Consumer Confidence Ticks Down but Remains Near a Multi-Decade High While Housing Weakens

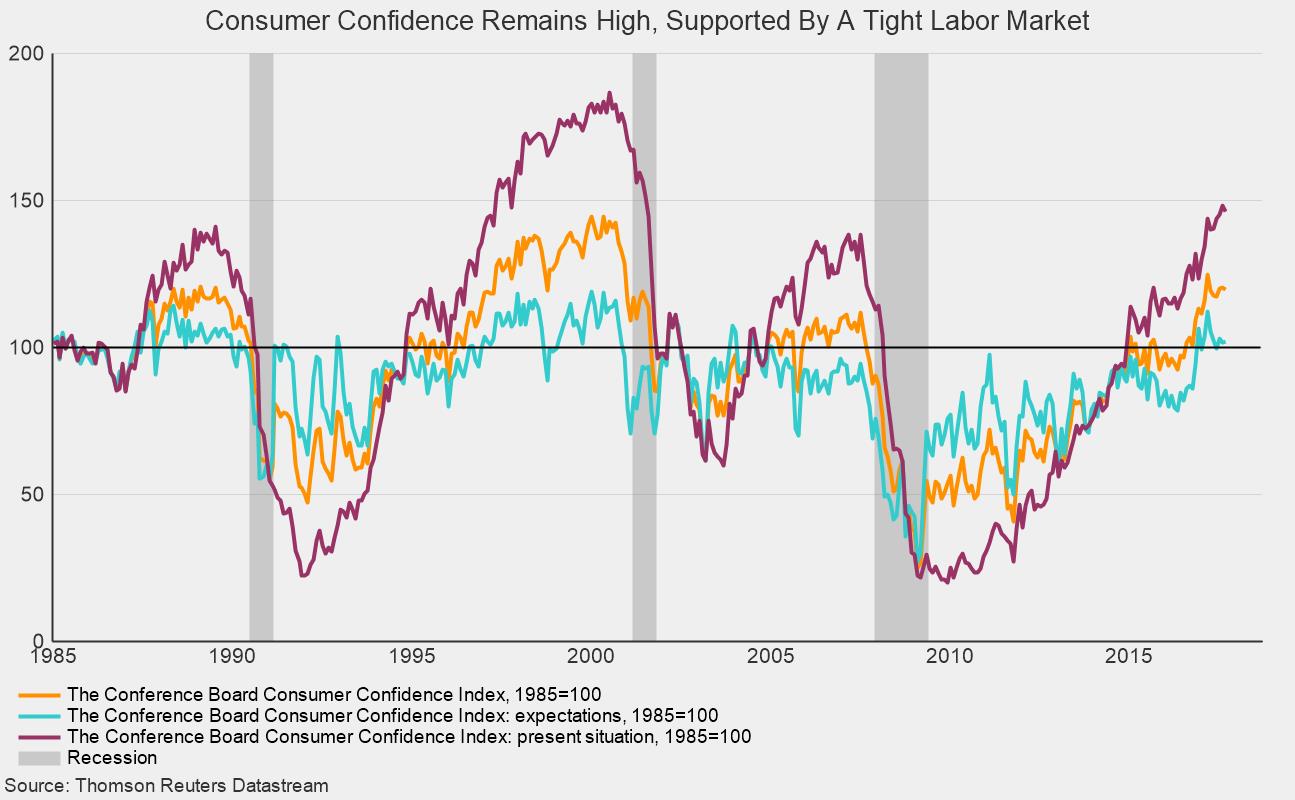

The Consumer Confidence Survey from The Conference Board shows consumer attitudes pulled back slightly in September relative to August but overall remain at historically favorable levels. The Consumer Confidence Index fell to 119.8 in the latest reading, down from 120.4 in August. At least some of the decline was attributed to sharp declines in confidence for residents of Texas and Florida. Since 1985, the composite index has ranged between 50 and 145 with weakest readings coming during and immediately following the 1991 and 2008-09 recessions. The strongest readings came in 2000 at the height of the Tech bubble. In the economic expansion of the late 1980s, the index hit levels between 115 and 120 while the expansion of the mid-2000s saw peaks in the 100 to 110 range. Today’s consumer confidence index has been bouncing around in the 115 to 125 range for most of 2017.

Among the two major components, the present situation index fell slightly to 146.1 from 148.4 in August while the expectations index rose slightly to 102.2 from 101.7. The expectations index is about in-line with previous expansions, ranging from 100 to 120 over the past several months. The present situation index is at very high levels, exceeded only by the readings from the late 1990’s. One key source for the strong levels of confidence in the present situation is the robust labor market. According to the survey, the net percentage of respondents reporting jobs are hard to get fell to 18.1 from 18.4 in August, nearly matching the cycle low of 17.9 in 2005, though it is still above the all-time low of 9.6 in 2000. Conversely, the percentage of respondents saying jobs are plentiful came in at 32.6, down slightly from 34.4 in August but still significantly higher than the peak of 30.3 from the prior expansion. The positive view of jobs is still below the all-time peak of 55.8 in 2000. Overall, consumer confidence remains at historically favorable levels, supported by a robust labor market, suggesting support for on-going economic expansion in the short-term.

The healthy level of consumer confidence is not providing enough support to boost housing activity. New single-family home sales fell 3.4 percent in August to a 560,000 seasonally-adjusted annual rate, down from a 380,000 pace in July. The selling rate is 1.2 percent below August 2016 and 12.2 percent below the recent peak of 638,000 in March 2017. Sales were down in three of the four regions in the country with the fourth only managing to hold steady from the prior month. In addition, the inventory of new homes for sale rose 3.6 percent in august to 284,000. That gain along with the slower pace of sales pushed the months’ supply (inventory divided by selling rate) to 6.1 months, a 7.0 percent increase over the prior month and the highest level since July 2014. Many measures of housing activity are showing signs of softening. Reconstruction in areas hit by hurricanes may provide a boost to overall activity but new-home construction should be monitored carefully over the next several months for signs of further weakening in other areas of the country.