Consumer Confidence Rose in February, But Home Construction Fell in December

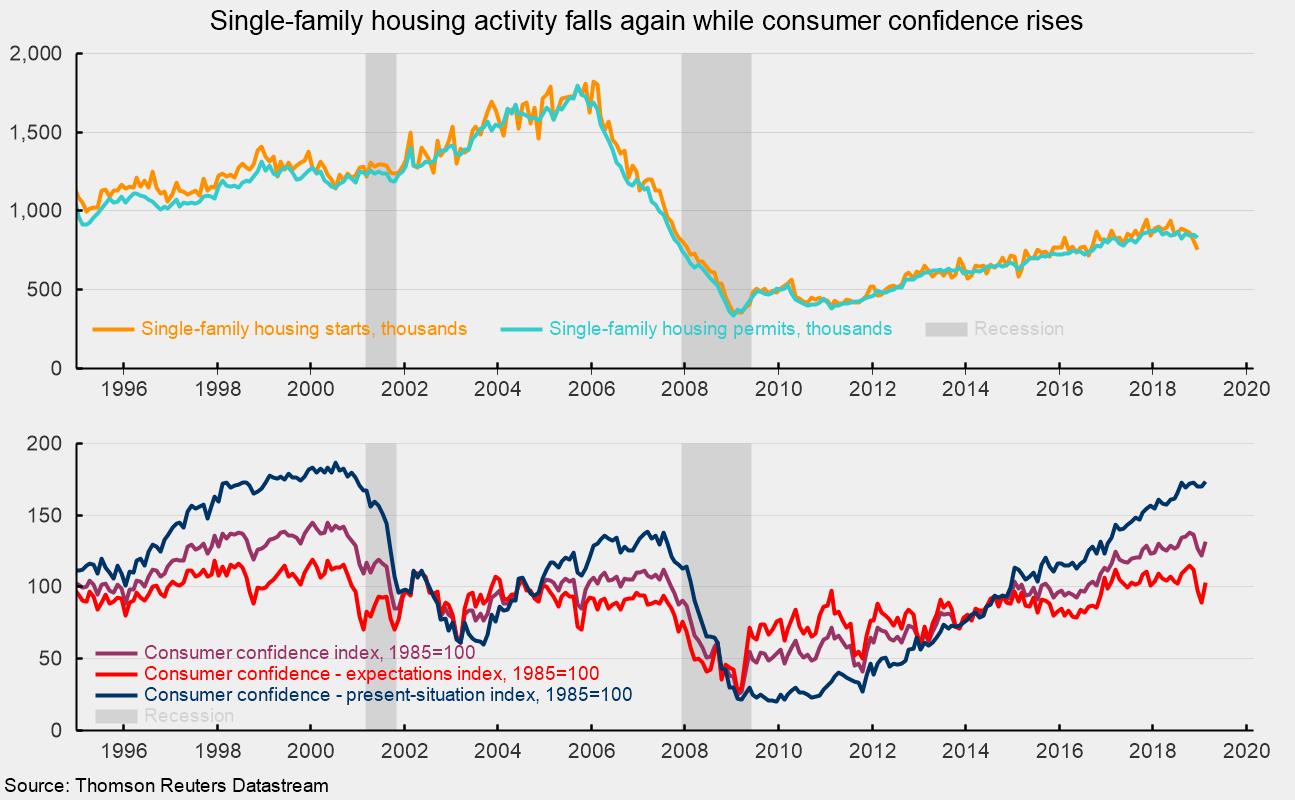

The Consumer Confidence Index from The Conference Board rebounded in February, increasing by 9.7 points to 131.4. The index is constructed so that it equals 100 in 1985. The February gain follows three consecutive monthly declines from November through January. The composite index is 6.5 points below the recent high of 137.9 in November and 13.3 points below the all-time record of 144.7 in May 2000 (see bottom chart).

Both components of the index posted gains for the month. The present-situation component rose 3.3 points to 173.5, hitting a new cycle high and reaching the highest level since December 2000. This index has posted a remarkable rebound, rising 153.3 points from a low of 20.2 in December 2009, just after the end of the Great Recession.

The expectations component added 14 points, following three consecutive monthly declines, taking it to 103.4 from 89.4 in the prior month. The expectations index has been a bit more restrained compared to the present-situation index but has risen sharply from a reading of 27.3 in February 2009. The index has been trending sideways over the last two years, averaging 105.0 over the last 27 months and staying within a range of 90 to 115. The all-time high for the expectations component is 125.8, recorded in April 1967.

Overall, consumer attitudes remain at historically favorable levels, driven by solid gains in income and a tight labor market. The recent government shutdown and financial-market volatility were the primary reasons for the declines in recent months. The rebound in consumer confidence is a positive sign for consumer spending and the economy overall.

Housing construction activity slowed in December as starts fell by 11.2 percent. Total housing starts dropped to a 1.078 million annual rate from a 1.214 million pace in November. The dominant single-family segment, which accounts for about three-fourths of new home construction, fell 6.7 percent for the month to a rate of 758,000 units (see top chart). Starts of multifamily structures with five or more units plunged 22.0 percent to 302,000.

Among the four regions in the report, total starts fell in three regions, the West (−26.3 percent), the Midwest (−13.2 percent), and the South (−6.0 percent), while the Northeast was unchanged. For the single-family segment, starts were down in three regions, the Northeast (−20.3 percent), the West (−18.5 percent), and the Midwest (−14.2 percent), but rose 2.2 percent in the South.

For housing permits, total permits rose 0.3 percent to 1.326 million from 1.322 million in November. Total permits are just 0.5 percent above the December 2017 level. Single-family permits fell 2.2 percent to 829,000 while permits for two- to four-family units were off 5.1 percent, but permits for five or more units rose 5.7 percent to 460,000. Permits for single-family structures are down 5.5 percent from a year ago while permits for two- to four-family structures are off 2.6 percent. However, permits for structures with five or more units are up 13.6 percent over the past year.

Despite ongoing signs of weakness in housing, home-builder sentiment from the National Association of Home Builders ticked up slightly in February. The index came in at 62 after a 58 in January. However, the index is still down from a recent peak of 74 in December 2017. The three components of the index, Single Family Sales: Present, Single Family Sales: Next 6 Months, and Traffic of Prospective Buyers, all posted gains in February. However, on a regional basis, two regions, the Midwest and the South, had gains while the Northeast and West fell.

The housing market appears to be struggling with a combination of elevated home prices and rising interest rates. While affordability overall remains favorable, it has become significantly less favorable over the past few years. With interest rates likely to drift even higher over coming months and quarters, the outlook for housing is cautious. While the overall economy appears to be recovering from a bit of a soft patch, headwinds are likely to continue to restrain gains for housing.