Labor Market Warning Sign: Weekly Initial Claims for Unemployment Benefits Rise Again

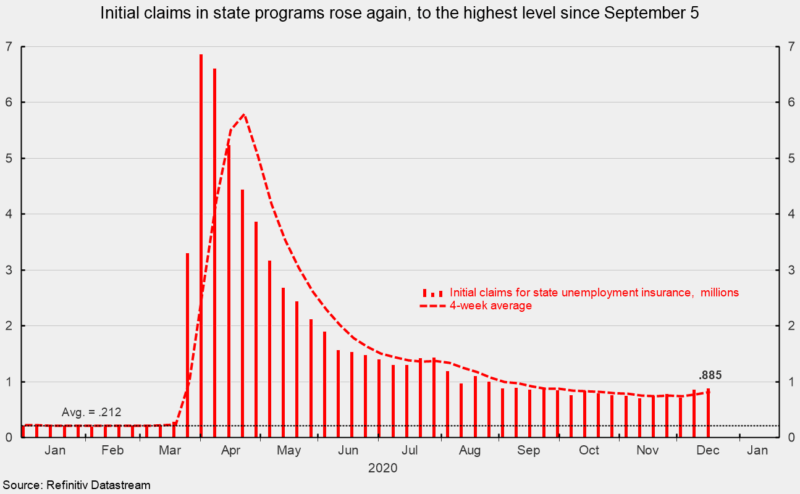

Initial claims for regular state unemployment insurance totaled 885,000 for the week ending December 12, up 23,000 from the previous week’s upwardly revised tally of 862,000 (see first chart). Claims are now at the highest level since September 5 and posted the largest back-to-back increases since March. The four-week average was 812,500, up 34,250 from the prior average and the highest since October 17. The latest week is the 39th week of historically massive claims. Prior to the lockdowns, initial claims averaged 212,000 over the first 10 weeks of 2020. A second consecutive increase in initial claims is a very worrying sign amid renewed government restrictions on consumers and businesses. Persistent initial claims at such a historically high level suggest an uncertain outlook for the labor market recovery and the economy (see first chart).

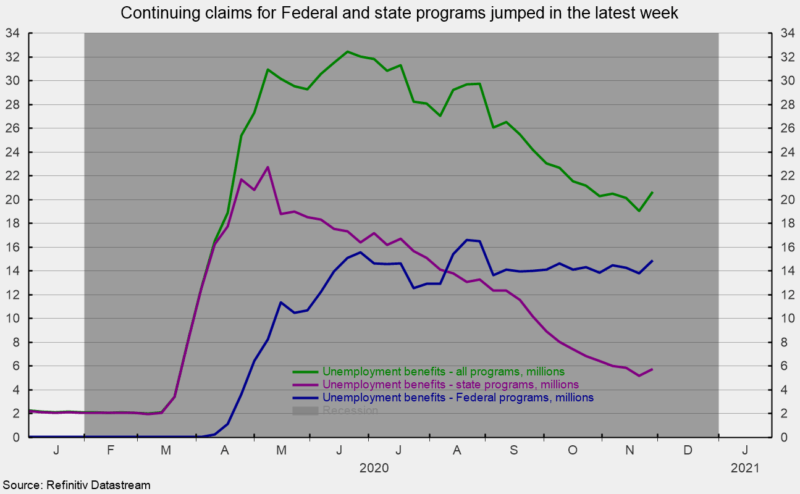

The number of ongoing claims for state unemployment programs totaled 5.766 million for the week ending November 28, up 552,349 from the prior week, the first increase since August 29 (see second chart). For the same week in 2019, ongoing claims were 1.752 million.

Continuing claims in all federal programs also rose in the latest week, coming in at 14.881 million for the week ending November 28, up 1,050,932, the largest increase since August 22. Since the beginning of September, claims in all Federal programs have averaged 14.175 million (see second chart).

The total number of people claiming benefits in all unemployment programs including all emergency programs was 20.647 million for the week ended November 28, up 1.603 million from the prior week. While continuing claims have trended lower for state programs, Federal programs have remained in a flat trend.

The increases in the latest week for both categories suggest the labor market may suddenly be weakening as government restrictions on consumers and businesses harm the economy. Government-imposed restrictions intended to slow the spread of Covid-19 pose a significant threat to the outlook for economic growth. The longer consumers remain restricted and businesses remain closed or limited, the more uncertain a labor market recovery becomes and the higher the probability of a slow and drawn-out economic recovery.