Existing-Home Sales Holding in a Flat Trend

Sales of existing homes fell 0.4 percent in May to a 5.43 million-unit annual rate versus a 5.45 million pace in April, according to the National Association of Realtors. That May selling rate is 3.0 percent below the May 2017 sales rate. Sales fell in three of the four regions, with the Northeast posting the only gain, up 4.6 percent for the month. For the past year, three regions are down while one, the South, is flat.

For single-family existing homes, the May tally was 4.81 million units at an annual rate, down 0.6 percent for the month and down 3.0 percent from a year ago. Condo and coop sales rose 1.6 percent for the month but are still down 3.1 percent from May 2017.

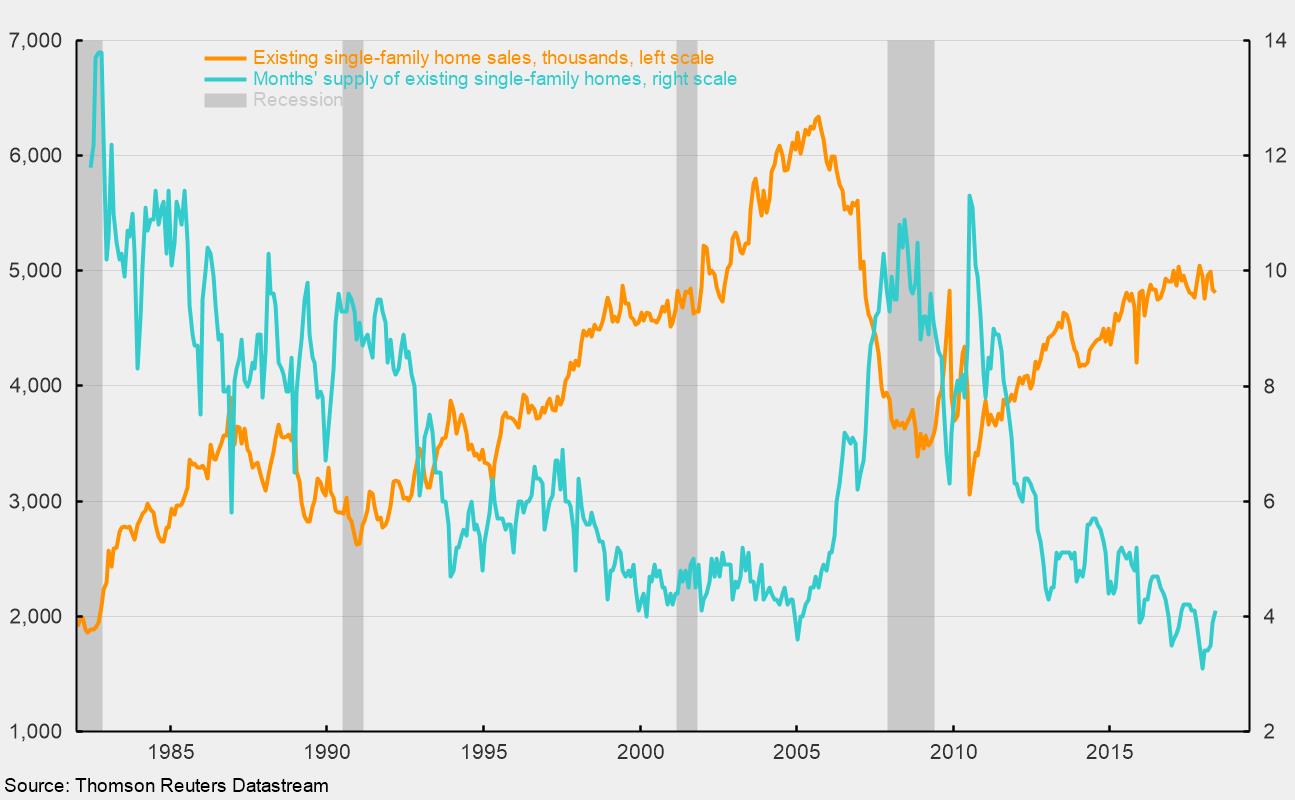

Among the primary reasons for weak existing-home sales despite a relatively strong economy, tight labor market, and high level of consumer confidence is the tight supply of available existing homes for sale. The months’ supply of existing homes for sale ticked up slightly to 4.1 from 3.9 in the prior month while the months’ supply of condos and coops dropped to 3.9 from 4.2 previously. The 4.1 months’ supply for single-family homes is up from a record-low 3.1 months in December but is still very low by historical measures. In fact, the average months’ supply from January 1998 through December 2005, the heart of the housing bubble, was 4.7, significantly above the 3.9-month average over the past two years. The lack of inventory is likely a primary reason for the plateauing of existing single-family home sales.

Home prices on average have risen above those seen during the peak of the housing bubble. However, it is plausible that some potential sellers may be struggling to sell homes that are still worth less than the purchase price if the home was bought during the height of the housing bubble. Over time, continued gains in home prices should help those sellers. In addition, new construction continues to add to the overall housing stock, offering a potential alternative to existing-home buyers. However, builders appear to be keeping a controlled pace of new construction for fear of overproduction resulting in lower prices and profits. The months’ supply of new single-family homes has been trending relatively steady in the five- to six-month range since 2014. The lingering risk to housing is the potential for rising interest rates to dampen demand.