Manufacturing Expansion Slowed in April

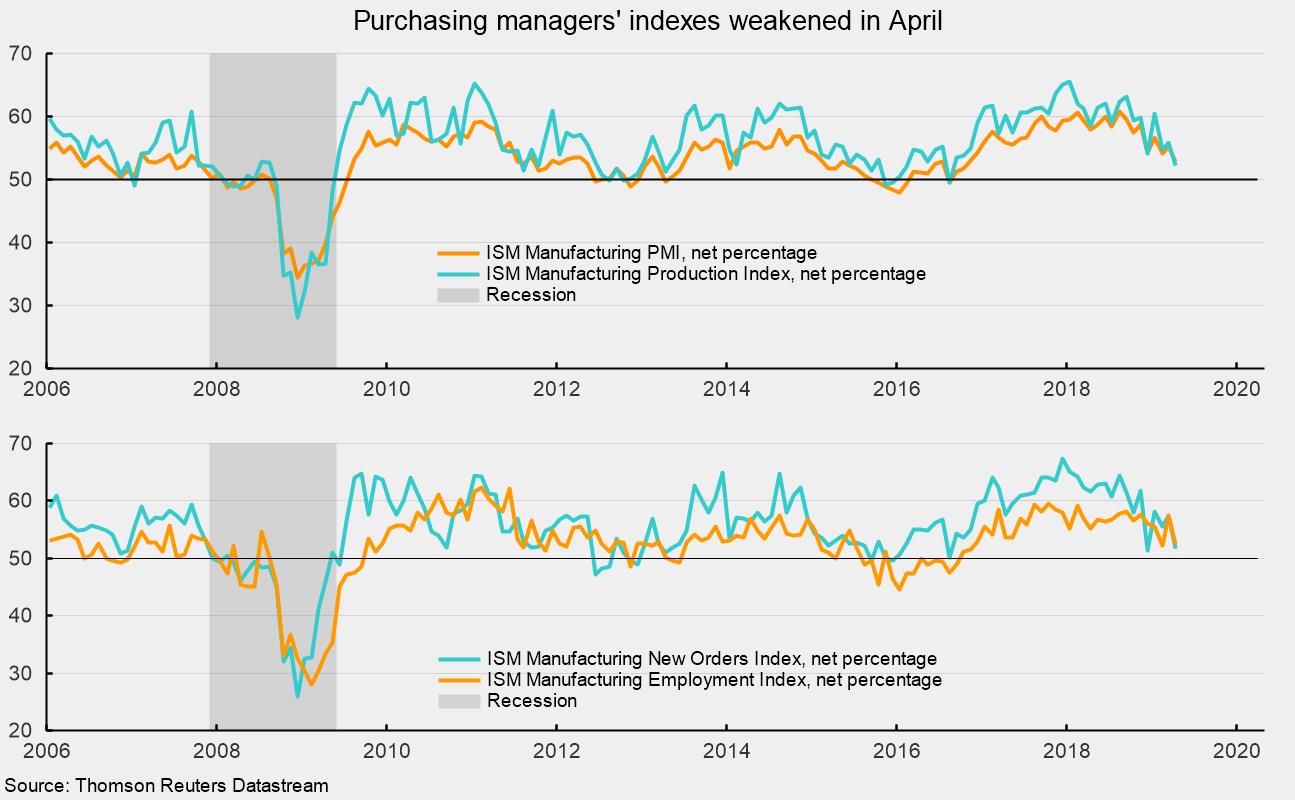

The Manufacturing Purchasing Managers Index from the Institute for Supply Management registered a 52.8 percent reading in April, down 2.5 points from 55.3 in March and the lowest reading since November 2016 (see top chart). April is the 32nd month in a row above the neutral 50 level and the 120th above the 42.9 percent threshold consistent with expansion in the overall economy. Comments from purchasing executives highlight policy concerns including trade wars, rising tariffs, difficulty with flows of goods across the southern border, and Brexit as significant issues.

Among the key components of the Purchasing Managers Index, the New Orders Index sank 5.7 points to 51.7, the second-lowest reading since August 2016. The result was the 40th consecutive month with readings above 50, but the weak reading suggests demand is growing very slowly (see bottom chart). New export orders fell, losing 2.2 points to 49.5, the first reading below 50 since February 2016. The backlog of unfilled orders gained 3.5 points to 53.9, one of just three components to show an improvement over the prior month.

The production index was at 52.3 percent in April, down from 55.8 in March. April marks the 32nd month in a row above 50. Historically, readings above 51.7 are consistent with growth in the industrial-production index from the Federal Reserve. In April, 13 industries surveyed reported growth while 3 reported a decrease in production.

The employment index fell to 52.4 percent in April, down from 57.5 in March. Despite the decline, the result suggests employment in manufacturing likely increased in April. The Bureau of Labor Statistics’ Employment Situation report for April is due out on Friday, May 3. Consensus expectations are for 185,000 new nonfarm-payroll jobs including 10,000 new jobs in manufacturing. Payroll processor ADP released its estimate for private payrolls for April, projecting a very strong 275,000 new employees for the month. Those data stand in stark contrast to the generally weak results from the ISM.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, came in at 54.6, up slightly from 54.2 in March. April was the 38th consecutive month above 50, and the results suggest suppliers delivering to manufacturers are still falling behind but at a somewhat slower pace.

The prices index eased again, falling 4.3 points to 50.0 in April from 54.3 in March. The index has been close to the neutral 50 level since January after being as high as 79.5 in May 2018. These results suggest manufacturers are experiencing much less materials-costs pressure recently, consistent with the generally weaker economy in recent months. Some input-cost pressures may still exist because of higher tariffs.

Customer inventories in April are still considered too low, with the index falling to 42.6 from 42.7 in the prior month (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 31 consecutive months.

Today’s report from the Institute for Supply Management suggests the manufacturing sector continued to grow in April but at a decelerated pace, continuing a trend in place since mid-2018. This report continues the run of mixed economic data in recent months and supports a high degree of caution amid continued economic expansion.