Job Openings Increase in December, But Labor Questions Remain

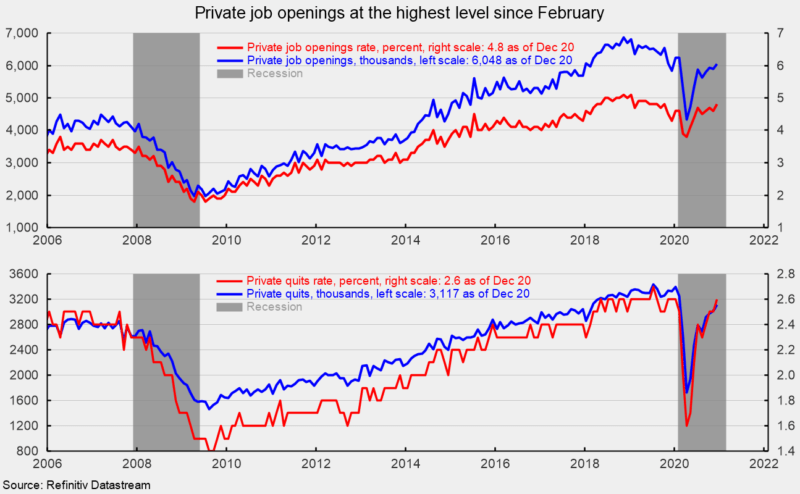

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the total number of job openings in the economy rose to 6.646 million in December, up from 6.572 million in November. The number of open positions in the private sector increased to 6.048 million in December (see top of first chart). Private-sector openings are well above the low of 4.332 million in April at the height of government-imposed lockdowns, posting gains in six of the last eight months, but are still below the pre-pandemic peak of 6.858 million in November 2018. The private-sector job-openings rate, openings divided by the sum of jobs and openings, was 4.8 percent, up from 4.6 percent in November and well above the low of 3.8 percent in April (see top of first chart).

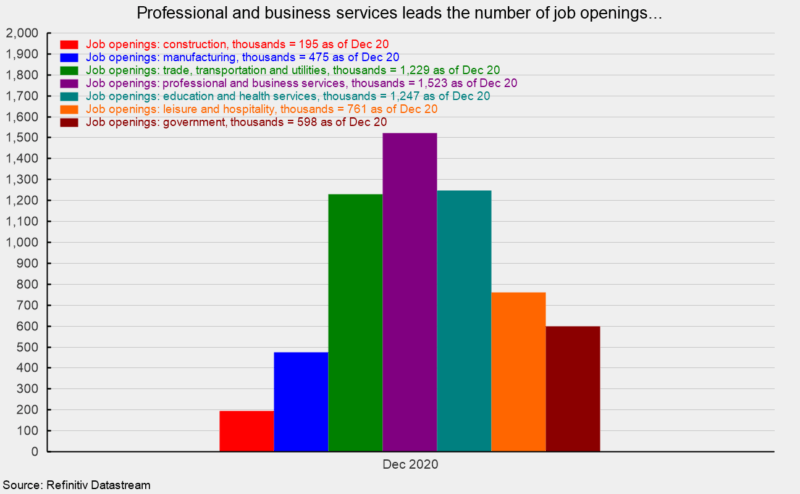

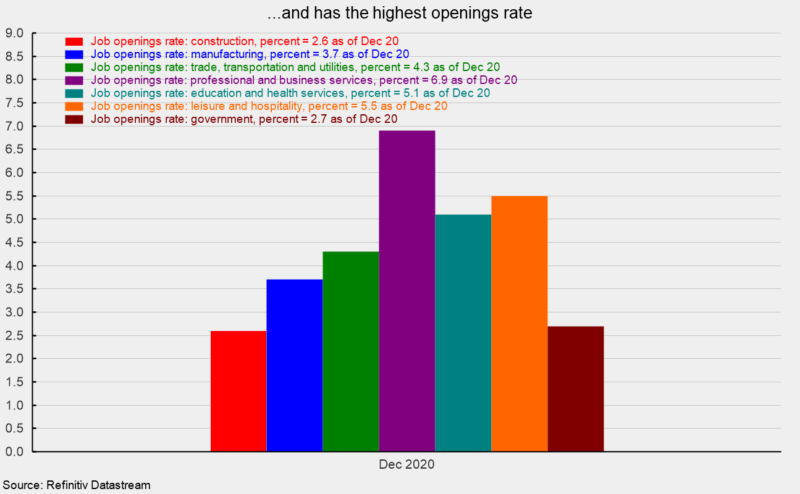

The industries with the largest number of openings were professional and business services (1.523 million), education and health care (1.247 million), and trade, transportation, and utilities (1.229 million; see second chart). The highest openings rates were in professional and business services (6.9 percent), leisure and hospitality (5.5 percent), and education and health care (5.1 percent; see third chart).

