Communist Theory Can’t Account for Crypto

A number one fallacy in the history of economics is the labor theory of value. The idea here is that things and actions are made valuable by how much work we put into making them. Sounds intuitively right. It’s completely wrong. Things have value because you and I value them, regardless of labor inputs.

It turns out that the crypto intellectual space is replete with this simple mistake. A widespread view is that Bitcoin is valuable only because of the proof-of-work method that demands some CPU power be applied to solving complex algorithms. That’s how the network establishes both access to the ledger and the authority to change it. Because of this work, Bitcoin obtains value as a reflection.

Again, this is completely wrong.

I’ve noticed this bad theory being tossed around in Bitcoin circles. But it only took a quick search to discover that the problem is much worse than I thought! Here is an article at the P2P Foundation, published this year no less, which argues that free-market theory can’t explain Bitcoin’s value. Only Marxism can. Yep, you read that right. Here is our friend making his case.

Marx’s theory of money is not rooted in redeemability, nor collateralization, nor income, nor usefulness, but rather in labour.

Ironically, while libertarian capitalist theories of money can not account for Bitcoin, Marxist theories of money can. The face value of Bitcoin represents a certain worth in terms of the labour time embedded in the computation power used to mine it. The Marxist theory of money is a Proof of Work theory.

For Marx, the value of all commodities is not subjective, but objective; all commodities have a value that is created by the labour required to produce them. The reason that money can be used as a way to express the price of other commodities is because it represents a certain amount of labour, which is also what the worth of the other commodities is based on.

I can hear the trained economists out there right now, screaming while pulling their hair out! What we have here is a confusion sewn by a metaphor. The Bitcoin ecosphere is filled with them: wallets (no, not really wallets), proof of work (no, not really work), mining (no, not real mining), and even Bitcoin (it’s not a coin but rather a mathematical numeraire). All this vivid language gives us a way to talk in more-or-less English but it also introduces fantastic confusion over the reality.

Notice that our crypto-Marxist friend (Dmytri Kleiner) is not just claiming that Bitcoin’s value comes from work. He says that this is the source of all value.

Hairball Cookies

Just think about this. Let’s say you decide to spend the whole of your holiday making cookies out of hairballs coughed up by your cat. Your cat worked so hard to make those, and you slaved all day to turn them into baked edibles.

Now you go into the marketplace with your glorious creations. You try to sell them. Now, I of course can’t say for sure whether you will find willing buyers. But I’m not going far out on a limb to predict that you are unlikely to find buyers. Your are more likely only to cause lots of gagging.

To your major annoyance, it seems like your cookies have no value, despite the many hours and hours of work both you and your cat put into them. How can this be?

Here’s why: your theory is wrong. Value is imparted to a good or service by others in the marketplace. They must value it or else it is not valuable to them (which sounds like a truism but if it is so obvious, why do so many people get it wrong?). That value extends from the minds of others, not your own work. This is absolutely and universally true with every single good or service in the economy.

No Objective Value

You are trying to think of exceptions. Water? Well, that depends. No question you have to have it but that imparts no objective value to water. If you have unlimited access to Pierre without end, the price will eventually fall to zero. On the other hand, if you are in dying in the desert, you might be rational to pay your entire life savings for a drink.

Or maybe you think that the Bible has objective value. It might have moral value or you personally might value it, but in economic terms, any Bible unit is valuable only so long as people are willing to pay for it. Nothing more.

Back to Bitcoin. Let’s say you have computers the world over grinding away to perform hashing functions. Rooms are hot and noisy. This “mining” is providing massive proof of work, more than all other work combined. The result is that you get tons of WorkCoin. Then you set out to use it for something. As it turns out, WorkCoin doesn’t do anything at all. You can’t send it or buy anything with it, and it doesn’t convert into anything valuable at all.

In other words, you have wasted all your work.

It’s the same way with Bitcoin. If you couldn’t do anything with it at all, if there were no Blockchain ledger that allows P2P exchange of this mathematical numeraire, if you could somehow drive a wedge between Bitcoin and Blockchain, what would be its value? The value would be absolutely zero. This is not speculation at all. Between January 3, 2009, and October 5 of 2009, the value of Bitcoin was precisely: $0. This is so far as we know simply because there was no posted price at all.

Why did people mine it, i.e., work for it? Because the hope was that it could eventually be useful.

The first posted price of Bitcoin emerged October 5, and it was something like 1/16 of a penny. If it only became valuable on that date, why were there so many transactions taking place over the previous 10 months? Geeks were testing and pounding on the network to see if it could work. It did work and the value began to emerge. Where did it come from? From the minds of the users. No one said: “hey, computers have been working so hard for 10 months, so this magic internet money must surely by now have some value!”

All of which is to say that Bitcoin’s value is not caused by the work performed to create them. Bitcoin’s value comes from its value in actual use. That’s all. That’s why people are willing to expend resources to mine it. Bitcoin made it is possible to bundle up immutable information packets and transfer them peer-to-peer without an intermediary, on a geographically non-contiguous basis, within a censorship-resistant network while preserving an audit trail of ownership rights.

Is that valuable? Yes because this thing we’ve wanted to do (Byzantine Generals Problem) has never before been possible in the history of the world. The value traces to the service it provides, nothing more. If it didn’t provide that service – or if it didn’t do it as well or better than conventional financial services – the value would again fall to zero.

(Bitcoin developers: I hope you are listening. There is no “store of value” that can be sustained without the ability to use the stuff for something.)

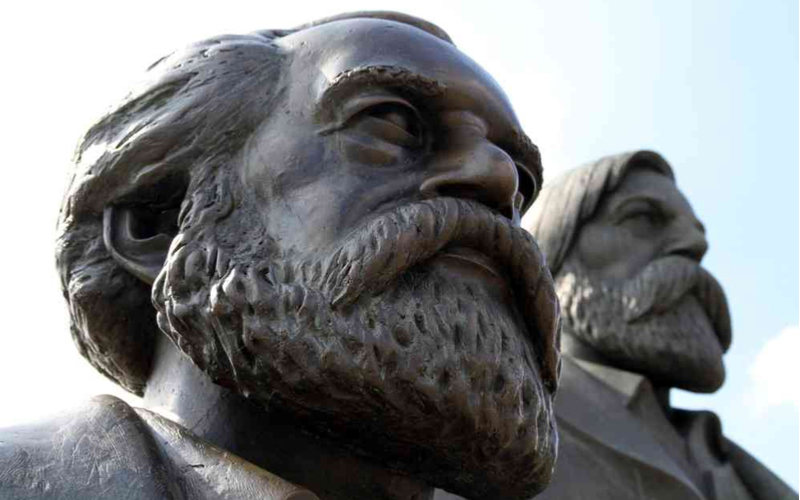

A final note about Karl Marx himself: he did indeed believe in the labor theory of value, as did many classical economists before him. His particular spin was that if the value belongs to laborers, then the capitalists shouldn’t be taking it from them. That’s why we need socialism, he said. But he was proven wrong about this core point in the late 19th century by a gigantic turn in economic theory called the Marginal Revolution.

This one turn in economics put the defense of free markets and sound money on a better footing than it had been in the 18th century, and prepared way for most of the scientific advances in economics over the subsequent 150 years. The labor theory of value drags us back in time, and it is no basis on which to explain or understand digital-age monetary developments.