Durable-Goods Orders Rose Again in September

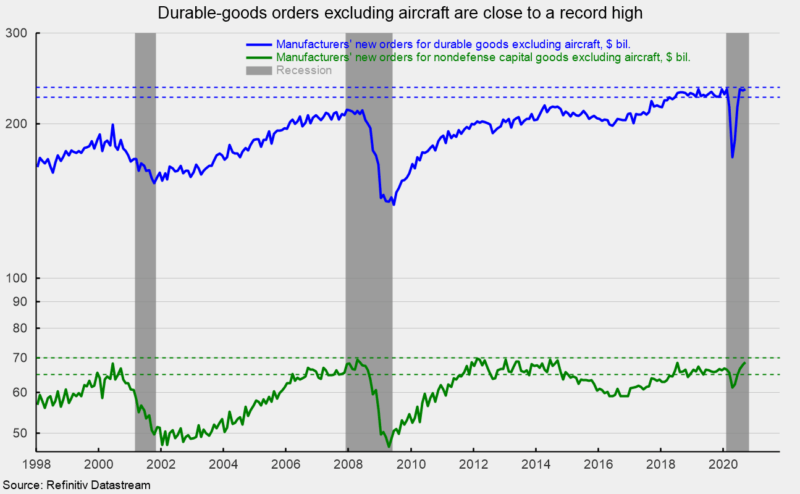

New orders for durable goods posted a fifth consecutive gain in September, rising 1.9 percent following a gain of 0.4 percent in August, 11.8 percent in July, 7.7 percent in June, and 15.0 percent in May. The gains followed drops of 18.3 percent in April and 16.7 percent in March. Durable-goods orders excluding aircraft and parts rose 0.5 percent for the month following a dip of 0.5 percent in August and three monthly gains from May through July. That puts the level of orders at $233.1 billion, just 0.6 percent below the all-time high of $233.3 billion in July and just the fourth time orders have exceeded $233 billion (see first chart).

New orders for nondefense capital goods excluding aircraft, a proxy for business equipment investment, rose 1.0 percent in September after gaining 2.1 percent in August, putting the level at $68.7 billion, the highest since September 2014. This important category had been in the peak $65 to $70 billion range for several periods over the past 15 years before dropping to $61.3 billion in April 2020. The $61.3 billion pace was the slowest since September 2017 (see first chart).

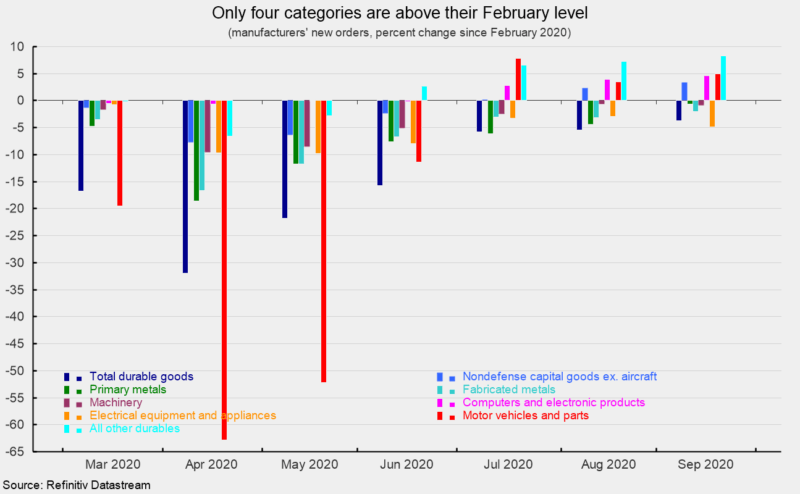

Despite the positive performance of overall durable-goods orders, the major categories of durable goods shown in the report had mixed results in the latest month. Among the individual categories, primary metals rose 4.0 percent, fabricated metal products gained 1.2 percent, machinery orders were off 0.3 percent, computers and electronic products increased 0.6 percent, electrical equipment and appliances declined 2.0 percent, transportation equipment orders rose 4.1 percent, and the catch-all “other durables” category was up 0.9 percent. Furthermore, while all the categories fell sharply in March and April, only four categories are above their February 2020 level as of September: nondefense capital goods excluding aircraft, computers and electronic products, motor vehicles and parts, and all other durables (see second chart).

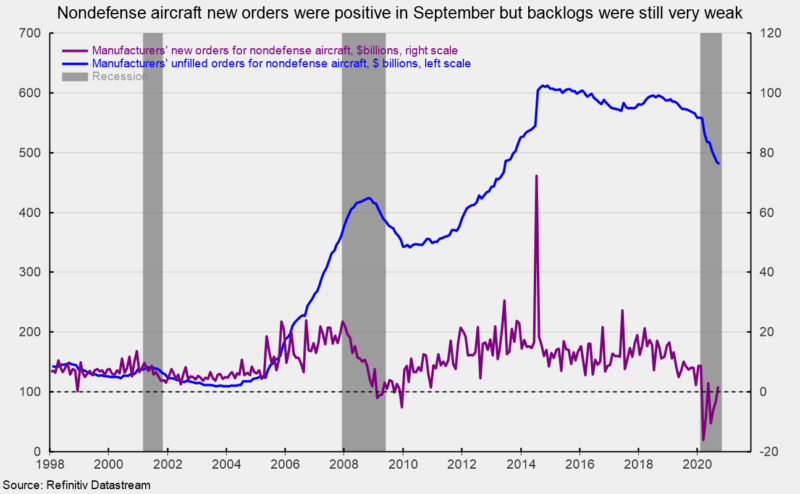

Nondefense aircraft orders were positive in September, totaling $1.8 billion after suffering net negative orders in five of the past six months (see third chart). Net negative new orders represent cancellation of previously placed orders totaling more than total new orders for the period. Significant cancellations over the past few months have left unfilled orders for nondefense aircraft at $481.3 billion, the lowest total since May 2013 (see third chart).

The report on durable-goods orders reflects the continued positive effects of the easing of government shutdown policies implemented in reaction to the outbreak of Covid-19. Extraordinary damage has been caused, but as government restrictions are eased, signs of recovery are emerging. However, the recovery is very uneven across the economy and the pace has slackened in some areas, raising concern about the durability of the recovery.