A Prediction Social Security Recipients Won’t Like

Every October, Social Security recipients, numbering close to 60 million today, get the announcement of the cost-of-living adjustment (COLA) to be applied to their benefits the following year. This usually results in a little extra money in their pockets.

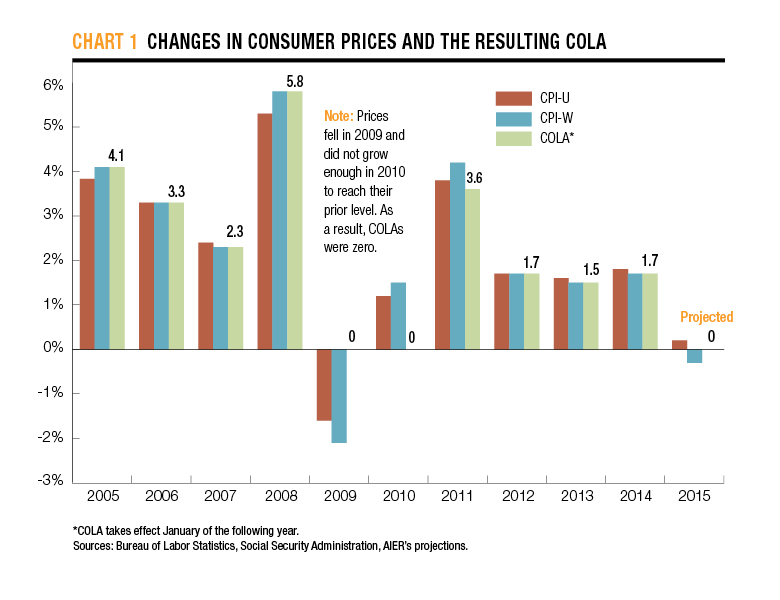

This year the announcement will come October 15, when the last piece of data required to compute the COLA becomes available. But the data we have today are sufficient to forecast that the adjustment, sorry to say, will be zero next year.

AIER has published COLA forecasts every year since 2010 and they have been accurate. A year ago we predicted that the adjustment for 2015 would be in the range of 1.6-1.8 percent; it ended up being 1.7 percent. The year before that, our prediction was an adjustment of 1.4-1.6 percent, and the actual increase was 1.5 percent.

The Social Security Administration determines the COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) compiled by the Bureau of Labor Statistics. In the 12 months ending August 2015, the CPI-W fell 0.3 percent. The decrease was driven mostly by fuel prices, which fell more than 20 percent over this period.

This trend continued in September, so when we get the final data they will show that prices fell for the year. In this case, the Social Security COLA for 2016 will be zero, because the law prohibits negative adjustments.

Zero COLA’s are rare. Since automatic Social Security COLA’s were introduced in 1975, zero COLA happened only twice – in 2010 and 2011, when prices fell during the Great Recession.

The intent of automatic COLA’s was to compensate retirees for the erosion of the purchasing power of Social Security benefits by inflation. In the case of deflation (falling prices) no compensation is necessary. But not everyone agrees that the prices faced by retirees are adequately captured by the CPI-W, on which COLA is based. Retirees may face higher inflation because, for example, they spent more of their income on medical care, prices of which are rising faster than general inflation.

When the Social Security COLA is zero, it has effects beyond the Social Security benefits alone. With zero COLA, the maximum earnings subject to Social Security tax, Supplemental Security Income benefits, retirement earnings exempt amounts, and the earnings required for one Social Security credit will all stay fixed in 2016.

Zero COLA also means that most people on Medicare will see their Medicare Part B premiums stay fixed in 2016. This is because a provision in the law prevents Medicare premiums from rising more than the dollar amount of the Social Security COLA. But a small number of Medicare beneficiaries not covered by this provision may see much larger increases in Medicare premiums. AIER explains the details here.