New Home Sales Tick Upward in September

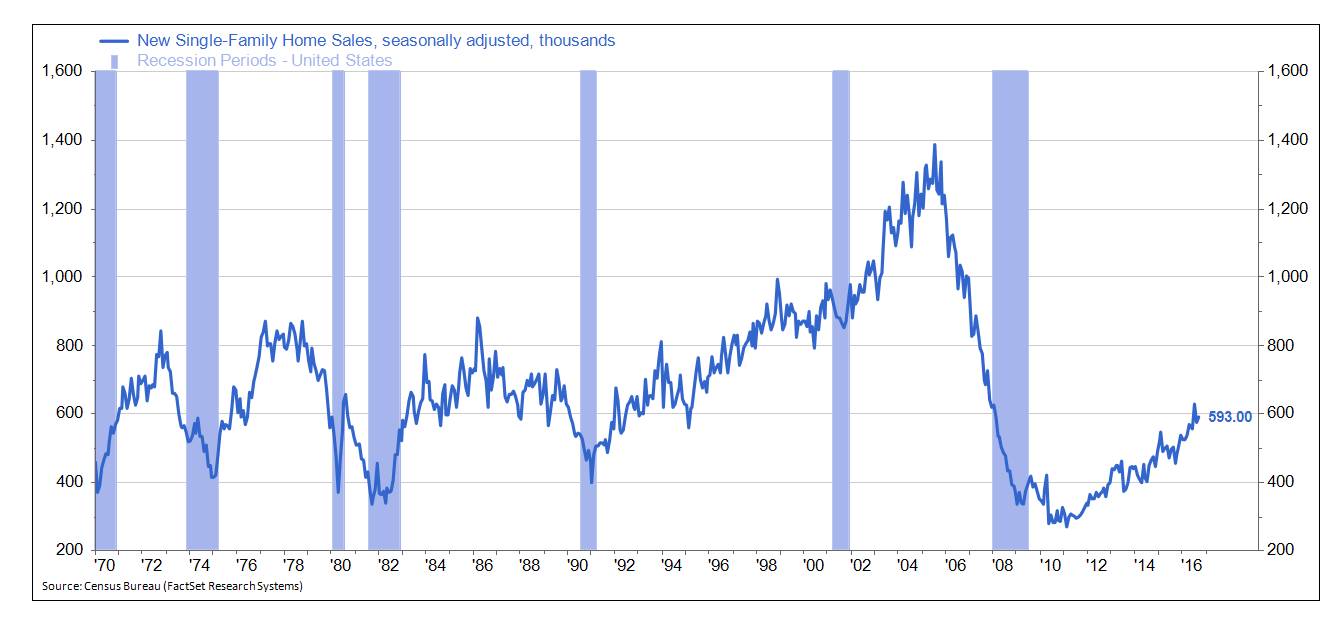

Sales of new single-family homes rose 3.1 percent in September to a pace of 593,000 homes, from a downward revised 575,000 pace in August (see chart). Though new home sales have been trending higher since hitting a post-recession low of 270,000 in February 2011, the overall level of activity remains tepid by historical standards.

Over the past four decades, new homes sales typically ranged between 600,000 to 800,000 during expansions. During the housing boom of 1996 to 2005, new home sales rose to a peak of almost 1.4 million, as the chart shows. The 593,000 pace for September is just approaching that lower end of the typical range, more than seven years into the current expansion.

The pace of new home building has generally paralleled the pace of sales, resulting in a relatively tight supply. The number of new homes for sale in September fell 0.4 percent to 235,000, resulting in 4.8 months’ worth of supply for September. Since 1970, the months’ supply for new homes in the U.S. has typically ranged between 5 and 8 months during economic expansions. During recessions, the months’ supply can spike as high as 11 or 12 months. Conversely, during the housing boom, months’ supply often fell below 4.

In general, low interest rates combined with jobs and income growth should be supportive of the housing market. However, caution among buyers, lenders, and builders may be restraining a more rapid recovery.

Click here to sign up for the Daily Economy weekly digest!