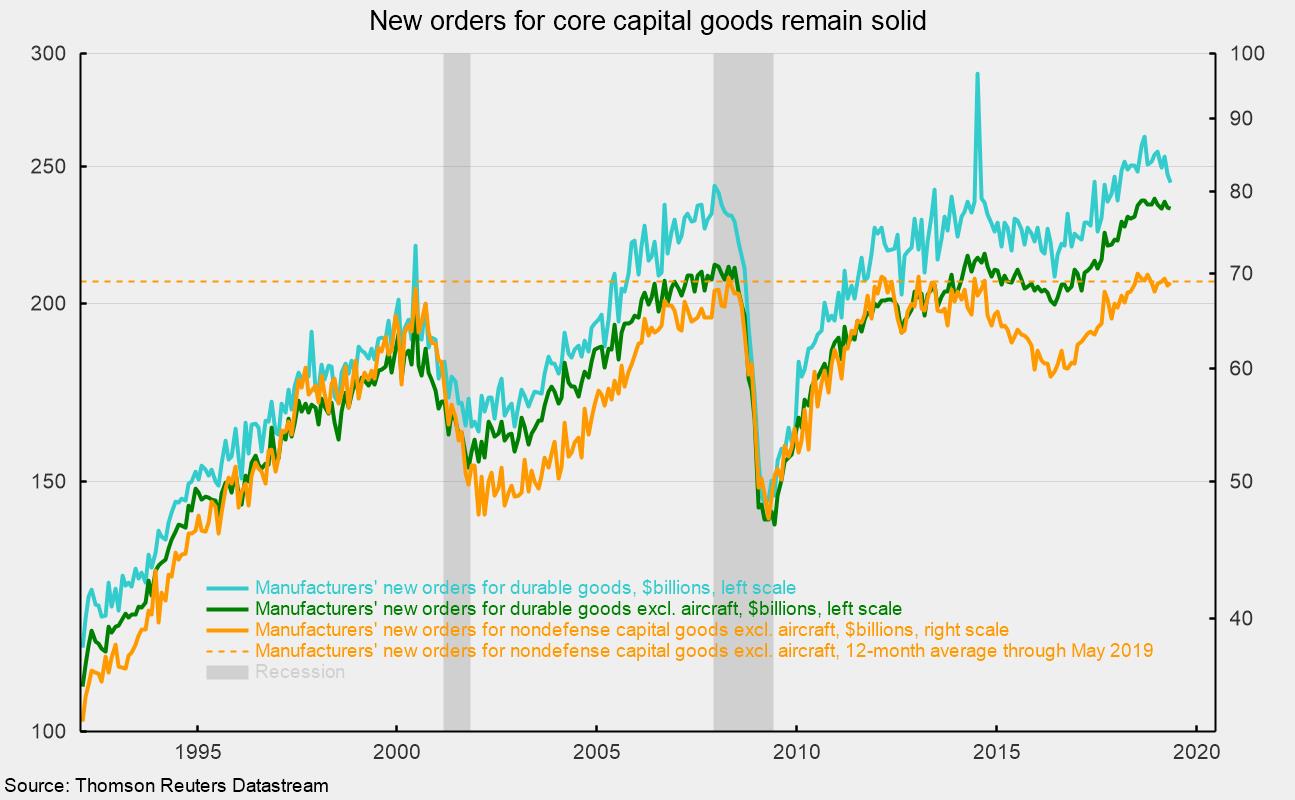

Core Capital-Goods Orders Holding Near Record High

New orders for durable goods decreased 1.3 percent in May, led by large declines in defense and nondefense aircraft orders. Over the past year, total orders are up just 0.1 percent to $254.1 billion (see top chart). Excluding the volatile aircraft categories, orders were off 0.2 percent for the month but are 1.7 percent above May 2018 (see top chart again).

Nondefense aircraft orders fell 28.2 percent while defense aircraft fell 15.3 percent, more than offsetting the 0.6 percent increase in orders for motor vehicles. Combined, all transportation-equipment orders were off 4.6 percent for the month. The results for the other categories of durable goods shown in the report tilted slightly positive in the latest month. Only two industries outside of aircraft showed decreases: fabricated-metals orders fell 0.4 percent after a 0.8 percent gain in April while electrical-equipment and appliances orders lost 0.4 percent in May after a 1.0 percent rise in April.

Categories showing gains for May are computers and electronics products, up 0.8 percent as a 2.4 percent decline in computers was more than offset by a 1.7 percent gain in communications-equipment orders; primary metal products were up 0.4 percent; machinery orders gained 0.7 percent; and the catchall “other durables” category added 0.6 percent for May.

Within the report on new orders for durable goods are data on new orders for capital equipment, or business investment. This subcategory is particularly important for two reasons. First, business investment can have a major impact on future productivity trends, and productivity is critical for helping offset cost increases as well as raising living standards over the long term. Second, capital-goods orders tend to be early indicators of turns in the business cycle. Real new orders for core capital goods — that is, real nondefense capital goods excluding aircraft — is one of the indicators in AIER’s Leading Indicators index.

On a nominal basis, new orders for core capital goods rose 0.4 percent in May. In a manner similar to the broader durables-goods category, core capital-goods orders appear to be plateauing near the $70 billion level, slightly above the peaks of the two prior business cycles (see chart). The average monthly order for core capital goods for the 12 months through May 2019 was $69.1 billion (see chart).

Concerns over trade policy, escalating trade wars, and global economic growth may be starting to impact investment plans. While uncertainty regarding the outlook is significant, the outlook is cautiously positive as the economy approaches the record for longest U.S. economic expansion.