Nippon Acquisition of US Steel

Japanese steelmaker Nippon agreed in December 2023 to acquire US Steel at a 40 percent premium to its stock price. It’s no surprise shareholders welcomed the proposal. But opposition to the deal immediately sprang forth from union bosses, the Biden administration, and politicians from both sides of the aisle. An all-out public relations war is goading regulators into blocking the acquisition.

Politicians salivate at the optics of “saving” a US company. Lobbyists could earn a windfall bonus by torpedoing the proposal. Meanwhile, Cleveland-Cliffs works behind the scenes and publicly to scuttle the deal. A US Steel infused with new capital, equipment, and expertise would be a daunting competitor. In the wake of US Steel rebuffing its prior offer, the Cleveland-Cliffs CEO is reportedly considering a new bid at $30 per share, a whopping 45 percent less than Nippon proposed.

Detractors falsely claim the Nippon buyout threatens US national security, manufacturing, and jobs. In reality, blocking the deal will harm American workers, shareholders, and other businesses. Why wouldn’t we want to move money from Japan to right here in the US?

Valid concerns certainly arise with foreign direct investments (FDI) from hostile powers. China, for instance, poses a threat — notably but not exclusively in the tech space. After all, the Chinese Communist Party (CCP) is a dictatorial regime playing a major role in, or outright ownership of, scores of Chinese companies. The CCP openly declares its quest to spread its form of Marxism globally using these entities. Furthermore, the CCP has an infamous track record of stealing and exploiting competitors’ intellectual property.

The President possesses statutory authority to block such an acquisition upon “credible evidence” of a national security threat upon recommendation by Committee on Foreign Investment in the United States (CFIUS). Use of CFIUS to stop acquisitions is rare — only occurring once prior to 2012, twice under President Obama, and four times under President Trump. Every blocked transaction under CFIUS involved Chinese investments except for President Trump’s decision to block Singapore-based Broadcom Ltd.’s takeover of Qualcomm, Inc. Even rarer is for a president to preemptively encourage a CFIUS investigation as President Biden did shortly after the Nippon-US Steel announcement.

But Japan is no China.

For more than 60 years, both the United States and Japan have cultivated a deep defense relationship. In 1960, Japan and the United States entered The Treaty of Mutual Cooperation and Security in 1960. Japan currently hosts seven American military bases consisting of more than 60,000 military personnel and their families — in addition to being home to the US Seventh Fleet with 13,000 sailors, 18 ships, and 100 airplanes. Japan also manufactures Patriot missiles for deployment in Okinawa to deter aggression by North Korea.

This Treaty also expressly aimed to “eliminate conflict in their international economic policies” and to “encourage economic collaboration…” Our economic ties reflect the desired ends of this special relationship. Japan holds more than $1.1 trillion of federal debt, suppressing borrowing costs. Unlike hostile investors (such as China), this financing does not come with the added risk of being weaponized by a rapid sell-off timed to wreak havoc.

Far more importantly, Japan is our leading source of FDI, with $289 billion invested in 2016-2021 and more than $700 billion in aggregate — close to $8,000 per family of four. More than 900,000 Americans are employed at US subsidiaries and affiliates of Japanese companies. Half of these investment dollars from Japan flow to the manufacturing sector.

In continuation of this long partnership, the two nations signed a new trade agreement in 2019 further reducing or eliminating tariffs and aiming to diminish barriers to investment. Enhancing trade and investment with one of our closest democratic allies mutually enhances our security and economies.

Perhaps the most easily recognizable contribution to our own economy from Japanese FDI are the 14 automobile assembly plants operated across seven states. This automobile manufacturing renaissance followed the malaise and even bankruptcy brought upon domestic counterparts succumbing to financially unsound agreements and underfunded pensions pushed by organized labor year after year. Japanese FDI breathed life into this sector, with their factories having churned out more than 2.8 million vehicles in the United States in 2022.

Japanese auto manufacturers now directly employ more than 107,000 Americans — with close to 2.2 million Americans additionally employed in intermediate jobs, “spin-off” jobs, and Japanese automobile dealers. By the way, the assembly line workers at non-unionized Toyota Japanese factories earn $34.80 an hour to start — close to 50 percent higher than the average hourly rate nationally for all assembly line workers. An influx of FDI and ingenuity will rejuvenate domestic steel production in a way that economically damaging tariffs and subsidies have utterly failed to accomplish.

