Consumer Credit, a Double-Edged Sword

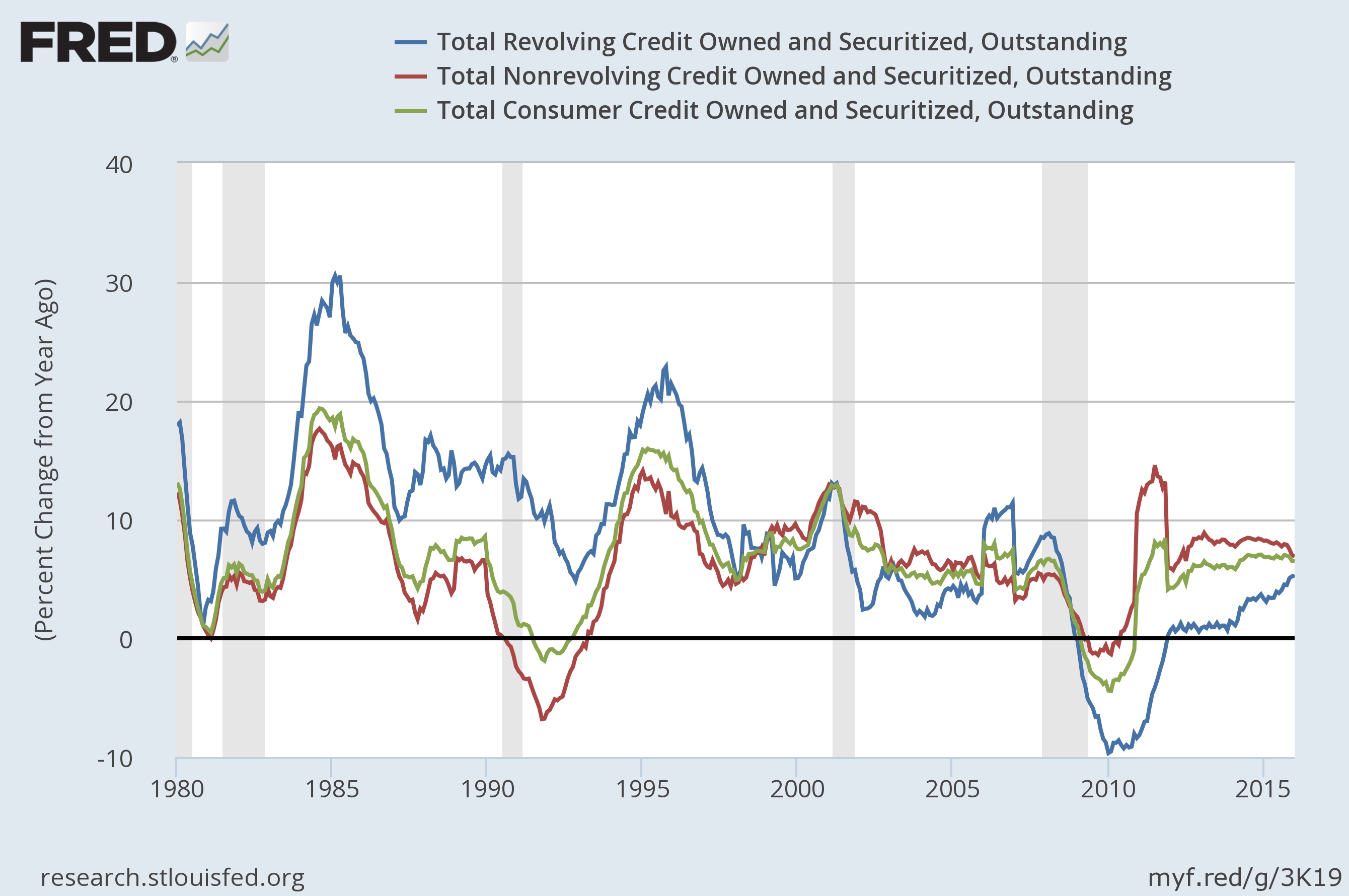

Consumers continued to add debt to their balance sheets in January, according to data released by the Federal Reserve on Monday. Total consumer credit, credit cards and unsecured loans rose by an annualized 3.9 percent, or $129 billion for the month. However, the gain all came from unsecured loans, typically auto loans and education loans. Credit card balances actually declined for the month, falling 2.1 percent at an annual rate.

Consumer credit can be a double-edged sword. In the short term, it can boost consumer spending, but if used recklessly, over indebtedness can cause severe harm to the individual and the economy as a whole. For the moment, consumer debt levels in aggregate appear manageable, but close monitoring will be critical to identifying potential risks to the economy in the future.