The rise in job openings was a function of hires, separations and changing labor requirements. Hires in December fell to 5.539 million from 5.935 million in November. At the same time, the number of separations fell to 5.460 million in December with the number of private sector separations increasing to 5.130 million. Within separations, total quits were 3.286 million (versus 3.180 million in November) and layoffs were 1.812 million, down from 2.055 million in the prior month.

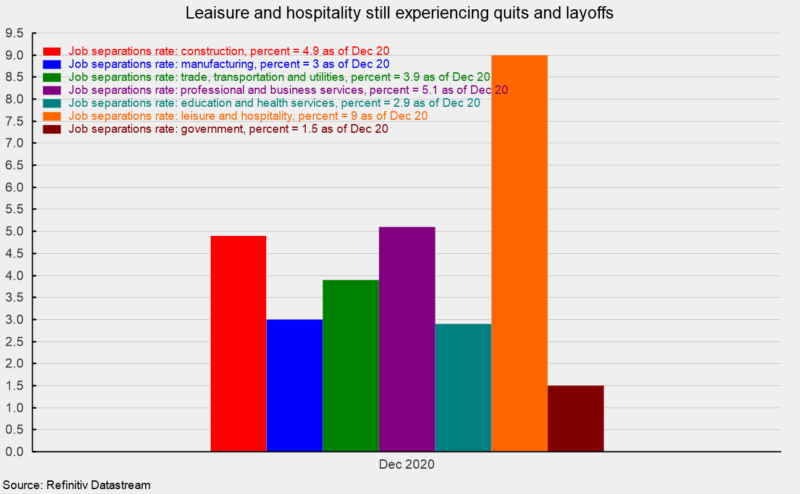

The total separations rate fell to 3.8 percent with the private sector experiencing a rate of 4.2 percent, unchanged from November. By industry, leisure and hospitality leads with a separations rate of 9.0 percent (layoffs rate of 3.9 percent and quits rate of 4.9 percent; see fourth chart).

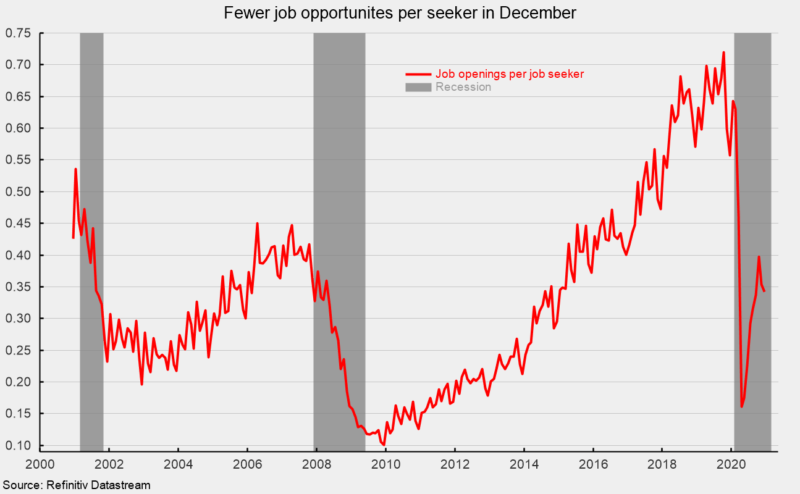

From the worker perspective, labor market conditions remain challenging. The number of openings per job seeker (unemployed plus those not in the labor force but who want a job) fell to a modest 0.342. That is well below the 0.72 openings per seeker in November 2019 but well above the low of 0.101 in December 2009 (see fifth chart).

Overall, the data relating to the labor market paint a cautious picture. Today’s data on openings and turnover along with persistently elevated initial claims for unemployment benefits and the sharply slower pace of net payroll gains reported in the January jobs report show the lingering devastation of government lockdowns. The impacts of those lockdowns vary widely among industries. With the ongoing distribution of vaccines providing some hope, the outlook for the economy is cautiously optimistic but still highly uncertain.