Durable-Goods Orders Tick Down in May but Remain in an Uptrend

New orders for durable goods placed with the nation’s manufacturers fell 0.6 percent in May, the second consecutive decline. However, orders have been on a solid rising trend over the past two years and the level remains high by historical comparison. The recent declines do not appear to suggest that the rising trend is in danger.

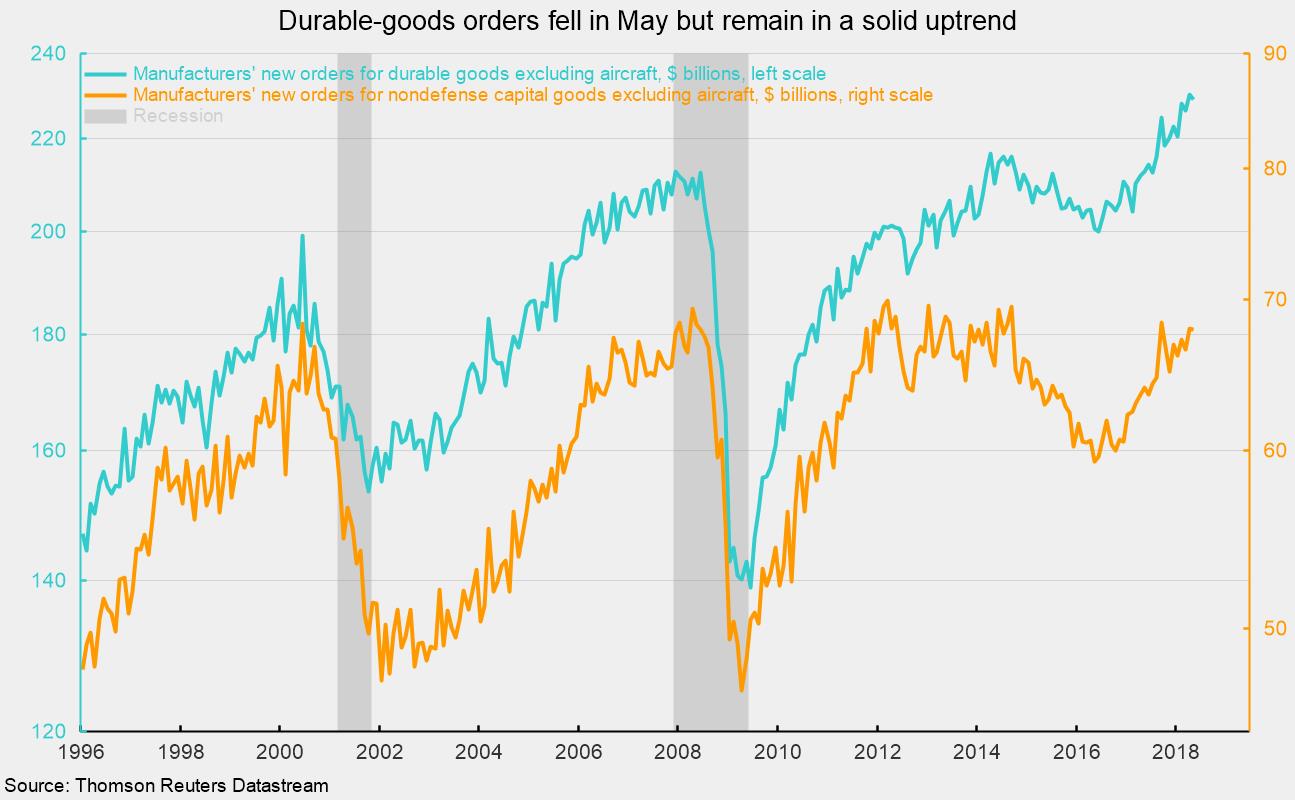

Durable-goods orders excluding the very volatile aircraft category fell 0.5 percent for the month from a record-high $229.1 billion in April (see chart). From a year ago, durable-goods orders excluding aircraft are up 7.7 percent.

Among the 10 categories shown separately, 3 increased in May: machinery, up 0.3 percent; communications equipment, up 5.7 percent; and all other durables, up 0.2 percent. From a year ago, 8 of the 10 categories are showing year-to-date increases with 3 posting double-digit percent gains: primary metals, up 15.8 percent; fabricated metals, up 11.8 percent; and nondefense aircraft, up 52.3 percent. Two categories declined in their year-to-date changes: computer and related products, down 13.0 percent; and defense aircraft, down 18.7 percent.

The capital-goods components increased 0.2 percent in May, pushing the year-to-date increase versus last year to 14.7 percent. Excluding defense-related capital goods, orders fell 2.0 percent in May, dragged down by a 7.0 percent drop in nondefense aircraft orders.

Nondefense capital-goods orders excluding aircraft, a proxy for business capital investment, fell 0.2 percent for the month following a 2.3 percent increase in April. Total new orders for May came in at $67.9 billion, about 3 percent below the all-time peak of $70 billion in March 2012 (see chart again). Year to date, nondefense capital-goods orders excluding aircraft total $334.2 billion, 6.8 percent above the same period in 2017.

Overall, new-orders data suggest healthy levels of activity at the nation’s factories. High levels of new orders for nondefense capital goods excluding aircraft suggest businesses remain willing and able to invest in productive capacity, suggesting a positive outlook for future business conditions.