Business Investment Rebounding; Household Net Worth Hits a New Record High

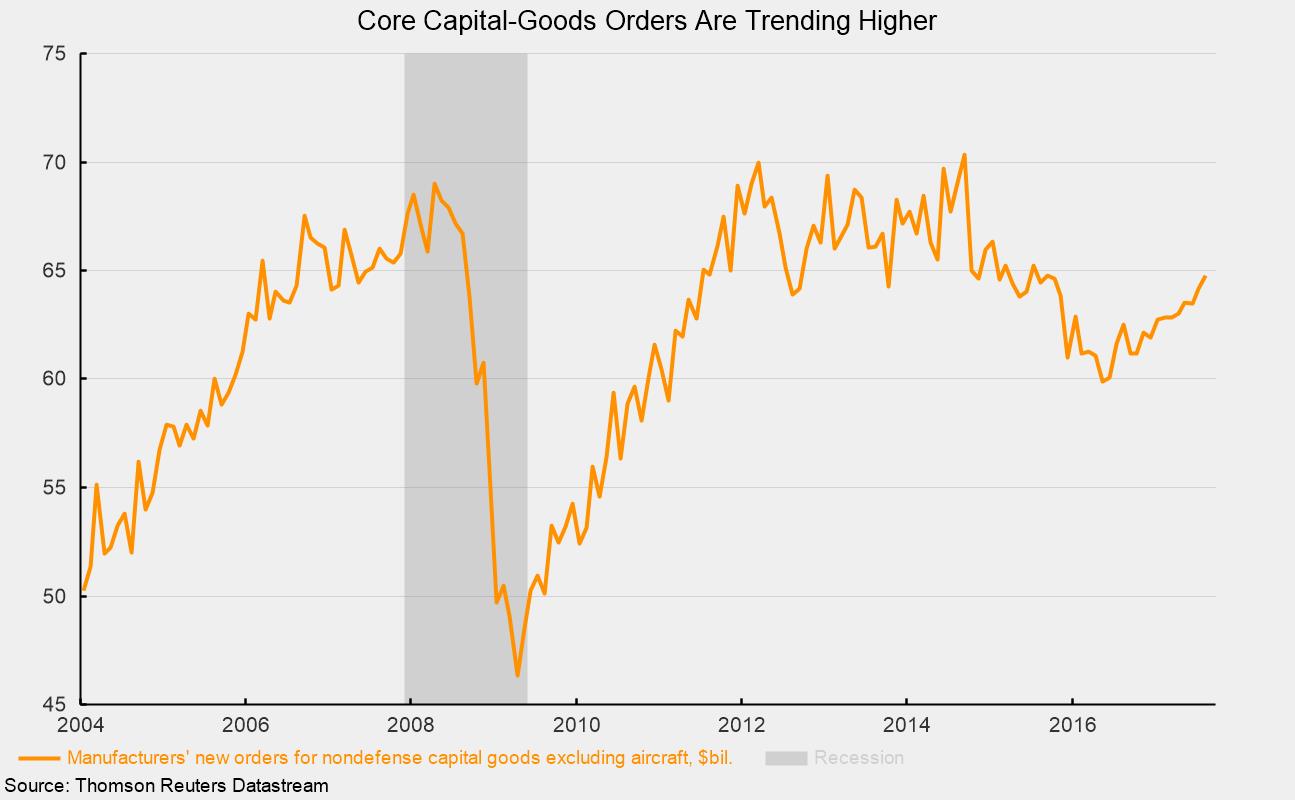

New orders at U.S. manufacturers for durable goods rose 1.7 percent in August versus July. Year to date, orders are up 5.0 percent from the same period last year. The important category of nondefense capital goods excluding aircraft, a proxy for business investment, rose 0.9 percent in August and shows a 3.3 percent gain year to date versus 2016. The August rise marks the seventh monthly increase over the past eight months for business investment. Since hitting a recent low in May 2016, orders are up in 11 of 15 months for a total rise of 8.2 percent. The solid upward trend is a favorable sign for the manufacturing sector, the corporate sector in general, and the economy overall (see chart).

Among the individual industries, new orders for nondefense aircraft, an extremely volatile category, jumped 44.8 percent, partially offset by a 24.3 percent drop in defense aircraft. The transportation sector in total rose 4.9 percent versus a 19.6 percent drop in July. Primary metals (+0.3 percent), machinery (+0.3 percent), and technology products (+1.3 percent) all posted gains for the month while fabricated metals (−0.4 percent) and electrical equipment and appliances (−0.1 percent) were down and the catchall other-durables category was unchanged.

For the consumer sector, the Federal Reserve released data showing household net worth hit a record $96.2 trillion as of the end of the second quarter. The new record was driven by a $1.8 trillion rise in the value of assets ($607 billion from nonfinancial assets, primarily real estate, and $1.24 trillion from financial assets). Total liabilities for the household sector rose just $146.2 billion, or 1 percent, versus the prior quarter. Within household liabilities, mortgage debt rose $64 billion while consumer credit increased $55.3 billion. Together these two areas accounted for about 82 percent of the increase in total household liabilities.

Weekly initial claims for unemployment insurance continued to rise, driven largely by the impacts from Hurricanes Harvey and Irma. Claims came in at 272,000 for the week ending September 23. The weekly claims number is up from a recent low of 232,000 just six weeks ago. Still, numbers below 300,000 are considered low by historical comparison. Most other data suggest the labor market remains tight and that the claims number will likely recede as business activity returns to normal in the hardest-hit areas.

Finally, the Bureau of Economic Analysis released the third estimate for second-quarter gross domestic product. The latest data show the economy grew at a 3.1 percent pace in the second quarter, revised up from a 3.0 percent estimate released last month and an initial estimate of 2.6 percent. While the BEA made minor adjustments to many components, the major implications from the report were largely unchanged. The economy posted a healthy gain in the second quarter, with positive contributions from consumer spending and business investment, while housing remains soft. Real final sales to private domestic purchasers, a key measure of domestic demand, rose 3.3 percent for the quarter. The report also shows that price increases remain quite tame across most sectors of the economy.