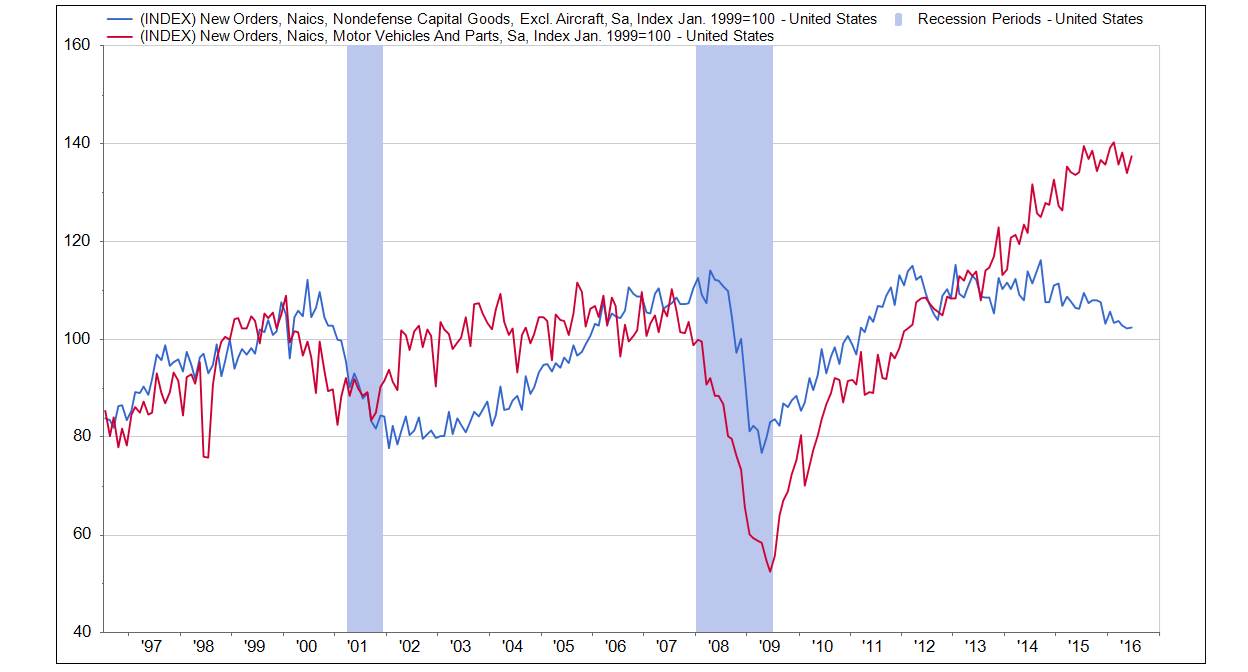

Factory Orders for Durable Goods Remain Sluggish

Strong orders for motor vehicles are offsetting weakness among capital goods orders

While the jobs market and consumer spending have showed renewed strength recently, the nation’s manufacturers continue to struggle. New data released by the Department of Commerce show that orders for durable goods (items meant to last three years or longer) placed with manufacturers in June fell 4.0 percent from May. For the first six months of 2016, total new orders for durable goods were unchanged compared to the first half of 2015.

Among the positive details in the report, some familiar themes emerge. First, orders for motor vehicles remain healthy, rising 2.6 percent for the month, and 4.6 percent for the first half versus 2015. The catch-all “other” category, which has a large share of household durable goods such as furniture, also showed a solid gain of 3.2 percent for the first half, though that category was unchanged for the month of June. Computers and other technology products fell 2.2 percent for the month, but still show a 3.6 percent gain for the first half. All of these are tied to consumer spending to some degree.

Among the weaker segments, new orders for nondefense capital goods orders excluding aircraft, a proxy for overall business equipment investment, rose 0.2 percent for June, but are off 3.8 percent for the entire first half. Business investment has been one of the weaker parts of the economy in recent quarters. Orders for industrial machinery fell 0.1 percent in June and are off 5.2 percent in the first half, while primary metals orders fell 1.3 percent for the month and 9.7 percent compared to last year.

Overall, the latest data on the factory sector suggests continued weakness, as consumer spending offsets soft business investment. If there’s a silver lining, it may be that business investment represents one of the areas that could show improvement in the second half, as long as consumers keep spending and corporate profits show continued gains.

Click here to sign up for the Daily Economy weekly digest!