Manufacturing Survey Suggests Strong Momentum

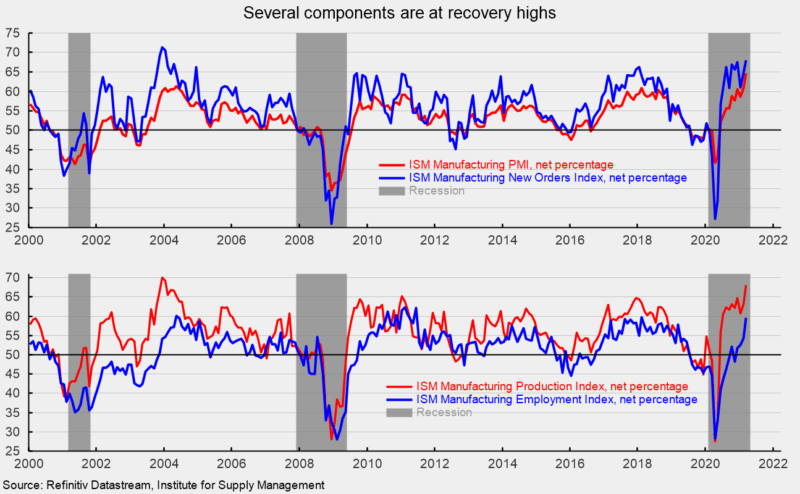

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index rose again in March, registering a 64.7 percent reading for the month, the highest since December 1983. The March result is a gain of 3.9 points over the 60.8 percent result in February. March is the tenth consecutive reading above the neutral 50 threshold (see top of first chart). Over the past ten months, the Purchasing Managers’ index has averaged 57.8, the highest since January 2019. The survey results suggest that the manufacturing-sector recovery continues to gain momentum.

Among the key components of the Institute for Supply Management’s most recent survey, the New Orders Index came in at 68.0 percent, up 3.2 percentage points from 64.8 percent in February (see top of first chart). The New Orders Index has been above 50 for ten consecutive months and above 60 for nine consecutive months. The nine-month average is 64.7, the highest since August 2004. The new export orders index, a separate measure from new orders, fell to 54.5 versus 57.2 in February. The new export orders index has been above 50 for nine consecutive months.

The Production Index registered a 68.1 percent result in March, up from 63.2 percent in February. The index has been above 50 for ten consecutive months and above 60 for the last nine months (see bottom of first chart). The nine-month average is 63.0, the highest since October 2004.

The Employment Index rose in March, adding 5.2 percentage points to 59.6 percent in March, the highest since February 2018. The employment index had been one of the weaker components, but is now posting very strong results (see bottom of first chart). The Bureau of Labor Statistics’ Employment Situation report for March is due out on Friday, April 2nd. Consensus expectations are for a very strong gain of 647,000 nonfarm-payroll jobs including the addition of 33,000 jobs in manufacturing. The unemployment rate is expected to fall to 6.2 percent.

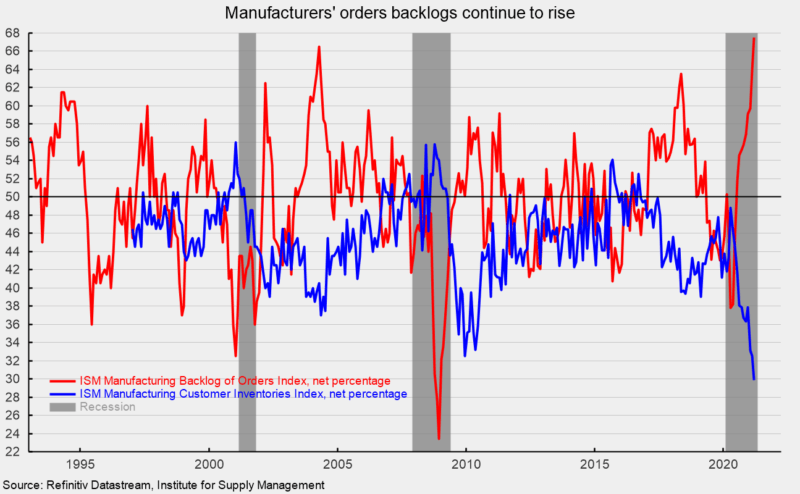

The Backlog-of-Orders Index rose again, coming in at 67.5 percent in March, up from 64.0 percent in the prior month, the highest level since the series began in 1993 (see second chart).

Customer inventories in March are still considered too low, with the index remaining below 50 at 29.9 percent versus 32.5 percent in the prior month (index results below 50 indicate customers’ inventories are too low; see second chart). The index has been below 50 for 54 consecutive months and is the lowest since this index began in 1997. Insufficient inventory may be a positive sign for future production.