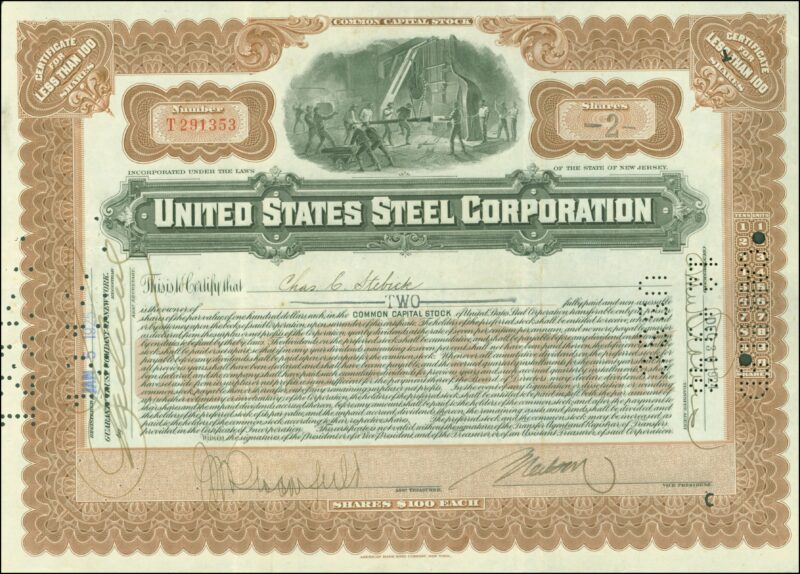

The rancor surrounding the sale of a relatively small American company to a foreign investor stems largely from its marquee name and illustrious history. Three years after J.P. Morgan founded US Steel in 1898, the company issued the largest initial public offering (IPO) in the history of mankind. For the next 90 years, the company remained part of the Dow Jones Industrial Index’s prestigious basket of the (at the time) dozen most important industrial stocks. Within one month of its IPO, the market cap of US Steel neared a colossal 4 percent of total US economic output.

But although once a crown jewel of American industry, US Steel in recent decades has shuttered factories, sold others, and exited segments of the industry. Since 2020, this decline accelerated as the company laid off 25 percent of the remaining unionized portion of its workforce. Stock performance reflects this harsh reality. Since its peak in 2008, shares of US Steel declined more than 75 percent. Over the past 30 years, performance lagged the broad market by more than 340 percent. Today’s market cap of just $9.42 billion is less than 1/100th of its size in 1901 as a proportion of the overall economy. US Steel is now the 648th largest American company, a stark contrast to seventh — where it would be had it maintained its size relative to GDP since 1901.

Despite its shrunken condition, the Japanese suitor looks to infuse new life into this former behemoth with an infusion of cash, technology, and vision. Blocking this acquisition will result in losses to shareholders, workers, and our economy.

What of the national security argument? A possible renewal of US Steel under new management strongly counters the notion that this deal threatens our national security. Of course, steel itself is a vital component of the tanks, fighter planes, sea vessels, and artillery used to defend our nation. Capacity utilization at domestic steel producers stands at only 77.3 percent. Consider that an aircraft carrier requires 50,000 tons of steel. With capacity of more than 115 million metric tons and excess capacity of 26 million metric tons, the US could double the size of our existing fleet of 11 aircraft carriers and barely use 2 percent of this excess capacity.

Given US Steel’s market share of just 10 percent within the iron and steel industry, the buffer remains enormous even if every existing US Steel factory ceased production. Of course, such a hypothetical ignores the fact that closing US Steel’s domestic infrastructure would defeat the purpose of Nippon’s planned acquisition. Their goal of this acquisition is to ramp up steel production here in the United States. In fact, Nippon plans on spending $1.4 billion in capital investments at US Steel plants — roughly $140,000 of investment per each of the current US Steel’s workforce.

Simply put: Nippon’s acquisition of US Steel deal does not present a national security threat.

A select few stand to benefit if the government blocks this deal at the behest of the politically connected. But many others will bear the consequences. US Steel shareholders stand to lose $3.5 billion from the 40 percent premium offered by Nippon. No longer will those proceeds be available for investment in other businesses. The absence of the planned capital investments to increase efficiency translate into lower productivity gains, directly limiting wage growth for employees as profits remain suppressed. A less competitive, higher-cost market translates into lower profit margins for steel-reliant manufacturers, furthering limiting their ability to compete globally. Lastly, federal intervention will deter other foreign direct investment vital economic growth.

A loss for the shareholders of US Steel is a loss for all of us.