charles G.] Dawes as head of the RFC was the Hon. Atlee Pomerene … Under Pomerene’s aegis, the FRC promptly authorized a $12.3 million loan to the Guardian Trust Company, of Cleveland, of which Pomerene was a director. Another loan of $7.4 million was made to the Baltimore Trust Company, the vice-chairman of which was the influential Republican Senator Phillips L. Goldsborough. A loan of $13 million was granted to the Union Guardian Trust Company of Detroit, a director of which was the Secretary of Commerce, Roy D. Chapin. Some $264 million were loaned to railroads during the five months of secrecy. The theory was that railroad securities must be protected, since many were held by savings banks and insurance companies, alleged agents of the small investor.

Of the $187 million of loans that have been traced, $37 million were for the purpose of making improvements, and $150 million to repay debts. One of the first loans, for example, was a $5.75 million grant to the Missouri Pacific to repay its debt to J.P. Morgan and Company. A total of $11 million was loaned to the Van Sweringen railroads (including the Missouri Pacific) to repay bank loans. $8 million was loaned to the Baltimore and Ohio to repay a debt to Kuhn, Loeb and Company. All in all, $44 million were granted to the railroads by the RFC in order to repay bank loans … In the case of the Missouri Pacific, the RFC granted the loan despite an adverse warning by a minority of the Interstate Commerce Commission, and, as soon as the line had repaid its debt to Morgan, the Missouri Pacific was gently allowed to go into bankruptcy.

That blizzard of highly questionable loans completed, in June of 1932 the RFC began extending emergency loans under a new mandate of transparency, publicly posting the names of banks and other firms which received its aid.

And this is where the myth of the RFC’s success is put to rest. The move to transparency, of course, was self-defeating: the public perception of a firm (in particular, financial firms) having requested and received government support was sufficient to undermine any remaining commercial viability it might have had. Thus in some cases the newly-translucent Reconstruction Finance Corporation actually caused, rather than quelled, bank runs; and in virtually all cases, confidence in the loan beneficiary vanished.

(This dynamic, incidentally, is what led the crafters of 2008’s Troubled Asset Relief Program to essentially force certain large financial institutions to receive aid – whether or not they were in need.)

In addition,

Although the rate of bank failures temporarily slowed down after the corporation began lending, this was probably a coincidence … By early 1933 banks again began failing at an alarming rate, and RFC loans failed to avert the banking crisis. The ineffectiveness of the RFC was most apparent in February 1933, when the banks in Michigan collapsed despite the efforts of the RFC directors to save the leading banks of Detroit.

In addition to its directors not understanding the effect of transparency on financial institutions dependent upon public confidence, the practice of taking a bank’s strongest assets as collateral for a loan is at odds with principles of sound banking, and served to fundamentally weaken many of its borrowers.

These are the characteristic mistakes of appointed bureaucrats.

Additionally, the RFC’s crony capitalism tendences didn’t end after that short (but shamelessly enthusiastic) period in 1932. In the late 1940s, it loaned money to Northwest Orient Airlines in what was suspected as a favor to Boeing, who’d supported the Presidential campaign of Harry S. Truman; a Congressional investigation was triggered. Worse yet, one of the surviving tendrils of the RFC – the Ex-Im Bank – is nothing if not a veritable slush fund for corporate welfare.

What’s the Cure for Cronyism?

The author of The New Yorker piece states, “Unless we are willing to let troubled corporations collapse, which could accentuate the coming slump, we need a way to support them in a reasonable and transparent manner that minimizes the scope for political cronyism.”

Few would disagree with this – no one, I’d bet, other than the handful of beneficiaries on both sides of such inside dealing. Fortunately, there is an alternate way to avoid corrupt lending practices, and it’s vastly more affordable, equitable, and time-tested than bilking taxpayers or appointing apparatchiks to distribute taxpayer dollars. Best of all, it carries as powerful an anti-crony feature as one could ask for: the market. Let firms receive aid from other firms, individually or via consortia; or let them liquidate in a swift way, unfettered by the shackles that prevent assets, employees, and know-how from being acquired by financially stronger, better managed firms.

And in this case, preferential dealing is a matter of private property and the choices of independent managers and directors of firms who are accountable to shareholders and themselves. Taxpayers will emerge unscathed.

The contention behind the repeated efforts to relaunch the Reconstruction Finance Corporation – including this idea of a Coronavirus Finance Corporation – is the same that underpins all policy proposals which tilt toward central planning: that either the current economic situation is too complex for markets to tackle, or that rapid action requires the imposition of bureaucrats. Both of these are provably false: in the former case, only markets have demonstrated the ability to gather, assimilate, and process local information efficiently. And the latter claim is hardly worth taking seriously.

The Reconstruction Finance Corporation was far from the model of a scrupulous, competent and independent government agency that it is alleged to be. Governments have done enough damage locking down billions of people and crushing commercial enterprise when there have been clear alternatives to doing so from the start. However well-intended, a Coronavirus Finance Corporation would inevitably follow the same path as the RFC did.